UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the Appropriate Box:

|

| |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to § 240.14a-12 |

Appliance Recycling Centers of America, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | |

x | No fee required |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

o | Fee paid previously with preliminary materials: |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

APPLIANCE RECYCLING CENTERS OF AMERICA, INC.

7400 Excelsior Boulevard

Minneapolis, Minnesota 55426

__________________________

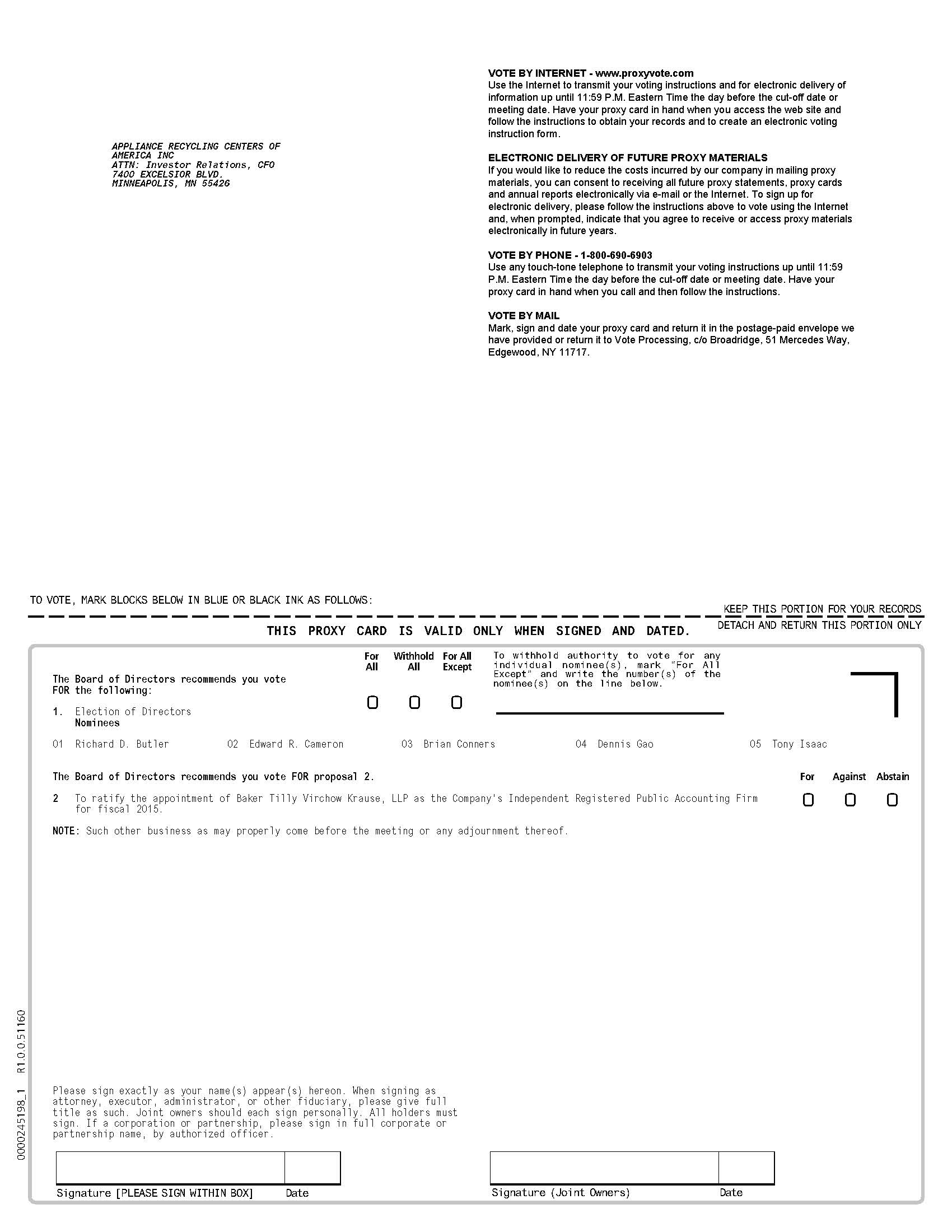

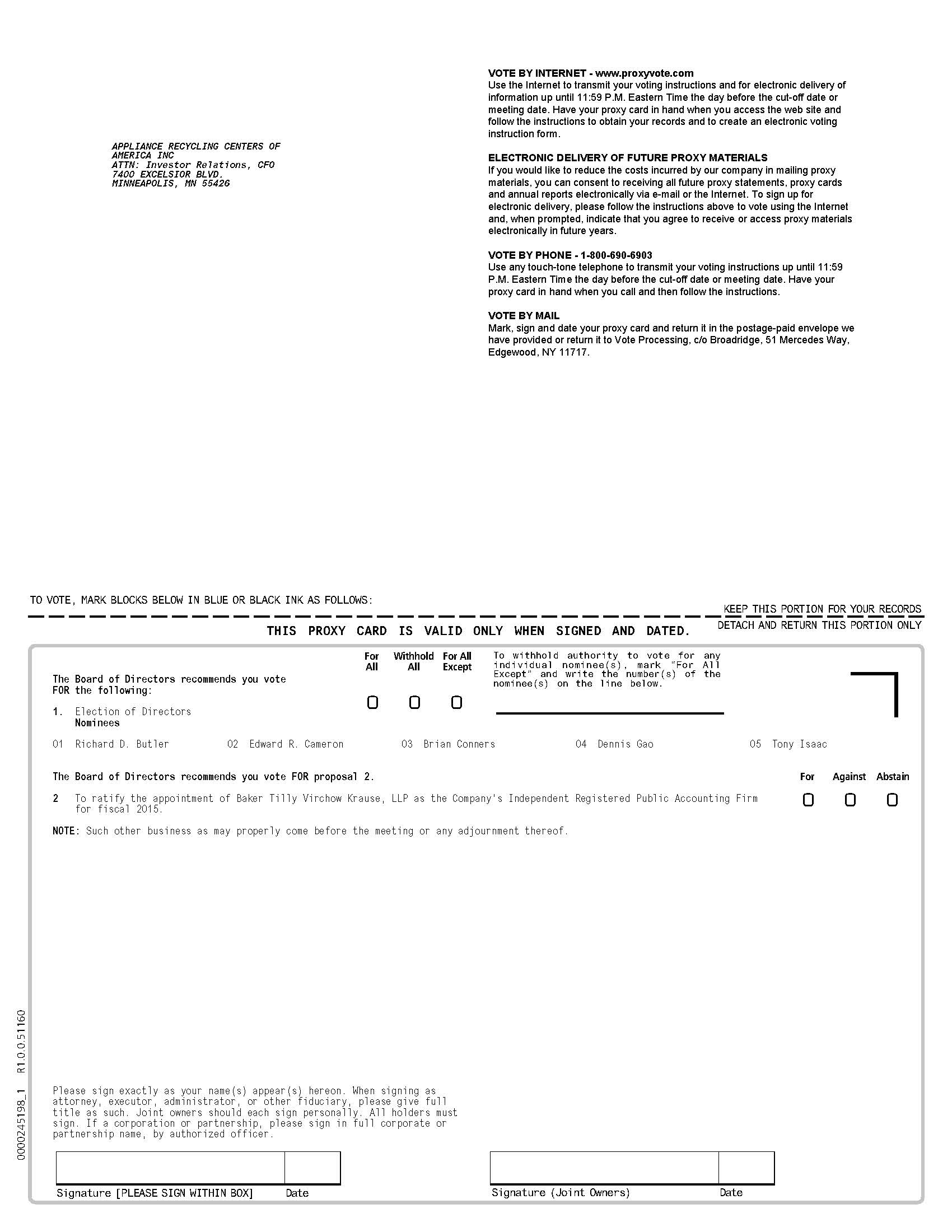

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 18, 2015

__________________________

TO OUR SHAREHOLDERS:

The annual meeting of the shareholders of Appliance Recycling Centers of America, Inc. will be held on Monday, May 18, 2015, at 1:00 p.m., at the law offices of Dewitt Mackall Crounse & Moore, 2050 AT&T Tower, 901 Marquette Avenue, Minneapolis, Minnesota 55402. At the meeting, shareholders will act on the following matters:

| |

• | Proposal One: To elect five directors to serve for a term of one year expiring at the 2016 annual meeting of shareholders. |

| |

• | Proposal Two: To ratify the appointment of Baker Tilly Virchow Krause, LLP as the Company’s independent registered public accounting firm for fiscal year 2015. |

| |

• | To transact such other business as may properly come before the annual meeting or any adjournment or postponement of the meeting. |

Only shareholders of record at the close of business on March 19, 2015 are entitled to notice of and to vote at the annual meeting and any adjournment or postponement of the meeting.

Each of you is invited and urged to attend the annual meeting in person if possible. Whether or not you are able to attend in person, you are requested to submit your proxy or voting instructions as soon as possible to ensure that your shares are voted at the annual meeting in accordance with your instructions. For instructions on voting, please refer to the enclosed Proxy Statement.

By Order of the Board of Directors

Denis E. Grande, Secretary

April 14, 2015

|

|

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Shareholders to Be Held on May 18, 2015: This Proxy Statement and our Annual Report on Form 10-K

for the fiscal year ended January 3, 2015 are available on the internet at: http://www.arcainc.com/company-filings |

TABLE OF CONTENTS

APPLIANCE RECYCLING CENTERS OF AMERICA, INC.

7400 Excelsior Boulevard

Minneapolis, Minnesota 55426

PROXY STATEMENT

SOLICITATION OF PROXIES

This proxy statement contains information relating to the annual meeting of shareholders of Appliance Recycling Centers of America, Inc. (the “Company”) to be held on Monday, May 18, 2015, beginning at 1:00 p.m., at the law offices of DeWitt Mackall Crounse & Moore, S.C., 2050 AT&T Tower, 901 Marquette Avenue, Minneapolis, Minnesota. Your proxy is solicited on behalf of the Board of Directors of the Company for use at the 2015 annual meeting of shareholders and any adjournment or postponement of the meeting.

The approximate date on which this proxy statement and form of proxy will first be made available to shareholders is April 14, 2015.

ABOUT THE MEETING

What is the purpose of the annual meeting?

At the Company’s annual meeting, shareholders will act upon the matters described in the accompanying Notice of Annual Meeting of Shareholders. This includes the election of five directors and the ratification of the appointment of our independent registered public accounting firm. In addition, the Company’s management will report on the performance of the Company during the 2014 fiscal year and respond to questions from shareholders.

Who is entitled to vote?

Only shareholders of record of outstanding common stock of the Company at the close of business on the record date, March 19, 2015, are entitled to receive notice of and to vote at the meeting, or any postponement or adjournment of the meeting. Each outstanding share of common stock entitles its holder to cast one vote on each matter to be voted upon.

Who can attend the meeting?

All shareholders as of the record date, or their duly appointed proxies, may attend the meeting.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the shares of common stock of the Company outstanding on the record date will constitute a quorum. A quorum is required for business to be conducted at the meeting. As of the record date, 5,800,818 shares of common stock of the Company were outstanding. You will be considered part of the quorum if you submit a properly executed proxy card, vote your proxy by using the Internet voting service or vote your proxy by using the toll-free telephone number listed on the proxy card, even if you abstain from voting.

How do I vote?

Even if you plan to attend the annual meeting you are encouraged to vote by proxy. You may vote by proxy by one of the following ways:

| |

1) | Sign and date each proxy card you receive and return it in the prepaid envelope; |

| |

2) | Vote by Internet at the address listed on the proxy card; or |

| |

3) | Vote by telephone using the toll-free number listed on the proxy card. |

If you vote by Internet or telephone, your electronic vote authorizes the proxy holders in the same manner as if you signed, dated and returned your proxy card. If you vote by Internet or telephone, do not return your proxy card.

If you return your signed proxy card or vote by Internet or telephone but do not give specific instructions as to how you wish to vote, your shares will be voted FOR all nominees in Proposal 1, and FOR ratifying the appointment of our independent registered public accounting firm in Proposal 2.

Can I change my vote after I return my proxy card or my Internet or telephone vote?

Yes. Even after you have submitted your proxy or voted by Internet or telephone, you may change your vote or revoke your proxy at any time before the proxy is exercised at the meeting. You may change or revoke it by:

| |

1) | Returning a later-dated signed proxy card or re-accessing the Internet voting site or telephone voting number listed on the proxy card; |

| |

2) | Delivering a written notice of revocation to the Company’s Secretary at the Company’s principal executive office at 7400 Excelsior Boulevard, Minneapolis, Minnesota 55426; or |

3) Attending the meeting and voting in person at the meeting (although attendance at the meeting without

voting at the meeting will not, in and of itself, constitute a revocation of your proxy).

What are the Board’s recommendations?

The Board’s recommendations are set forth after the description of each proposal in this proxy statement. In summary, the Board recommends a vote:

| |

• | FOR the election of each of the nominated directors (see Proposal 1 on page 7). |

| |

• | FOR ratification of the appointment of our independent registered public accounting firm (see Proposal 2 on page 12). |

If you submit your proxy card or vote by Internet or telephone, unless you give other instructions on your proxy card or your Internet or telephone vote, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board.

With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is given, in their own discretion.

What vote is required to approve each proposal?

For the election of directors, each shareholder will be entitled to vote for five nominees and the five nominees with the greatest number of votes will be elected.

With respect to ratification of the appointment of our independent registered public accounting firm or any other matter that properly comes before the meeting, the affirmative vote of the holders of a majority of the shares of common stock represented in person or by proxy and entitled to vote on the proposal will be required for approval. A properly executed proxy marked “ABSTAIN” with respect to any proposal will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, an abstention will have the effect of a negative vote with respect to all proposals.

If you hold your shares in “street name” through a broker or other nominee, your broker or nominee may not be permitted to exercise voting discretion with respect to the proposal to be acted upon. Thus, if you do not give your broker or nominee specific instructions, your shares may not be voted on the proposal and will not be counted in determining the number of shares necessary for approval of the proposal. Shares represented by such “broker non-votes” will, however, get counted in determining whether there is a quorum.

Who will count the vote?

An Inspector of Elections will be appointed for the annual meeting and will work with a representative of Wells Fargo Shareowner Services, our independent stock transfer agent, to count the votes.

What does it mean if I receive more than one proxy card?

If your shares are registered differently and are in more than one account, you will receive more than one copy of the proxy materials and more than one proxy card. To ensure that all your shares are voted, sign and return all proxy cards or use the Internet voting service or telephone voting service for each proxy card. We encourage you to have all accounts registered in the same name and address whenever possible. You can accomplish this by contacting our stock transfer agent, Wells Fargo Shareowner Services, at 1-800-468-9716.

How will voting on any other business be conducted?

Although we do not know of any business to be considered at the 2015 annual meeting other than the proposals described in this proxy statement, if any other business is presented at the annual meeting, your proxy gives authority to Mark G. Eisenschenk, President and Chief Executive Officer, and Denis E. Grande, Secretary, to vote on such matters at their discretion.

When are shareholder proposals for the 2016 annual meeting of shareholders due?

To be considered for inclusion in the Company’s proxy statement for the Company’s annual meeting to be held in 2016, shareholder proposals must be received at the Company’s office no later than December 15, 2015. Proposals must be in compliance with Rule 14a-8 under the Securities Exchange Act of 1934, as amended, and must be submitted in writing and delivered or mailed to the Company’s Secretary, at Appliance Recycling Centers of America, Inc., 7400 Excelsior Boulevard, Minneapolis, Minnesota 55426.

Under Rule 14a‑4(c)(1) of the Securities Exchange Act of 1934, as amended, any shareholder who wishes to have a proposal considered at the 2016 annual meeting of shareholders, but not submitted for inclusion in the Company’s proxy statement, must set forth such proposal in writing and file it with the Secretary of the Company no later than February 28, 2016. Failure to notify the Company by that date would allow the Company’s proxy holders to use their discretionary voting authority (to vote for or against the proposal) when the proposal is raised at the annual meeting without any discussion of the matter being included in the Company’s proxy statement.

Who pays the cost of this proxy solicitation?

The expense of the solicitation of proxies for this annual meeting, including the cost of mailing, has been or will be borne by the Company. Arrangements will be made with brokerage houses and other custodian nominees and

fiduciaries to send proxies and proxy materials to their principals, and the Company will reimburse them for their expense in so doing. In addition to solicitation by mail, proxies may be solicited by telephone, email or personally by certain of the Company’s directors, officers and regular employees, without additional compensation. Proxy solicitors may also be hired in connection with the annual meeting.

COMMON STOCK OWNERSHIP

Beneficial Ownership of Common Stock

The following table sets forth as of March 19, 2015 the beneficial ownership of common stock by each of the Company’s directors and director nominees, each of the executive officers named in the Summary Compensation Table on page 15, and all directors, director nominees and executive officers of the Company as a group, as well as information about beneficial owners of 5% or more of the Company’s common stock. Beneficial ownership includes shares that may be acquired in the next 60 days through the exercise of options or warrants.

|

| | | | | | | |

Beneficial Owner | | Position with Company | | Number of Shares Beneficially Owned (1) | | Percent of Outstanding (2) |

Directors, director nominees and executive officers: | | | | | | |

Edward R. Cameron (3) (4) | | Chairman of the Board | | 482,634 | | 8.1 | % |

Mark G. Eisenschenk (4) | | President and Chief Executive Officer | | 16,667 | | * |

|

Jeffery Ostapeic (4) | | Chief Financial Officer | | -- | | * |

|

Bradley S. Bremer (4) | | President of ApplianceSmart, Inc. | | 52,300 | | * |

|

Steve Lowenthal (4) | | Director | | 32,500 | | * |

|

Randy L. Pearce (4) | | Director | | 25,000 | | * |

|

Dean R. Pickerell (4) (5) | | Director | | 524,500 | | 9.0 | % |

Richard D. Butler (4) | | Nominee | | -- | | * |

|

Brian T. Conners (4) (6) | | Nominee | | 9,000 | | * |

|

Dennis (De) Gao | | Nominee | | -- | | * |

|

Tony Isaac | | Nominee | | -- | | * |

|

All directors, director nominees and executive officers as a group (11 persons) (4) | | | | 1,142,601 | | 18.7 | % |

Other 5% shareholders: | | | | | | |

Isaac Capital Group, LLC (7) | | | | 688,201 | | 11.9 | % |

Medallion Capital, Inc. (5) | | | | 492,000 | | 8.5 | % |

Abacab Capital Management (8) | | | | 439,587 | | 7.6 | % |

_______________________

* Indicates ownership of less than 1% of the outstanding shares

| |

(1) | Unless otherwise noted, each person or group identified possesses sole voting and investment power with respect to such shares. |

| |

(2) | Applicable percentage of ownership is based on 5,800,818 shares of common stock outstanding as of March 19, 2015 plus, for each shareholder, all shares that such shareholder could purchase within 60 days upon the exercise of existing stock options and warrants. |

| |

(3) | Includes 302,690 shares that are pledged to secure a personal line of credit. The address for Mr. Cameron is 7400 Excelsior Boulevard, Minneapolis, Minnesota 55426. |

| |

(4) | Includes shares which could be purchased within 60 days upon the exercise of existing stock options or warrants, as follows: Mr. Cameron, 160,167 shares; Mr. Eisenschenk, 16,667 shares; Mr. Bremer, 37,300 shares; Mr. Lowenthal, 32,500 shares; Mr. Pearce, 25,000 shares; Mr. Pickerell, 32,500 shares; Mr. Conners, 9,000 shares; and all directors, director nominees and executive officers as a group, 313,134 shares. |

| |

(5) | Includes shares held by Medallion Capital, Inc. (“MCI”), of which Mr. Pickerell is an executive officer. According to a Schedule 13D filed June 4, 2007 and a Form 4 filed April 2, 2008, MCI has sole dispositive power and sole voting power as to all 492,000 shares. Mr. Pickerell, a director of the Company, is an executive vice president at MCI and serves as portfolio |

manager for the shares held by MCI. Mr. Pickerell has shared voting power and shared dispositive power with respect to the shares held by MCI. Mr. Pickerell disclaims beneficial ownership of such shares. The address for MCI and Mr. Pickerell is 3000 West County Road 42, Suite 301, Burnsville, Minnesota 55337.

| |

(6) | Mr. Connors serves as President and Chief Operating Officer of ARCA Advanced Processing, LLC, in which the Company owns a 50% interest. |

| |

(7) | According to a Schedule 13D/A filed February 18, 2015, Isaac Capital Group (“Isaac Capital”) beneficially owned 688,201 shares of common stock. Isaac Capital has sole dispositive power as to all 688,201 shares and sole voting power as to 688,201 shares. The address for Isaac Capital is 3525 Del Mar Heights Road, Suite 765, San Diego, CA 92130. |

| |

(8) | According to a Schedule 13G filed March 1, 2015, Abacab Capital Management LLC (“Abacab”) beneficially owned 439,587 shares of common stock. Abacab has sole dispositive and voting power as to all 439,587 shares. The address for Abacab is 33 W. 38th Street, New York, NY 10018. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s officers and directors, and persons who own more than 10% of a registered class of the Company’s equity securities, to file reports of ownership on Form 3 and changes in ownership on Form 4 or Form 5 with the SEC. Such officers, directors and 10% shareholders are also required by SEC rules to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on its review of copies of such forms received by it, or written representations from certain reporting persons, the Company believes that, during the fiscal year ended January 3, 2015, its officers, directors and 10% shareholders timely complied with all Section 16(a) filing requirements, except as follows: Mr. Bremer filed a late Form 4 on February 6, 2014, reporting a January 29, 2014 exercise of a stock option.

PROPOSAL ONE:

ELECTION OF DIRECTORS

General Information

The property, affairs and business of the Company are managed under the direction of the Board of Directors. A board of five directors is to be elected at the meeting. Unless otherwise instructed, the proxy holders will vote the proxies received by them for management’s five nominees (see pages 7-9). The term of office for each person elected as a director will continue until the next annual meeting of shareholders and until a successor has been elected and qualified, or until such director is removed or resigns.

The nominees named below have been nominated for election at the Annual Meeting, and all nominees have indicated a willingness to serve if elected. Mr. Cameron is presently serving as a director of the Company and has served continuously since the year indicated. Four of the nominees have been nominated to fill positions of three current directors who are not standing for reelection and one vacancy resulting from the resignation of a director in November 2014. Those four nominees were recommended by Isaac Capital Group, LLC (“Isaac Capital”), the holder of 11.9% of the Company‘s shares. The Governance Committee has reviewed the background and qualifications of the nominees, including those recommended by Isaac Capital Group, LLC, and has approved each such nominee as a director candidate.

All shares represented by proxies that have been properly executed and returned or properly voted using the Internet or telephone voting service will be voted for the election of all of the nominees named below, unless other instructions are indicated thereon. The five nominees with the greatest number of votes will be elected. In the event any one or more of such nominees should for any reason not be able to serve as a director, the proxies will be voted for such other person or persons as may be designated by the Board.

The Board recommends a vote FOR all of the nominees.

Nominees

The names of the nominees are set forth in the table below. Following the table is certain information for at least the last five years regarding each nominee.

|

| | | | | | |

Name | |

Position with Company | | Director Since | |

Age |

Edward R. Cameron | | Chairman of the Board, Director | | 1976 | | 74 |

Richard D. Butler | | Nominee for Director | | --- | | 66 |

Brian T. Conners | | Nominee for Director | | --- | | 49 |

Dennis (De) Gao | | Nominee for Director | | --- | | 34 |

Tony Isaac | | Nominee for Director | | --- | | 60 |

Edward R. Cameron is the founder and served as president of the Company from its inception in 1976 through August 2014. He has been a director and Chairman of the Board of the Company since 1989, and prior to 1989 he was a director of a predecessor of the Company. Prior to founding the Company, Mr. Cameron served as a district product manager and an account manager for Burroughs Corporation (a predecessor of Unisys Corporation) and served in executive positions for several small businesses. Mr. Cameron has a Bachelor of Science degree in business administration from Montana State University.

In his more than 35 years with the Company, Mr. Cameron has developed and brings to the Board extensive knowledge of all aspects of the Company, its businesses, industry, markets and day-to-day operations, and the issues, opportunities and challenges facing the Company. Mr. Cameron’s role as Chairman of the Board of the Company creates a critical link between the Board and management and facilitates the implementation of our business strategies by management.

Richard D. Butler, Jr. is the owner of Solution Provider Services, an advisory firm which provides real estate, corporate and financial advisory services, since 1999, and is the co-Founder, Managing Director and major shareholder of Ref-Razzer Corporation, a whistle manufacturing and vending company, since 2005. Prior to this, Mr. Butler was the Co-Founder and Executive Vice President of Aspen Healthcare, Inc., from 1996 to 1999. From 1993 to 1996, Mr. Butler was a Managing Director at Landmark Financial and from 1989 to 1993. Mr. Butler was a Partner at Cal Ventures Real Estate Investment Group. Prior to this, Mr. Butler has also served as the President and Chief Executive Officer of Mt. Whitney Savings Bank, Chief Executive Officer of First Federal mortgage Bank, Chief Executive Officer of Trafalgar Mortgage, and Executive Officer and Member of the President’s Advisory Committee at State Savings & Loan Association (peak assets $14 billion) and American Savings & Loan Association (NYSE: FCA; peak assets $34 billion). Mr. Butler has served on the board of directors of LiveDeal, Inc. (NASDAQ: LIVE), a company providing specialized online marketing solutions to small-to-medium sized local business that boost customer awareness and merchant visibility, since August 2006 (including YP.com from 2006 to 2007). Mr. Butler has been a director of Dataram Corporation (NASDAQ: DRAM), an independent memory manufacturer, which develops, manufactures, and markets large capacity memory products primarily used in servers and workstations worldwide, since November 2014. Mr. Butler attended Bowling Green University in Ohio, San Joaquin Delta College in California, and Southern Oregon State College.

Mr. Butler would bring to the Board extensive experience in financial management and executive roles, which would enable him to provide important expertise in financial, operating and strategic matters that impact our Company.

Brian T. Conners has been the President and Chief Operating Officer of ARCA Advanced Processing, LLC (“AAP”), a company that recycles appliances generated from twelve states in the Northeast and Mid-Atlantic regions of the United States principally for General Electric Company (“GE”) acting through its GE Appliances business component, since 2007. The Company owns a 50% interest in AAP. Prior to this, Mr. Conners was the President of Safe Disposal Systems, Inc. (“Safe Disposal”), from 1992 to 2007. In February 2008, Safe Disposal petitioned the court under Chapter 11 of the Bankruptcy Code to combat an improperly used Confession of Judgment executed by a landlord; however, Safe Disposal successfully demonstrated its position and withdrew its petition in June 2008. The matter was ultimately settled out of court. Mr. Conners has a Bachelor of Science degree in Manufacturing Engineering from Boston University.

Mr. Conners has extensive experience in leadership roles and highly relevant industry experience, including his experience with AAP, and would provide valuable insight to the Board regarding operations and the industry in which the Company operates.

Dennis (De) Gao co-founded and, from July 2010 to March 2013, served as the CFO at Oxstones Capital Management, a privately held company and a social and philanthropic enterprise, serving as an idea exchange for the global community. Prior to establishing Oxstones Capital Management, from June 2008 until July 2010, Mr. Gao was a product owner at The Procter & Gamble Company for its consolidation system and was responsible for the Procter & Gamble’s financial report consolidation process. From May 2007 to May 2008, Mr. Gao was a financial analyst at the Internal Revenue Service's CFO division. Mr. Gao has served as a director of LiveDeal, Inc. (NASDAQ: LIVE) and as a member of the Audit Committee of LiveDeal, Inc. since January 2012. Mr. Gao has a dual major Bachelor of Science degree in Computer Science and Economics from University of Maryland, and an M.B.A. specializing in finance and accounting from Georgetown University’s McDonough School of Business.

Mr. Gao has significant finance, accounting and operational experience and would bring substantial finance and accounting expertise to the Board.

Tony Isaac has served as Financial Planning and Strategist/Economist of LiveDeal, Inc. (NASDAQ: LIVE), a company providing specialized online marketing solutions to small-to-medium sized local business that boost customer awareness and merchant visibility, since July 2012. He is the Chairman and Co-Founder of Isaac Organization, a privately held investment company. Mr. Isaac has invested in various companies, both private and public from 1980

to present. Mr. Isaac’s specialty is negotiation and problem-solving of complex real estate and business transactions. Mr. Isaac has served as a director of LiveDeal, Inc. since December 2011. Mr. Isaac graduated from Ottawa University in 1981, where he majored in Commerce and Business Administration and Economics.

Mr. Isaac would bring to the Board significant investment and financial expertise and public board experience.

Director Independence

There are no family relationships between any of the directors, director nominees, or executive officers of the Company. Four of the persons who have served as directors during the fiscal year ended January 3, 2015, and three of the director nominees for election at this Annual Meeting are or, if elected, will be “independent” directors as defined under the rules of The NASDAQ Stock Market (“NASDAQ”) for companies included in The NASDAQ Capital Market. The four independent directors are Steve Lowenthal, Randy L. Pearce and Dean R. Pickerell, current members of the Board, and Stanley Goldberg, who served as a director until November 2014. The three independent director nominees are Richard D. Butler, Dennis (De) Gao and Tony Isaac.

Board Leadership Structure

Edward R. Cameron, our founder and former Chief Executive Officer, serves as Chairman of the Board of Directors. The Company has not named a lead director. The Company believes this is appropriate at this time because of the size of the Company, the size of the Board, and Mr. Cameron’s extensive experience in the appliance sales and recycling industry. In view of these factors, the Board of Directors believes it makes sense for Mr. Cameron to chair the Board’s discussions of developments in the Company’s business and business strategy and its results of operations.

Board Role in Risk Oversight

It is management’s responsibility to manage risk and bring to the attention of the Board of Directors material risks affecting the Company. The Board of Directors, including through Board Committees comprised solely of independent directors, regularly reviews various areas of significant risk to the Company, and advises and directs management on the scope and implementation of policies, strategic initiatives and other actions designed to mitigate various types of risks. Specific examples of risks primarily overseen by the full Board of Directors include competition risks, industry risks, economic risks, liquidity risks, and business operations risks. The Audit Committee reviews with management and the independent auditors significant financial risk exposures and the processes management has implemented to monitor, control and report such exposures. The Audit Committee also reviews and approves transactions with related persons. The Compensation and Benefits Committee (the “Compensation Committee”) reviews and evaluates potential risks related to the attraction and retention of talent, and risks related to the design of compensation programs established by the Compensation Committee for the Company’s executive officers.

Actions and Committees of the Board of Directors

In 2014, the Board of Directors met seven times. In 2014, the Board of Directors had three standing committees, the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. The Audit Committee met four times; the Compensation Committee met once; and the Nominating and Corporate Governance Committee did not meet in 2014. In 2015, the Board established an additional committee, the Special Committee, comprised entirely of the Company’s independent directors, Mr. Lowenthal (Chairman), Mr. Pearce and Mr. Pickerell, for the purpose of developing and managing strategy relative to activist investors.

Each person who served as a director during 2014 attended all of the meetings of the Board of Directors and of the committees on which the director served. We encourage, but do not require, our directors and director nominees to attend annual meetings of shareholders. Three of our five directors then serving in office attended our last annual meeting on May 8, 2014.

Compensation and Benefits Committee

The Compensation Committee of the Board of Directors is comprised entirely of non-employee directors, Mr. Lowenthal, Mr. Pearce and Mr. Pickerell (Chairman), each of whom is also an “independent” director as defined under NASDAQ rules. The Compensation Committee is responsible for review and approval of officer salaries and other compensation and benefits programs and determination of officer bonuses. Annual compensation for the Company’s executive officers, other than the CEO, is recommended by the CEO and approved by the Compensation Committee. The annual compensation for the CEO is recommended by the Compensation Committee and formally approved by the full Board of Directors. The Compensation Committee may approve grants of equity awards under the Company’s stock compensation plans.

In the performance of its duties, the Compensation Committee may select independent compensation consultants to advise the committee when appropriate. In addition, the Compensation Committee may delegate authority to subcommittees where appropriate. The Compensation Committee may separately meet with management if deemed necessary and appropriate. The Compensation Committee operates under a written charter adopted by the Board of Directors in March 2011, which is posted on the Company’s website at www.ARCAInc.com under the caption “Investor Relations - Corporate Governance.”

Review, Approval or Ratification of Transactions with Related Persons

The Audit Committee, comprised of Mr. Lowenthal, Mr. Pearce (Chairman) and Mr. Pickerell, is responsible for the review and approval of all transactions in which the Company was or is to be a participant and in which any executive officer, director or director nominee of the Company, or any immediate family member of any such person (“related persons”) has or will have a material interest. In addition, all, if any, transactions with related persons that

come within the disclosures required by Item 404 of the SEC’s Regulation S-K must also be approved by the Audit Committee. The policies and procedures regarding the approval of all such transactions with related persons have been approved at a meeting of the Audit Committee and are evidenced in the corporate records of the Company.

Board Practice Related to Nominations of Directors

The Nominating and Corporate Governance Committee (the “Governance Committee”) is comprised of Mr. Lowenthal (Chairman), Mr. Pearce and Mr. Pickerell, each of whom is an “independent” director as defined under NASDAQ rules. The primary purpose of the Governance Committee is to ensure an appropriate and effective role for the Board of Directors in the governance of the Company. The principal recurring duties and responsibilities of the Governance Committee include (i) making recommendations to the Board regarding the size and composition of the Board, (ii) identifying and recommending to the Board of Directors candidates for election as directors, (iii) reviewing the Board’s committee structure, composition and membership and recommending to the Board candidates for appointment as members of the Board’s standing committees, (iv) reviewing and recommending to the Board corporate governance policies and procedures, (v) reviewing the Company’s Code of Business Ethics and Conduct and compliance therewith, and (vi) ensuring that emergency succession planning occurs for the positions of Chief Executive Officer, other key management positions, the Board chairperson and Board members. The Governance Committee operates under a written charter adopted by the Board of Directors in March 2011, which is posted on the Company’s website at www.ARCAInc.com under the caption “Investor Relations - Corporate Governance.”

The Governance Committee will consider director candidates recommended by shareholders. Four of the five candidates for election at the Annual Meeting were recommended by Isaac Capital Group, LLC. The Governance Committee has reviewed the background and qualifications of the nominees, including those recommended by Isaac Capital Group, LLC, and has approved each such nominee as a director candidate. The criteria applied by the Governance Committee in the selection of director candidates is the same whether the candidate was recommended by a Board member, an executive officer, a shareholder or a third party, and accordingly, the Governance Committee has not deemed it necessary to adopt a formal policy regarding consideration of candidates recommended by shareholders. Shareholders wishing to recommend candidates for Board membership should submit the recommendations in writing to the Secretary of the Company.

The Governance Committee identifies director candidates primarily by considering recommendations made by directors, management and shareholders. The Governance Committee also has the authority to retain third parties to identify and evaluate director candidates and to approve any associated fees or expenses. The Governance Committee did not retain any such third party with respect to the director candidates described in this Proxy Statement. Board candidates are evaluated on the basis of a number of factors, including the candidate’s background, skills, judgment, diversity, experience with companies of comparable complexity and size, the interplay of the candidate’s experience with the experience of other Board members, the candidate’s independence or lack of independence, and the candidate’s qualifications for committee membership. The Governance Committee does not assign any particular weighting or priority to any of these factors and considers each director candidate in the context of the current needs of the Board as a whole. Director candidates recommended by shareholders are evaluated in the same manner as candidates recommended by other persons.

Board Contact Information

If you would like to contact the Board or any committee of the Board, you can send an email to board@arcainc.com, or write to Appliance Recycling Centers of America, Inc., c/o Secretary, 7400 Excelsior Boulevard, Minneapolis, Minnesota 55426. All communications will be compiled by the Secretary of the Company and submitted to the Board or the applicable committee or director on a periodic basis.

PROPOSAL TWO:

RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected Baker Tilly Virchow Krause, LLP as the Company’s independent registered public accounting firm for fiscal year 2015 (i.e., the fiscal year ending January 2, 2016). The Company is submitting its selection of Baker Tilly Virchow Krause, LLP for ratification by the shareholders at the Annual Meeting. Baker Tilly Virchow Krause, LLP has audited the Company’s consolidated financial statements since 2005.

The Company’s bylaws do not require that shareholders ratify the selection of Baker Tilly Virchow Krause, LLP as the Company’s independent registered public accounting firm. However, the Company is submitting the selection of Baker Tilly Virchow Krause, LLP to shareholders for ratification as a matter of good corporate practice. If shareholders do not ratify the selection, the Audit Committee will reconsider whether to retain Baker Tilly Virchow Krause, LLP. Even if the selection is ratified, the Audit Committee at its discretion may change the appointment at any time during the year if it determines that such a change would be in the best interests of the Company and its shareholders.

The Board recommends a vote FOR ratifying the appointment of the Company’s independent registered public accounting firm.

INFORMATION CONCERNING OFFICERS AND KEY EMPLOYEES

WHO ARE NOT DIRECTORS

Bradley S. Bremer, 46, is President of ApplianceSmart, Inc., a subsidiary of the Company, a position he has held since February 2012. He served as Vice President of Retail Operations from 2007 until his appointment as President of ApplianceSmart. Mr. Bremer is responsible for directing all aspects of the Company’s retail division, including the management of sales, advertising and operations for the Company’s ApplianceSmart stores. He also oversees the selection of ApplianceSmart locations, planning for new stores, development of new markets, and implementation of retail programs and services. From 2000 to 2007, Mr. Bremer held the position of Retail Operations Manager for the Company. Mr. Bremer is a graduate of the University of Minnesota.

Mark Eisenschenk, 57, is the Company’s President and Chief Executive Officer and has held this position since August 2014. He is also President of ARCA Recycling, Inc., a position he has held since July 2013. Mr. Eisenschenk was employed by Vanguard Graphics International, LLC (Vanguard) from 2001 to March 2013. Vanguard is a holding company whose subsidiaries manufacture equipment, distribute consumables and develop and market specialty software for the graphics arts industry and mailing worldwide. He served as president of Vanguard and chief executive officer of its subsidiary, Xitron, LLC, from 2007 to 2013, and as chief financial officer and chief operating officer of Printware, LLC, the predecessor to Vanguard, from 2001 to 2007. Mr. Eisenschenk is a CPA (inactive) and holds a B.S. in Accounting from St. Cloud State University.

Rachel L. Holmes, 51, is the Vice President of Business Development. She has held the position of Vice President of Business Development since April 2008. Ms. Holmes focuses on business development, including strategic planning to obtain new clients for the Company’s appliance recycling and replacement services, and management of client accounts. She directs the Company’s environmental and regulatory research; participation in industry and government initiatives; and marketing and communications. She was employed by the Company from 1991 to 1999 in various corporate planning, marketing and advertising capacities. From 1999 until rejoining the Company in 2003, she was an independent marketing consultant for the Company. Ms. Holmes earned a B.A. from the University of Minnesota.

Jeffery P. Ostapeic, 46, is the Company’s Chief Financial Officer, a position he has held since December 2014. Mr. Ostapeic is responsible for the Company’s financial and accounting compliance, compiles and analyzes the Company’s financial statements, budgets and manages all of the Company’s day-to-day accounting operations,

including treasury, taxes, billing, collections and accounts payable. Mr. Ostapeic served most recently as an audit partner with Grant Thornton LLP, an international accounting firm, from 2011 to 2014. He previously served with McGladrey & Pullen LLP from 2007 to 2011 and Ernst & Young LLP from 1990 to 2007, also international public accounting firms. He is a CPA and holds a B.A. in Administrative and Commercial Studies - Finance and Economics from the University of Western Ontario.

Jeffrey L. Woloz, 63, is the Vice President and General Manager of ARCA Recycling, Inc. (formerly “ARCA California”). Mr. Woloz joined the Company in 2007 as General Manager of ARCA California and was named to the position of Vice President in April 2008. He directs the operations of the Company’s regional recycling facilities in Compton, CA, Portland, OR and Kent, WA, and oversees customer relations for replacement and recycling programs in California and Washington. Prior to joining the Company, Mr. Woloz was Director of Operations for Network Services, LLC, where he assisted in planning the strategic direction of the company while assuming a variety of operational responsibilities. He holds an MBA from California State University.

COMPENSATION OF NON-EMPLOYEE DIRECTORS

The Company uses a combination of cash and share-based incentive compensation to attract and retain qualified candidates to serve on the Board of Directors. In setting director compensation, the Company considers the significant amount of time that directors expend fulfilling their duties to the Company as well as the skill level required by the Company of members of the Board.

Non-employee directors of the Company receive an annual fee of $15,000 for their service as directors and an attendance fee of $1,000 per Board meeting. The Chairperson of the Audit Committee receives an additional annual fee of $10,000 and each other member of the Audit Committee receives an additional annual fee of $5,000. The Chairperson of the Compensation and Benefits Committee receives an additional annual fee of $1,500, and the Chairperson of the Nominating and Governance Committee receives an additional annual fee of $1,000. All of the Company’s directors are reimbursed for reasonable travel expenses incurred in attending meetings.

Non-employee directors also receive stock options under the 2011 Stock Compensation Plan. Each year, on the date of the Company’s annual meeting, non-employee directors receive an option to purchase 10,000 shares of common stock. In addition, upon their initial appointment or election to the Board, non-employee directors receive a one-time grant of options to purchase 10,000 shares of common stock. Generally, such options become exercisable in full six months after the date of grant and expire ten years from the date of grant.

The table below presents cash and non-cash compensation paid to non-employee directors during the last fiscal year.

Non-Management Director Compensation for Fiscal Year Ended January 3, 2015

|

| | | | | | | | |

Name (1) | | Fees Earned or Paid in Cash ($) | | Option Awards ($) | | All Other Compensation ($) | |

Total ($) |

| | | | | | | | |

Stanley Goldberg (2) | | 21,250 | | -- | | -- | | 21,250 |

Steve Lowenthal | | 26,750 | | 29,400 (3) | | -- | | 56,150 |

Randy L. Pearce | | 33,000 | | 29,400 (3) | | -- | | 62,400 |

Dean R. Pickerell | | 28,250 | | 29,400 (3) | | -- | | 57,650 |

_______________________

| |

(1) | Edward R. Cameron, the Company’s Chairman of the Board, has been omitted from this table since he receives no additional compensation for serving as a director of the Company; his compensation is described below under “Executive Compensation.” |

| |

(2) | Stanley Goldberg resigned as a Director on November 5, 2014. |

| |

(3) | These amounts reflect the fair value of the options granted during fiscal 2014. See Note 3 to the Company’s consolidated financial statements in the 2014 Annual Report on Form 10-K furnished with this proxy statement for discussion of the assumptions made in the valuation of option grants. At fiscal year-end, the non-management directors held options to purchase shares of common stock as follows: Mr. Lowenthal, 32,500 shares; Mr. Pearce, 25,000 shares; and Mr. Pickerell, 32,500 shares. |

EXECUTIVE COMPENSATION

The following table sets forth the cash and non-cash compensation earned for each of the Company’s last two fiscal years by (i) the Chairman, (ii) the President and Chief Executive Officer, and (ii) the other executive officers of the Company in 2014. We refer to the officers named in the table as our “Named Executive Officers.”

Summary Compensation Table for Fiscal Year Ended January 3, 2015 |

| | | | | | | | | | | | |

Name and Principal Position | | Year | | Salary ($) | | Bonus ($) | | Option Awards ($) | | All Other Compensation ($) | | Total ($) |

Edward R. Cameron (1) Chairman of the Board; Former President and CEO

| |

2014 2013

| |

300,000 218,555

| |

30,000 -- | |

80,500 (6) 147,000 (6) | |

7,028 (7) 7,028 (7) | |

417,528 372,583

|

Mark G. Eisenschenk (2) President and CEO

| |

2014 2013

| |

185,000 76,846 | |

11,785 -- | |

-- 206,000 (6) | |

7,200 3,000 | |

203,985 285,846 |

Jeffrey A. Cammerrer (3) Chief Financial Officer through Nov 21, 2014 | |

2014 2013

| |

146,160 156,000 | |

23,400 -- | |

46,000 (6) 36,750 (6) | |

-- -- | |

215,560 192,750 |

Jeffery Ostapeic (4) Chief Financial Officer

| |

2014

| |

6,461

| |

--

| |

98,500 (6)

| |

--

| |

104,961

|

Bradley S. Bremer (5) President of ApplianceSmart, Inc.

| |

2014 2013

| |

168,617 165,000 | |

24,750 -- | |

34,500 (6) 11,025 (6) | |

-- -- | |

227,867 176,025 |

______________________

| |

(1) | Mr. Cameron was President and Chief Executive Officer of the Company through August 13, 2014, the date on which he retired. Subsequent to his retirement, Mr. Cameron continues to be paid an annual salary of $300,000. He also is provided a Company-paid automobile. |

| |

(2) | Mr. Eisenschenk was appointed President and Chief Executive Officer of the Company on August 13, 2014 and is paid an annual salary of $185,000. Previously, and since July 11, 2013, he served as the Company's Chief Operating Officer. He is provided a $600 per month car allowance. See “Employment Agreement” below. |

| |

(3) | Mr. Cammerrer resigned as Chief Financial Officer of the Company effective November 21, 2014. |

| |

(4) | Mr. Ostapeic was appointed Chief Financial Officer of the Company effective December 18, 2014. He is paid an annual salary of $180,000 and provided a $600 per month car allowance. See “Employment Agreement” below. |

| |

(5) | Mr. Bremer was appointed President of ApplianceSmart, Inc., a subsidiary of the Company, effective February 23, 2012. He served as Vice President of Retail Operations from 2007 until his appointment as President of ApplianceSmart. |

| |

(6) | This amount reflects the fair value of the options granted during fiscal 2013 and 2014. See Note 3 to the Company’s consolidated financial statements in the 2014 Annual Report on Form 10-K furnished with this proxy statement for discussion of the assumptions made in the valuation of option grants. |

| |

(7) | These amounts reflect personal use of a Company-owned automobile of $7,028 per year. |

Employment Agreements

The Company has entered into employment agreements with Mark Eisenschenk and Jeffery Ostapeic. The material terms of the employment agreements entered into with the Named Executive Officers are described below.

Under their respective employment agreements, Mr. Eisenschenk’s base salary is $185,000 and Mr. Ostapeic’s base salary is $180,000. The employment agreements also provide for, among other things, participation in stock-based benefit plans and fringe benefit programs applicable to Mr. Eisenschenk and Mr. Ostapeic.

Each of the employment agreements provides the Employee with a severance benefit in an amount up to twelve (12) months base salary in the event the Company terminates his employment without Cause (as defined in each employment agreement). The cash severance benefit would be paid in accordance with the Company’s regular payroll practices, and would continue for a period of twelve (12) months following the date of termination or until the Employee enters into an employment, consulting or other business arrangement or relationship with another employer, whichever date is earlier.

If a Change of Control (as defined in each employment agreement) occurs during the term of the employment agreement and the Employee’s employment is terminated by the Company without Cause or by the Employee for Good Reason, the agreements provide for a cash severance benefit in the form of (i) a lump sum cash payment equal to one (1) times the Employee’s annual base salary, payable within 60 days after the date of termination, and (ii) continuation of the Employee’s base salary for a period of twelve (12) months following the date of termination or until the Employee enters into an employment, consulting or other business arrangement or relationship with another employer, whichever date is earlier. In addition, all unvested stock options to purchase capital stock of the Company held by the Employee shall immediately vest in full and shall be exercisable by the Employee for a period of 90 days after the date of termination. The agreements also provide that the Employee is entitled to receive all benefits payable to the Employee under any of the Company’s pension, life insurance, medical, health, disability, deferred compensation or savings plans in which the employee was participating immediately prior to the change in control.

Outstanding Equity Awards at January 3, 2015

The following table provides a summary of equity awards outstanding for our Named Executive Officers at January 3, 2015:

|

| | | | | | | | |

Name | | Number of Securities Underlying Unexercised Options (#) Exercisable | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | Option Exercise Price ($) | | Option Expiration Date |

Edward R. Cameron | | 50,000 (1) | | -- | | 5.27 | | 01/18/2015 |

Edward R. Cameron | | 8,500 (2) | | -- | | 2.22 | | 11/11/2016 |

Edward R. Cameron | | 35,000 (3) | | -- | | 2.30 | | 08/16/2017 |

Edward R. Cameron | | 5,000 (4) | | -- | | 4.25 | | 02/24/2018 |

Edward R. Cameron | | 75,000 (5) | | 25,000 (5) | | 1.89 | | 05/09/2020 |

Edward R. Cameron | | --- | | 35,000 (10) | | 3.00 | | 02/26/2021 |

| | | | | | | | |

Mark G. Eisenschenk | | 16,667 (10) | | 33,333 (10) | | 2.65 | | 07/22/2020 |

Mark G. Eisenschenk | | --- | | 33,333 (11) | | 2.65 | | 07/22/2020 |

| | | | | | | | |

Jeffrey A. Cammerrer | | 8,000 (6) | | -- | | 6.41 | | 02/14/2015 |

Jeffrey A. Cammerrer | | 1,000 (4) | | -- | | 4.25 | | 02/14/2015 |

Jeffrey A. Cammerrer | | 12,500 (7) | | 12,500 (7) | | 1.89 | | 02/14/2015 |

| | | | | | | | |

Jeffery Ostapeic | | --- | | 50,000 (12) | | 2.80 | | 12/18/2021 |

| | | | | | | | |

Bradley S. Bremer | | 7,500 (1) | | -- | | 5.27 | | 01/18/2015 |

Bradley S. Bremer | | 2,500 (8) | | -- | | 5.05 | | 03/10/2015 |

Bradley S. Bremer | | 4,800 (2) | | -- | | 2.22 | | 11/11/2016 |

Bradley S. Bremer | | 15,000 (9) | | -- | | 3.55 | | 05/13/2017 |

Bradley S. Bremer | | 5,000 (4) | | -- | | 4.25 | | 02/24/2018 |

Bradley S. Bremer | | 3,750 (7) | | 3,750 (7) | | 1.89 | | 05/09/2020 |

Bradley S. Bremer | | --- | | 15,000 (10) | | 3.00 | | 02/26/2021 |

_______________________

| |

(1) | Option granted January 18, 2008 and vested in two equal installments on each annual anniversary thereafter. |

| |

(2) | Option granted November 11, 2009 and vested twelve months thereafter. |

| |

(3) | Option granted August 16, 2010 and vested twelve months thereafter. |

| |

(4) | Option granted February 24, 2011 and vested twelve months thereafter. |

| |

(5) | Option granted May 9, 2013 vested with respect to 25,000 shares on July 22, 2013 the date in which the new Chief Operating Officer was hired, vested with respect to 25,000 shares on December 28, 2013 the date in which the 2013 action plan was achieved and will vest with respect to 25,000 shares on each anniversary of the date of grant. |

| |

(6) | Option granted July 28, 2008 and vested in two equal installments on each annual anniversary thereafter. |

| |

(7) | Option granted May 9, 2013 and will vest in two equal installments on each annual anniversary thereafter. |

| |

(8) | Option granted March 10, 2008 and vested in two equal installments on each annual anniversary thereafter. |

| |

(9) | Option granted May 13, 2010 and vested twelve months thereafter. |

| |

(10) | Option granted February 26, 2014 and will vest in three equal installments on each anniversary |

| |

(11) | Options granted July 22, 2013 and will vest when certain performance conditions are met. |

| |

(12) | Options granted December 18, 2014 and will vest in three equal installments on each anniversary. |

Stock Option Plans

The Company uses stock options to attract and retain executives, directors, consultants and key employees. Stock options are currently outstanding under three stock option plans. The Company’s 2011 Stock Compensation Plan (the “2011 Plan”) was adopted by the Board of Directors in March 2011 and approved by the shareholders at the 2011 annual meeting of shareholders. Under the 2011 Plan, the Company has reserved an aggregate of 700,000 shares of its common stock for option grants. The Company’s 2006 Stock Option Plan (the “2006 Plan”) was adopted by the Board of Directors in March 2006 and approved by the shareholders at the 2006 annual meeting of shareholders. The 2006 Plan expired on June 30, 2011, but options granted under the 2006 Plan before it expired will continue to be exercisable in accordance with their terms. The Company’s Restated 1997 Stock Option Plan (the “1997 Plan”) was adopted by the Board of Directors in March 1997 and approved by the shareholders at the 1997 annual meeting of shareholders. The 1997 Plan expired in March 2007, but options outstanding under the expired 1997 Plan continue to be exercisable in accordance with their terms. As of March 19, 2015, options to purchase an aggregate of 755,633 shares were outstanding, including options for 500,033 shares under the 2011 Plan, options for 247,800 shares under the 2006 Plan and options for 7,500 shares under the 1997 Plan. The Plans are administered by the Compensation Committee or the full Board of Directors acting as the Committee.

The 2011 Plan provides that a grant of non-qualified stock options, restricted stock or restricted stock units will be made to each non-employee director on the date of each annual meeting of shareholders at which the director is elected or reelected to the Board. The Board has the authority to determine the type of award and the number of shares subject to such annual grants prior to each annual meeting of shareholders. The total number of non-qualified options, restricted stock awards or restricted stock units granted each year at the annual meeting of shareholders may not exceed 15,000 shares per non-employee director unless the Compensation Committee determines that all independent directors or any independent director has performed substantial services. In addition to the annual grant, the Board has the ability to grant awards to non-employee directors at times other than the annual meeting.

Under the 2011 Plan, the Board may grant stock options that either qualify as “incentive stock options” under the Internal Revenue Code of 1986, as amended, (the “Code”) or as “non-qualified stock options.” Stock options may be granted in such form and upon such terms as the Board may approve from time to time. Stock options granted under the 2011 Plan may be exercised during their respective terms as determined by the Board. The purchase price may be paid by tendering cash or, in the Board’s discretion, by tendering common stock of the Company. No stock option shall be transferable by the optionee or exercised by anyone else during the optionee’s lifetime. Eligible persons will not pay any consideration to the Company in order to receive options, but will pay the exercise price upon exercise of an option.

Stock options may be exercised after a participant’s termination of employment for a period specified by the Board at the time the option is granted. The term of any stock option granted under the 2011 Plan may not exceed ten years (or five years in the case of an incentive stock option granted to a participant who owns or is deemed to own more than 10% of the combined voting power of all classes of stock of the Company, any subsidiary or affiliate). The exercise price of any stock option granted under the 2011 Plan may not be less than the fair market value of the common stock on the date the option is granted (or, in the case of an incentive stock option granted to a participant who owns more than 10% of the combined voting power of all classes of stock of the Company, the option price shall be not less than 110% of the fair market value of the stock on the date the option is granted).

The Board may grant stock appreciation rights (“SARs”) alone as “freestanding SARs” or in connection with all or part of any stock option as “tandem SARs” either at the time of the stock option grant, or, in the case of non-qualified options, later during the term of the stock option. SARs entitle the participant to receive from the Company the same economic value that would have been derived from the exercise of an underlying stock option and the immediate sale of the shares of common stock. Such value is paid by the Company in cash or shares of common stock, in the discretion of the Board. SARs are exercisable only at such times and to the extent stated in an award agreement. The Board may grant other awards of stock or awards that are valued in whole or in part by reference to, or otherwise based on, stock, either alone or in addition to or in tandem with stock options or SARs.

AUDIT COMMITTEE REPORT

The Audit Committee is responsible for selecting and approving the Company’s independent auditors, for relations with the independent auditors, for review of internal auditing functions (whether formal or informal) and internal controls, and for review of financial reporting policies to assure full disclosure of financial condition. The Audit Committee operates under a written charter adopted by the Board of Directors, which is posted on the Company’s website at www.ARCAInc.com under the caption “Investor Relations - Corporate Governance.” Mr. Lowenthal, Mr. Pearce (Chairman) and Mr. Pickerell, each of whom is a non-employee director, serve on the Audit Committee. Each member of the Audit Committee is “independent,” as independence for audit committee members is defined by NASDAQ rules, and otherwise satisfies NASDAQ requirements for audit committee membership. The Board has determined that Mr. Pearce is an “audit committee financial expert” as defined in SEC rules.

The Audit Committee reviewed with management the audited consolidated financial statements included in the Company’s Annual Report on Form 10-K, including a discussion of the reasonableness of significant judgments and accounting principles.

The Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on those consolidated audited financial statements in accordance with standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”), their judgments as to the Company’s accounting principles and such other matters as are required to be discussed with the Audit Committee under standards of the PCAOB. In addition, the Audit Committee has discussed with the independent auditors the auditor’s independence from management and the Company, including the matters in the written disclosures required by the applicable requirements of the PCAOB.

The Audit Committee discussed with the Company’s independent auditors the overall scope and plans for their audit. The Audit Committee meets with the independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls and the overall quality of the Company’s financial reporting. The Audit Committee held four meetings during 2014, with the independent auditors present at each meeting. In addition, at the end of each quarter and year-end the chairman of the Audit Committee and/or the full Audit Committee discussed with the independent auditors their findings and procedures relative to the auditor’s quarterly reviews and annual audit.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board approved) that the audited consolidated financial statements be included in the Annual Report on Form 10-K for the year ended January 3, 2015, for filing with the Securities and Exchange Commission.

April 14, 2015 The Audit Committee

Steve Lowenthal

Randy L. Pearce

Dean R. Pickerell

The information set forth above in the Audit Committee Report is not to be considered “filed” with the SEC for any purpose or “incorporated by reference” into any Securities Act or Exchange Act document of the Company for any purpose.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

This section should be read in conjunction with the Audit Committee Report on page 19.

The Audit Committee has appointed Baker Tilly Virchow Krause, LLP as the independent registered public accounting firm for fiscal year 2015 (i.e., the fiscal year ending January 2, 2016). A representative of Baker Tilly Virchow Krause, LLP is expected to be present at the annual meeting, will have an opportunity to make a statement if he or she desires to do so and will be available to respond to appropriate questions.

Fees Paid to Auditors by the Company During Most Recent Fiscal Years

Baker Tilly Virchow Krause, LLP has served as the independent auditors for the Company since fiscal 2005. During the fiscal years ended December 28, 2013 and January 3, 2015 the Company paid fees to Baker Tilly Virchow Krause, LLP for the following professional services:

|

| | | |

| December 28, 2013 | | January 3, 2015 |

Description | | | |

Audit fees (1) | $216,975 | | $273,967 |

| |

(1) | Audit fees consist of fees for professional services rendered in connection with the audit of the Company’s year-end financial statements, quarterly reviews of financial statements included in the Company’s quarterly reports, services rendered relative to regulatory filings, and attendance at Audit Committee meetings. For fiscal year 2014, this amount includes estimated billings for the completion of the 2014 audit that were rendered after year-end. |

The Audit Committee of the Board of Directors has considered whether the provision of the services described above was and is compatible with maintaining the independence of Baker Tilly Virchow Krause, LLP.

The Audit Committee pre-approves all audit and permissible non-audit services provided by the independent auditors. All the fees and services for fiscal 2013 and fiscal 2014 were approved by the Audit Committee.

OTHER MATTERS

At the date of this proxy statement the Company’s management knows of no other matters which may come before the annual meeting. However, if any other matters properly come before the meeting, it is the intention of the persons named in the accompanying proxy form to vote such proxies received by the Company in accordance with their judgment on such matters.

The Annual Report includes, among other things, the consolidated balance sheets of the Company as of January 3, 2015 and December 28, 2013 and the related consolidated statements of comprehensive income (loss), shareholders’ equity and cash flows for fiscal years ended January 3, 2015 and December 28, 2013. If you desire a copy of the Annual Report or a copy of the Company’s Form 10-K filed with the SEC, you may obtain one (excluding exhibits) without charge by addressing a request to Investor Relations, Appliance Recycling Centers of America, Inc., 7400 Excelsior Boulevard, Minneapolis, Minnesota 55426. You may also access a copy of the Company’s Form 10-K on the SEC’s website at www.sec.gov.

By Order of the Board of Directors

Denis E. Grande, Secretary

April 14, 2015