|

|

|

|

APPLIANCE

RECYCLING CENTERS OF AMERICA, INC.

7400 Excelsior Blvd. Minneapolis, MN 55426-4517

|

|

TELEPHONE: (952)

930-9000

|

|

FACSIMILE: (952)

930-1800

|

January 8,

2008

Mr. Michael

Moran

Accounting

Branch Chief

Securities

and Exchange Commission

Mail

Stop 3561

Washington,

DC 20549

|

Re:

|

|

Appliance

Recycling Centers of America, Inc.

|

|

|

|

Comment

Letter dated November 21, 2007

|

|

|

|

Form 10-K

for Fiscal Year Ended December 30, 2006

|

|

|

|

File

No. 000-19621

|

Dear

Mr. Moran:

We

have received your comment letter dated November 21, 2007, with respect to

the above-referenced filing by Appliance Recycling Centers of America, Inc.

As

requested, we are providing the following responses and supplemental

information. To facilitate your review

of our responses, we have set forth below the full text of each comment,

followed by our response thereto.

Report of Independent Registered Public Accounting Firm, page 31

1. Please have your

independent accounting firm tell us what consideration was given to the fact

that you were in violation of your debt covenants at the time they opined on

your financial statements on March 16, 2007. We note the waiver was not obtained from your

lender until March 28, 2007 subsequent to the audit report date of March 16,

2007.

Response

from our accounting firm: The existence

of the covenant violation was considered at the time we opined on the Company’s

financial statements but had no impact on the dating of the audit report due to

the existing demand feature of the instrument.

Report of Independent Registered Public Accounting Firm, page 32

2. Please clarify

which audit report provides assurance for each individual period included in

Schedule II on page 52. The

McGladrey & Pullen audit report refers to the year ended January 1,

2005 while the Virchow, Krause & Company, LLP does not refer to any

periods presented.

Also, please tell us why the schedule does not include an

annual balance as of December 31, 2005.

Response: Virchow, Krause & Company, LLP

audited both the 2005 and 2006 fiscal years.

Data from both 2005 and 2006 should have been included in Schedule II on

page 52, and will be included in future filings.

Consolidated Balance Sheets, page 33

3. Please add a line

item to correspond with Note 5. See Rule 5-02.25

of Regulation S-X.

Response: In future filings, the company will add a

line to the balance sheet corresponding to Note 5, “Commitments and

Contingencies.”

Consolidated Statement of Income, page 34

4. Please separately

present cost of revenue to be consistent with revenues. See Rule 5-03(b)2 of Regulation

S-X. Alternatively, please tell us why

it is impracticable to separate, identify or reasonably allocate a significant

amount of the costs disclosed as cost of revenues.

Response: Many of the company’s employees and assets

are used in both retail and recycling activities. This makes it impractical for the company to

identify costs associated with each activity.

Byproduct revenue, for example, is generated from both retail and

recycling activities as the company’s retail stores offer free removal and

recycling of the customer’s replaced appliances. The company does not generate

separate financial statements reporting on the different activities.

Consolidated Statement of Cash Flows, page 36

5. Please revise your

disclosure to clarify why the line of credit cash flows are eligible for net

reporting. You disclose this line of

credit has a stated maturity date of one year and requires minimum monthly

interest payments. In your response

please include your consideration of the net reporting requirement that debt be

due on demand or have a stated maturity of three months or less to be reported

net. See paragraph 13 of SFAS No. 95. Alternatively, please tell us you will

present the cash flows on a gross basis in future filings.

Response: As stated in Note 2, the lender may demand

payment in full of the entire outstanding balance of the loan at any time,

therefore we determined it qualifies for net reporting under FAS 95 paragraph

13, footnote 3.

6. The cash flow

statement shows long-term obligation payments of $260,000 yet the balance sheet

shows no net change between periods.

Help us understand the reason for these changes between periods and how

the changes are reflected in cash flows.

In your response please also explain the net change of $180,000 between

the mortgage balances and capital leases shown in Note 3.

Response: The Company reported non-cash financing for

new capital leases in the amount of $260,000, which in 2006 coincidentally

offset the other debt payments in the same amount.

Notes to Consolidated Financial Statements, page 37

Note 1. Nature of Business and Significant Accounting

Policies, page 37

Revenue Recognition, page 38

Product Warranty, page 38

7. Please tell us why

you combine extended warranty agreement sales with retail product sales. See rule 5-03(b) of Regulation S-X.

Response:

Extended warranty sales amounted to less

then 1.5% of total retail sales in 2006 and the amount was deemed immaterial

and therefore not split out on the income statement.

8. In future filings

please disclose the basis for recognizing revenue over the term of the

contract. We refer you to the discussion

of 12 month contracts with retained service obligations in the fourth paragraph

on page 22. Please include an

example of your revised disclosure.

Response: Here is the proposed disclosure for future

filings: The company recognizes revenue

on extended warranties with retained service obligations on a straight-line

basis over the period of the warranty in accordance with FASB Technical

Bulletin 90-1, “Accounting for Separately Priced Extended Warranty and Product

Maintenance Contracts.

9. Please tell us If

the third party service provider or the company is the named legal obligor for

extended warranty agreements where the service provider is responsible for risk

of loss or service costs. In either

scenario, please tell us your basis for revenue recognition for these

agreements and the applicable accounting guidance. Specifically please confirm you recognize the

price of the extended warranty agreement, less commission, at inception and the

basis for this treatment.

Response: The third party service provider is the named

legal obligor for extended warranty agreements where the service provider is

legally responsible for risk of loss or service costs. The company has no obligation under these

agreements and the amount the Company earns is fixed per the agreement with the

service provider, so we recognize revenue net of cost and commissions immediately

per Emerging Issues Task Force No. 99-19, Reporting Revenue Gross as a

Principal vs. Net as an Agent.

Property and Equipment, page 39

10. Please tell us if

retirement obligations exist, and if so how you have accounted for these costs

and how you satisfy the disclosure requirements in 22 of SFAS No. 143.

Response: The Company has no contractual asset

retirement obligations.

Software development costs, page 39

11. Please disclose

the total amount of capitalized software developed for internal use included in

each balance sheet and identify the line item that includes capitalized

software.

Response: The total amount of unamortized capitalized

software was $609,000 and $611,000 respectively for the years 2006 and

2005. These amounts are included in the

line item “equipment” under the Property and Equipment section of the balance

sheet. The Company

plans

to present this as a separate line item in with Property and Equipment per the

requirements of SFAS 86 paragraph 11a in future filings.

Segment Information, page 41

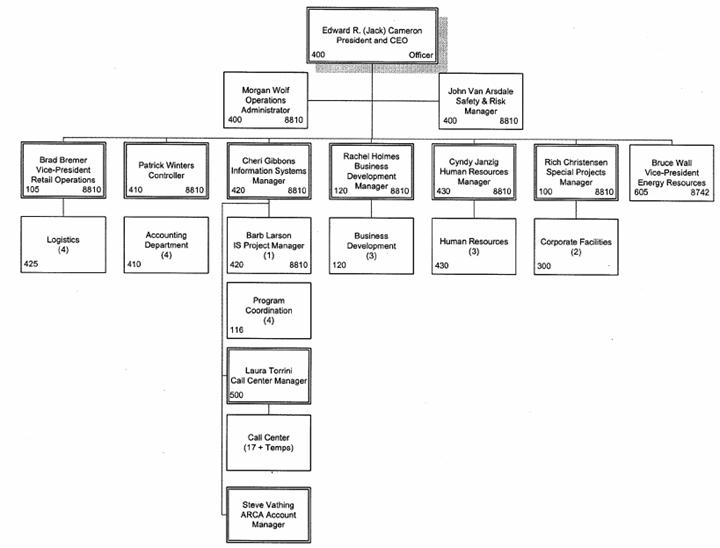

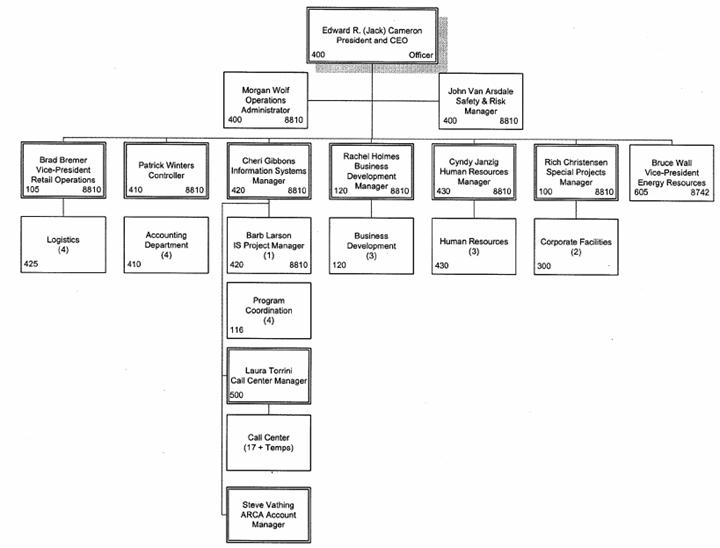

12. We observe the

filing contains many disclosures indicating the company has various unrelated

business activities and that these activities could be viewed as operating

segments which may not satisfy all of the aggregating criteria in paragraph 17

of SFAS No. 131. Please tell us how

management concluded the company has one reportable segment. In your response please provide us with the

financial information available to your chief operating decision maker (CODM)

as well as an organizational chart that describes the titles and functions of

managers within the company. In your

response please also specifically address the following:

· the dissimilarities of your

operations includes retail appliance outlets, providing recycling , reverse

logistics and byproduct activities services;

· the regulatory environment

that exists for recycling and byproduct activities but not retail stores, and

· customer dissimilarities

where retail stores serve the general public, recycling activities serves

electric utilities, reverse logistics serves appliance manufacturers and

retailers and byproduct activities serves waste haulers.

Response:

The company is managed as a single

operating unit as referenced by the attached organizational chart. The CEO is the sole chief operating decision

maker and he is not furnished with financial statements that separate the assets,

revenues, and associated costs by business activity. Revenues from recycling and by-product

activities are generated from both retail and recycling activities through

recycling services provided by the company and the free removal and recycling

of appliances through our retail stores.

Assets and staff are used in both activities and the Company does not

separate the use of these resources by activity. Financial information provided to our CEO and

management does not separate results by activity due to the multi-use nature

each location. Copies of the income statement and balance

sheet provided to the CEO and management are attached.

13. Please tell us

why you do not present the geographic segment information required by paragraph

38 of SFAS No. 131. We note you

disclose opening ARCA Canada, Inc. in 2006. To the extent your response states the

information is not material to your annual report; please tell us your

consideration of materiality with respect to subsequent interim periodic filings.

Response: The results of operations from ARCA Canada

were less than 1% of total revenues and assets for the fiscal year 2006. The company evaluates the impact of this

operation as a percent of total revenues and assets during each interim period

to determine if reporting as a separate segment is appropriate. During the first two quarters of 2007, the

results from ARCA Canada remained less than 1% of total revenues. The third quarter results were less than 8%

of total revenues.

Note 5. Commitments and Contingencies, page 44

14. We note your

recycling centers are registered as hazardous waste generators with the

EPA. Please tell us if there are any

environmental costs or obligations associated with

compliance with environmental laws for this business

activity. Tell us whether you use a

third party to dispose of hazardous waste.

Revise your disclosure here and/or MD&A as appropriate. See item 101 of Regulation S-K.

Response: The Company uses internally developed equipment

at each of our centers to recover refrigerants before any units are

recycled. The company uses only licensed

hazardous waste companies to transport, recycle or dispose of any hazardous

materials we generate. As of the balance sheet date, the company has no

environmental remediation liabilities or contingencies. We have not had any required environmental

remediation at any of our locations in the past and based on the safety programs

ARCA employs, as well as the use of only licensed companies to handle our

hazardous waste, we do not anticipate any liability associated with

environmental laws.

Note 2. Line of Credit, page 42

15. We note from your

disclosure that the payment of dividends is limited. Please expand your disclosure to state the

amount of income or retained earnings restricted and free of restrictions, as

applicable. See Rule 4-08(e) of

Regulation S-X.

Response: The agreement with our lender provides that

the company may not declare or pay any dividends, or make any distributions to

stockholders of any assets of the company.

In future filings, the company will revise its disclosure to indicate

that the agreement with our lender prohibits (rather than limits) payments of

dividends and distributions to stockholders.

Note 4. Accrued

Expenses, page 44.

16. Please explain

the facts and circumstances surrounding the accrual for recycling incentive

checks. In addition, we note the amount

of the accrual has remained the same for several periods. Please tell us when you anticipate paying the

amounts accrued.

Response: The amount accrued for incentive checks

reflects the amount of checks written in connection with our recycling program

that have not been cashed. These amounts are cleared as the checks are

presented for payment. After a period of time, these amounts will become

escheat property and be payable to the state associated with the program.

Note 7. Shareholders’ Equity, page 47

17. Please explain

the discrepancy of 500 stock options between the note and the statement of

shareholders’ equity. For example, we

note 21,500 stock options presented in this note and 21,000 in the statement of

equity for 2006.

Response: This discrepancy is due to rounding on the

equity statement. In future filings we

will present the actual number of shares throughout our filing, rather than

rounding to the nearest thousand as is done with dollar amounts.

In

connection with these responses, the Company hereby acknowledges that:

· The

company is responsible for the adequacy and accuracy of the disclosure in the

filing;

· staff

comments or changes to disclosure in response to staff comments do not

foreclose the Commission from taking any action with respect to the filing; and

· the

company may not assert staff comments as a defense in any proceeding initiated

by the Commission or any person under the federal securities laws of the United

States.

Please

contact Patrick Winters at 952-930-1782 if you have any questions about these

responses.

Sincerely,

Appliance

Recycling Centers of America, Inc.

By

Controller/Primary

Accounting Officer

Appliance

Recycling Centers of America, Inc.

Consolidated

Income Statement

For the Month

Ending November 24, 2007

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

JAN

|

|

FEB

|

|

MAR

|

|

APR

|

|

MAY

|

|

JUN

|

|

JUL

|

|

AUG

|

|

SEP

|

|

OCT

|

|

NOV

|

|

DEC

|

|

TOTAL

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SALES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Boxed-New

|

|

$

|

2,754,729

|

|

$

|

2,974,453

|

|

$

|

3,925,281

|

|

$

|

2,723,917

|

|

$

|

2,733,779

|

|

$

|

3,976,075

|

|

$

|

2,774,185

|

|

$

|

2,790,284

|

|

$

|

2,778,128

|

|

$

|

2,115,721

|

|

$

|

1,863,925

|

|

$

|

0

|

|

$

|

31,410,477

|

|

|

Unboxed - Special

Buy

|

|

1,946,324

|

|

2,289,011

|

|

3,069,934

|

|

2,618,916

|

|

2,815,947

|

|

3,228,047

|

|

2,799,520

|

|

2,783,096

|

|

3,087,000

|

|

2,791,402

|

|

4,689,116

|

|

0

|

|

32,118,313

|

|

|

Wholesale - Fixed

|

|

235

|

|

48,791

|

|

32,550

|

|

0

|

|

0

|

|

0

|

|

56,000

|

|

2,997

|

|

800

|

|

0

|

|

33,904

|

|

0

|

|

175,277

|

|

|

Net Appl. Sales

|

|

$

|

4,701,288

|

|

$

|

5,312,255

|

|

$

|

7,027,765

|

|

$

|

5,342,833

|

|

$

|

5,549,726

|

|

$

|

7,204,122

|

|

$

|

5,629,705

|

|

$

|

5,576,377

|

|

$

|

5,865,928

|

|

$

|

4,907,123

|

|

$

|

6,586,945

|

|

$

|

0

|

|

$

|

63,704,067

|

|

|

Wholesale-Unfixed

|

|

10,090

|

|

3,655

|

|

9,160

|

|

5,540

|

|

7,265

|

|

6,810

|

|

9,580

|

|

5,280

|

|

9,725

|

|

6,415

|

|

9,314

|

|

0

|

|

82,834

|

|

|

Warranty Income

|

|

68,562

|

|

86,525

|

|

118,414

|

|

81,461

|

|

80,653

|

|

106,007

|

|

91,955

|

|

47,638

|

|

(28,072

|

)

|

73,685

|

|

122,298

|

|

0

|

|

849,126

|

|

|

Service &

Labor Income

|

|

2,454

|

|

2,796

|

|

2,514

|

|

2,805

|

|

4,312

|

|

4,185

|

|

2,577

|

|

2,184

|

|

3,466

|

|

587

|

|

1,393

|

|

0

|

|

29,273

|

|

|

Parts S

Accessories Income

|

|

29,018

|

|

47,890

|

|

59,474

|

|

42,597

|

|

44,008

|

|

53,579

|

|

44,189

|

|

45,911

|

|

47,034

|

|

40,903

|

|

45,750

|

|

0

|

|

500,353

|

|

|

Delivery Income

|

|

53,029

|

|

62,830

|

|

90,980

|

|

64,471

|

|

61,186

|

|

81,428

|

|

82,738

|

|

58,945

|

|

66,085

|

|

58,670

|

|

81,039

|

|

0

|

|

761,401

|

|

|

Net Retail

Revenue

|

|

$

|

4,864,441

|

|

$

|

5,515,951

|

|

$

|

7,308,307

|

|

$

|

5,539,707

|

|

$

|

5,747,150

|

|

$

|

7,456,131

|

|

$

|

5,860,744

|

|

$

|

5,736,335

|

|

$

|

5,964,166

|

|

$

|

5,087,383

|

|

$

|

6,846,739

|

|

$

|

0

|

|

$

|

65,927,054

|

|

|

Recycling Revenue

|

|

471,510

|

|

534,745

|

|

887,641

|

|

723,041

|

|

820,566

|

|

1,809,809

|

|

1,817,725

|

|

2,911,087

|

|

4,305,784

|

|

4,551,659

|

|

3,492,365

|

|

0

|

|

22,325,932

|

|

|

By-Product

Revenue

|

|

111,399

|

|

101,087

|

|

136,649

|

|

179,304

|

|

121,886

|

|

184,374

|

|

172,711

|

|

217,669

|

|

384,115

|

|

320,199

|

|

359,798

|

|

0

|

|

2,289,191

|

|

|

TOTAL REVENUE

|

|

$

|

5,447,350

|

|

$

|

6,151,783

|

|

$

|

8,332,597

|

|

$

|

6,442,052

|

|

$

|

6,689,602

|

|

$

|

9,450,314

|

|

$

|

7,851,180

|

|

$

|

8,865,091

|

|

$

|

10,654,065

|

|

$

|

9,959,241

|

|

$

|

10,698,902

|

|

$

|

0

|

|

$

|

90,542,177

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COST OF SALES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Boxed-New

|

|

2,081,733

|

|

2,205,919

|

|

2,912,680

|

|

2,014,417

|

|

2,043,318

|

|

2,971,612

|

|

2,125,994

|

|

2,173,030

|

|

2,130,879

|

|

1,610,020

|

|

1,404,151

|

|

0

|

|

23,673,753

|

|

|

COGS Percent

|

|

75.6

|

%

|

74.2

|

%

|

74.2

|

%

|

74.0

|

%

|

74.7

|

%

|

74.7

|

%

|

76.6

|

%

|

77.9

|

%

|

76.7

|

%

|

76.1

|

%

|

75.3

|

%

|

0.0

|

%

|

75.4

|

%

|

|

Unboxed - Special

Buy

|

|

1,246,693

|

|

1,441,252

|

|

1,886,450

|

|

1,554,134

|

|

1,668,643

|

|

1,950,776

|

|

1,780,555

|

|

1,744,177

|

|

1,960,214

|

|

1,781,262

|

|

3,120,087

|

|

0

|

|

20,134,243

|

|

|

COGS Percent

|

|

64.1

|

%

|

63.0

|

%

|

61.4

|

%

|

59.3

|

%

|

59.3

|

%

|

60.4

|

%

|

63.6

|

%

|

62.7

|

%

|

63.5

|

%

|

63.8

|

%

|

66.5

|

%

|

0.0

|

%

|

62.7

|

%

|

|

Wholesale - Fixed

|

|

0

|

|

0

|

|

0

|

|

0

|

|

0

|

|

0

|

|

55,901

|

|

2,997

|

|

800

|

|

0

|

|

15,359

|

|

0

|

|

75,057

|

|

|

Manufacturer

Allowances’

|

|

(96,315

|

)

|

(44,614

|

)

|

(189,615

|

)

|

(62,363

|

)

|

(81,547

|

)

|

(364,569

|

)

|

(64,005

|

)

|

(49,824

|

)

|

(298,376

|

)

|

(128,403

|

)

|

(109,236

|

)

|

0

|

|

(1,488,867

|

)

|

|

Early Payment

Discounts

|

|

(45,348

|

)

|

(50,060

|

)

|

(69,144

|

)

|

(76,974

|

)

|

(60,261

|

)

|

(98,528

|

)

|

(85,912

|

)

|

(91,203

|

)

|

(100,097

|

)

|

(114,299

|

)

|

(111,245

|

)

|

0

|

|

(903,071

|

)

|

|

Total Loaded

Product Cost

|

|

$

|

3,186,764

|

|

$

|

3,552,498

|

|

$

|

4,540,372

|

|

$

|

3,429,215

|

|

$

|

3,570,154

|

|

$

|

4,459,292

|

|

$

|

3,812,534

|

|

$

|

3,779,178

|

|

$

|

3,693,421

|

|

$

|

3,148,581

|

|

$

|

4,319,117

|

|

$

|

0

|

|

$

|

41,491,116

|

|

|

Model 63%

|

|

67.8

|

%

|

66.9

|

%

|

64.6

|

%

|

64.2

|

%

|

64.3

|

%

|

61.9

|

%

|

67.7

|

%

|

67.8

|

%

|

63.0

|

%

|

64.2

|

%

|

65.6

|

%

|

0.0

|

%

|

65.1

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service Expense

|

|

34,702

|

|

69,871

|

|

59,023

|

|

49,336

|

|

44,730

|

|

63,187

|

|

49,536

|

|

51,134

|

|

75,243

|

|

54,201

|

|

54,155

|

|

0

|

|

605,118

|

|

|

Delivery Expense

|

|

82,130

|

|

70,853

|

|

80,602

|

|

81,313

|

|

89,256

|

|

140,762

|

|

89,916

|

|

94,938

|

|

118,487

|

|

57,557

|

|

86,001

|

|

0

|

|

991,815

|

|

|

Shipping &

Receiving

|

|

95,398

|

|

110,282

|

|

119,115

|

|

106,003

|

|

108,209

|

|

129,435

|

|

114,359

|

|

123,522

|

|

150,718

|

|

156,379

|

|

183,233

|

|

0

|

|

1,396,653

|

|

|

Freight -

Transfers

|

|

41,726

|

|

54,487

|

|

56,943

|

|

77,665

|

|

40,803

|

|

48,180

|

|

65,681

|

|

52,017

|

|

55,917

|

|

67,709

|

|

78,899

|

|

0

|

|

640,027

|

|

|

Warranty Expense

(Not Ext.

|

|

(4,464

|

)

|

(9,005

|

)

|

(9,201

|

)

|

8,133

|

|

(1,324

|

)

|

(6

|

)

|

(846

|

)

|

(313

|

)

|

(313

|

)

|

(29

|

)

|

199

|

|

0

|

|

(17,169

|

)

|

|

Warranty Claims

(Reimburse

|

|

3,817

|

|

(13,280

|

)

|

(15,858

|

)

|

(17,544

|

)

|

(13,420

|

)

|

(29,696

|

)

|

(20,405

|

)

|

(19,966

|

)

|

(31,652

|

)

|

(50,487

|

)

|

(63,538

|

)

|

0

|

|

(272,029

|

)

|

|

Production (Gain)

Loss

|

|

(36,549

|

)

|

17,141

|

|

17,033

|

|

(33,820

|

)

|

34,891

|

|

(110,733

|

)

|

(123,875

|

)

|

(48,009

|

)

|

(66,855

|

)

|

(64,357

|

)

|

(60,382

|

)

|

0

|

|

(475,515

|

)

|

|

Total Cost of

Other Sales

|

|

216,760

|

|

300,349

|

|

307,657

|

|

271,086

|

|

303,145

|

|

241,129

|

|

174,366

|

|

253,323

|

|

301,545

|

|

220,973

|

|

278,567

|

|

0

|

|

2,868,900

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inventory

Reserves

|

|

0

|

|

0

|

|

(54,299

|

)

|

(2,193

|

)

|

(15,112

|

)

|

(25

|

)

|

(3,969

|

)

|

(12,265

|

)

|

(3,679

|

)

|

2,107

|

|

(2,835

|

)

|

0

|

|

(92,270

|

)

|

|

Inventory

Adjustments

|

|

(200,668

|

)

|

49,656

|

|

112,114

|

|

(21,892

|

)

|

(2,938

|

)

|

238,974

|

|

(85,665

|

)

|

(156,207

|

)

|

17,762

|

|

14,453

|

|

6,136

|

|

0

|

|

(28,275

|

)

|

|

Total Inventory

Adjustments

|

|

(200,668

|

)

|

49,656

|

|

57,815

|

|

(24,085

|

)

|

(18,050

|

)

|

238,949

|

|

(89,634

|

)

|

(168,472

|

)

|

14,083

|

|

16,560

|

|

3,301

|

|

0

|

|

(120,545

|

)

|

|

Total Cost of

Other Sales & Inventory Adjustments

|

|

$

|

16,092

|

|

$

|

350,005

|

|

$

|

365,472

|

|

$

|

247,001

|

|

$

|

285,095

|

|

$

|

480,078

|

|

$

|

84,732

|

|

$

|

84,851

|

|

$

|

315,628

|

|

$

|

237,533

|

|

$

|

281,868

|

|

$

|

0

|

|

$

|

2,748,355

|

|

|

Model 5%

|

|

0.3

|

%

|

5.7

|

%

|

4.4

|

%

|

3.8

|

%

|

4.3

|

%

|

5.1

|

%

|

1.1

|

%

|

1.0

|

%

|

3.0

|

%

|

2.4

|

%

|

2.6

|

%

|

0.0

|

%

|

3.0

|

%

|

|

Total cost of

retail

|

|

$

|

3,202,856

|

|

$

|

3,902,503

|

|

$

|

4,905,844

|

|

$

|

3,676,216

|

|

$

|

3,855,249

|

|

$

|

4,939,370

|

|

$

|

3,897,266

|

|

$

|

3,864,029

|

|

$

|

4,009,049

|

|

$

|

3,386,114

|

|

$

|

4,600,985

|

|

$

|

0

|

|

$

|

44,239,471

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Processing Costs

|

|

176,998

|

|

151,881

|

|

169,822

|

|

136,389

|

|

130,002

|

|

175,176

|

|

169,602

|

|

224,228

|

|

342,768

|

|

276,969

|

|

287,447

|

|

0

|

|

2,241,282

|

|

|

Transportation

Costs

|

|

226,291

|

|

210,155

|

|

372,463

|

|

269,266

|

|

307,174

|

|

594,106

|

|

581,739

|

|

847,251

|

|

1,441,854

|

|

1,487,530

|

|

1,170,307

|

|

0

|

|

7,508,136

|

|

|

Cost of Utility

Change Out Uni

|

|

0

|

|

0

|

|

136,224

|

|

7,709

|

|

96,703

|

|

508,333

|

|

593,567

|

|

897,075

|

|

1,273,410

|

|

1,835,117

|

|

1,383,593

|

|

0

|

|

6,731,731

|

|

|

Total Recycling

Costs

|

|

$

|

403,289

|

|

$

|

362,036

|

|

$

|

678,509

|

|

$

|

413,364

|

|

$

|

533,879

|

|

$

|

1,277,615

|

|

$

|

1,344,908

|

|

$

|

1,968,554

|

|

$

|

3,058,032

|

|

$

|

3,599,616

|

|

$

|

2,841,347

|

|

$

|

0

|

|

$

|

16,481,149

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Facilities

|

|

(28,239

|

)

|

(30,155

|

)

|

(30,053

|

)

|

(30,081

|

)

|

(30,175

|

)

|

(28,800

|

)

|

(29,069

|

)

|

(21,973

|

)

|

(13,492

|

)

|

6,902

|

|

11,937

|

|

0

|

|

(223,198

|

)

|

|

TOTAL COST OF

REVENUE

|

|

3,577,906

|

|

4,234,384

|

|

5,554,300

|

|

4,059,499

|

|

4,358,953

|

|

6,188,185

|

|

5,213,105

|

|

5,810,610

|

|

7,053,589

|

|

6,992,632

|

|

7,454,269

|

|

0

|

|

60,497,422

|

|

|

GROSS PROFIT

|

|

$

|

1,869,444

|

|

$

|

1,917,399

|

|

$

|

2,778,297

|

|

$

|

2,382,553

|

|

$

|

2,330,649

|

|

$

|

3,262,129

|

|

$

|

2,638,075

|

|

$

|

3,054,481

|

|

$

|

3,600,476

|

|

$

|

2,966,609

|

|

$

|

3,244,633

|

|

$

|

0

|

|

$

|

30,044,755

|

|

|

Model 32%

|

|

34.3

|

%

|

31.2

|

%

|

33.3

|

%

|

37.0

|

%

|

34.8

|

%

|

34.5

|

%

|

33.6

|

%

|

34.5

|

%

|

33.8

|

%

|

29.8

|

%

|

30.3

|

%

|

0.0

|

%

|

33.2

|

%

|

1

Appliance Recycling Centers

of America, Inc.

Consolidated

Income Statement

For the Month Ending

November 24, 2007

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

JAN

|

|

FEB

|

|

MAR

|

|

APR

|

|

MAY

|

|

JUN

|

|

JUL

|

|

AUG

|

|

SEP

|

|

OCT

|

|

NOV

|

|

DEC

|

|

TOTAL

|

|

|

GROSS PROFIT

|

|

1,869,444

|

|

1,917,399

|

|

2,778,297

|

|

2,382,553

|

|

2,330,649

|

|

3,262,129

|

|

2,638,075

|

|

3,054,481

|

|

3,600,476

|

|

2,966,609

|

|

3,244,633

|

|

0

|

|

30,044,755

|

|

|

Model 32%

|

|

34.3

|

%

|

31.2

|

%

|

33.3

|

%

|

37.0

|

%

|

34.8

|

%

|

34.5

|

%

|

33.6

|

%

|

34.5

|

%

|

33.8

|

%

|

29.8

|

%

|

30.3

|

%

|

0.0

|

%

|

33.2

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Advertising

Expense

|

|

329,284

|

|

408,774

|

|

355,334

|

|

394,240

|

|

415,191

|

|

429,884

|

|

411,563

|

|

381,898

|

|

343,306

|

|

321,432

|

|

376,169

|

|

0

|

|

4,167,075

|

|

|

Advertising

Rebate

|

|

(10,000

|

)

|

(4,047

|

)

|

(20,000

|

)

|

0

|

|

0

|

|

(25,979

|

)

|

(30,000

|

)

|

0

|

|

0

|

|

(5,500

|

)

|

0

|

|

0

|

|

(95,526

|

)

|

|

Net Advertising

Expense

|

|

$

|

319,284

|

|

$

|

404,727

|

|

$

|

335,334

|

|

$

|

394,240

|

|

$

|

415,191

|

|

$

|

403,905

|

|

$

|

381,563

|

|

$

|

381,898

|

|

$

|

343,306

|

|

$

|

315,932

|

|

$

|

376,169

|

|

$

|

0

|

|

$

|

4,071,549

|

|

|

Model 3%

|

|

5.9

|

%

|

6.6

|

%

|

4.0

|

%

|

6.1

|

%

|

6.2

|

%

|

4.3

|

%

|

4.9

|

%

|

4.3

|

%

|

3.2

|

%

|

3.2

|

%

|

3.5

|

%

|

0.0

|

%

|

4.5

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Occupancy

Expenses

|

|

354,452

|

|

365,921

|

|

390,492

|

|

373,746

|

|

380,920

|

|

368,457

|

|

333,821

|

|

307,930

|

|

369,934

|

|

302,933

|

|

338,423

|

|

0

|

|

3,887,029

|

|

|

Model 6%

|

|

6.5

|

%

|

5.9

|

%

|

4.7

|

%

|

5.8

|

%

|

5.7

|

%

|

3.9

|

%

|

4.3

|

%

|

3.5

|

%

|

3.5

|

%

|

3.0

|

%

|

3.2

|

%

|

0.0

|

%

|

4.3

|

%

|

|

Retail Store

Selling

Expenses

|

|

889,207

|

|

756,207

|

|

998,647

|

|

659,536

|

|

571,682

|

|

1,041,734

|

|

829,080

|

|

879,991

|

|

904,665

|

|

788,753

|

|

788,001

|

|

0

|

|

9,107,503

|

|

|

Model 10%

|

|

16.3

|

%

|

12.3

|

%

|

12.0

|

%

|

10.2

|

%

|

8.5

|

%

|

11.0

|

%

|

10.6

|

%

|

9.9

|

%

|

8.5

|

%

|

7.9

|

%

|

7.4

|

%

|

00

|

%

|

10.1

|

%

|

|

Total Retail

Store

Expenses

|

|

$

|

1,243,659

|

|

$

|

1,122,128

|

|

$

|

1,389,139

|

|

$

|

1,033,282

|

|

$

|

952,602

|

|

$

|

1,410,191

|

|

$

|

1,162,901

|

|

$

|

1,187,921

|

|

$

|

1,274,599

|

|

$

|

1.091.686

|

|

$

|

1.126.424

|

|

$

|

0

|

|

$

|

12.994.532

|

|

|

TOTAL SELLING

EXPENSES

|

|

$

|

1,562,943

|

|

$

|

1,526,855

|

|

$

|

1,724,473

|

|

$

|

1,427,522

|

|

$

|

1,367,793

|

|

$

|

1,814,096

|

|

$

|

1,544,464

|

|

$

|

1,569,819

|

|

$

|

1,617,905

|

|

$

|

1,407,618

|

|

$

|

1,502,593

|

|

$

|

0

|

|

$

|

17,066,081

|

|

|

Model 19%

|

|

28.7

|

%

|

24.8

|

%

|

20.7

|

%

|

22.2

|

%

|

20.4

|

%

|

19.2

|

%

|

19.7

|

%

|

17.7

|

%

|

15.2

|

%

|

14.1

|

%

|

14.0

|

%

|

0.0

|

%

|

18.8

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Center G&A

Expenses

|

|

139,118

|

|

196,916

|

|

431,774

|

|

292,849

|

|

314,503

|

|

365,884

|

|

324,373

|

|

441,583

|

|

601,628

|

|

518,554

|

|

425,702

|

|

0

|

|

4,052,884

|

|

|

Alloc IN CTR

G&A

Expenses

|

|

22,991

|

|

36,342

|

|

62,288

|

|

72,288

|

|

59,844

|

|

67,920

|

|

93,493

|

|

101,604

|

|

89,304

|

|

62,060

|

|

66,215

|

|

0

|

|

734,349

|

|

|

Alloc OUT

CTRG&A

Expense

|

|

(22,991

|

)

|

(36,342

|

)

|

(62,288

|

)

|

(72,288

|

)

|

(59,844

|

)

|

(67,920

|

)

|

(93,493

|

)

|

(101,604

|

)

|

(89,304

|

)

|

(62,060

|

)

|

(66,215

|

)

|

0

|

|

(734,349

|

)

|

|

TOTAL CENTER

G&A EXPE

|

|

$

|

139,118

|

|

$

|

196,916

|

|

$

|

431,774

|

|

$

|

292,849

|

|

$

|

314,503

|

|

$

|

365,884

|

|

$

|

324,373

|

|

$

|

441,583

|

|

$

|

601,628

|

|

$

|

518,554

|

|

$

|

425,702

|

|

$

|

0

|

|

$

|

4,052,884

|

|

|

Model 2%

|

|

2.6

|

%

|

3.2

|

%

|

5.2

|

%

|

4.5

|

%

|

4.7

|

%

|

3.9

|

%

|

4.1

|

%

|

5.0

|

%

|

5.6

|

%

|

5.2

|

%

|

4.0

|

%

|

0.0

|

%

|

4.5

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME BEFORE

CORPOR

|

|

167,383

|

|

193,628

|

|

622,050

|

|

662,182

|

|

648,353

|

|

1,082,149

|

|

769,238

|

|

1,043,079

|

|

1,380,943

|

|

1,040,437

|

|

1,316,338

|

|

0

|

|

8,925,790

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CORPORATE

ALLOCATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate G&A

Expenses

|

|

326,900

|

|

343,019

|

|

488,462

|

|

340,633

|

|

365,552

|

|

480,592

|

|

402,861

|

|

413,353

|

|

543,463

|

|

398,575

|

|

534,373

|

|

0

|

|

4,637,783

|

|

|

Alloc IN IS

Expenses

|

|

86,029

|

|

93,350

|

|

115,623

|

|

99,666

|

|

104,519

|

|

138,814

|

|

115,009

|

|

129,316

|

|

125,296

|

|

109,033

|

|

122,906

|

|

0

|

|

1,239,561

|

|

|

Alloc OUT IS

Expenses

|

|

(85,926

|

)

|

(93,350

|

)

|

(115,623

|

)

|

(99,666

|

)

|

(104,519

|

)

|

(138,814

|

)

|

(115,009

|

)

|

(129,316

|

)

|

(125,296

|

)

|

(109,033

|

)

|

(122,906

|

)

|

0

|

|

(1,239,458

|

)

|

|

Alloc IN HR

Expenses

|

|

27,766

|

|

20,170

|

|

31,537

|

|

26,444

|

|

29,238

|

|

46,953

|

|

29,850

|

|

18,866

|

|

32,378

|

|

26,305

|

|

23,079

|

|

0

|

|

312,586

|

|

|

Alloc OUT HR

Expenses

|

|

(27,869

|

)

|

(20,170

|

)

|

(31,537

|

)

|

(26,444

|

)

|

(29,238

|

)

|

(46,953

|

)

|

(29,850

|

)

|

(18,866

|

)

|

(32,378

|

)

|

(26,305

|

)

|

(23,079

|

)

|

0

|

|

(312,689

|

)

|

|

Alloc IN Retail

Sales

Exp

|

|

10,290

|

|

15,862

|

|

18,830

|

|

15,948

|

|

15,512

|

|

17,414

|

|

13,924

|

|

20,013

|

|

27,983

|

|

14,238

|

|

13,786

|

|

0

|

|

183,800

|

|

|

Alloc OUT Retail

Sales Exp

|

|

(10,290

|

)

|

(15,862

|

)

|

(18,830

|

)

|

(15,948

|

)

|

(15,512

|

)

|

(17,414

|

)

|

(13,924

|

)

|

(20,013

|

)

|

(27,983

|

)

|

(14,238

|

)

|

(13,786

|

)

|

0

|

|

(183,800

|

)

|

|

Alloc IN Retail

Operations Exp

|

|

14,582

|

|

15,416

|

|

2,231

|

|

0

|

|

0

|

|

0

|

|

0

|

|

0

|

|

0

|

|

0

|

|

0

|

|

0

|

|

32,229

|

|

|

Alloc OUT Retail

Operations

|

|

(14,582

|

)

|

(15,416

|

)

|

(2,231

|

)

|

0

|

|

0

|

|

0

|

|

0

|

|

0

|

|

0

|

|

0

|

|

0

|

|

0

|

|

(32,229

|

)

|

|

Alloc IN Corp.

Admin Expens

|

|

100,473

|

|

110,050

|

|

135,945

|

|

110,329

|

|

118,135

|

|

197,411

|

|

117,618

|

|

110,197

|

|

204,984

|

|

111,047

|

|

133,699

|

|

0

|

|

1,449,888

|

|

|

Alloc OUT Corp.

Admin. Expe

|

|

(100,473

|

)

|

(110,050

|

)

|

(135,945

|

)

|

(110,329

|

)

|

(118,135

|

)

|

(197,411

|

)

|

(117,618

|

)

|

(110,197

|

)

|

(204,984

|

)

|

(111,047

|

)

|

(133,699

|

)

|

0

|

|

(1,449,888

|

)

|

|

Alloc IN

Accounting

Expenses

|

|

39,689

|

|

58,529

|

|

70,452

|

|

54,049

|

|

44,304

|

|

49,586

|

|

61,545

|

|

58,801

|

|

64,360

|

|

50,270

|

|

47,010

|

|

0

|

|

598,595

|

|

|

Alloc OUT

Accounting

Expen

|

|

(39,689

|

)

|

(58,529

|

)

|

(70,452

|

)

|

(54,049

|

)

|

(44,304

|

)

|

(49,586

|

)

|

(61,545

|

)

|

(58,801

|

)

|

(64,360

|

)

|

(50,270

|

)

|

(47,010

|

)

|

0

|

|

(598,595

|

)

|

|

Alloc IN Program

Coordination

|

|

0

|

|

0

|

|

0

|

|

0

|

|

13,694

|

|

14,024

|

|

12,073

|

|

17,381

|

|

20,158

|

|

20,081

|

|

20,769

|

|

0

|

|

118,180

|

|

|

Alloc OUT Program

Coordinat

|

|

0

|

|

0

|

|

0

|

|

0

|

|

(13,694

|

)

|

(14,024

|

)

|

(12,073

|

)

|

(17,381

|

)

|

(20,158

|

)

|

(20,081

|

)

|

(20,769

|

)

|

0

|

|

(118,180

|

)

|

|

Alloc IN Business

Developme

|

|

0

|

|

0

|

|

0

|

|

0

|

|

8,336

|

|

8,669

|

|

17,107

|

|

26,897

|

|

33,066

|

|

23,551

|

|

23,808

|

|

0

|

|

141,434

|

|

|

Alloc OUT

Business

Develop

|

|

0

|

|

0

|

|

0

|

|

0

|

|

(8,336

|

)

|

(8,669

|

)

|

(17,107

|

)

|

(26,897

|

)

|

(33,066

|

)

|

(23,551

|

)

|

(23,808

|

)

|

0

|

|

(141,434

|

)

|

|

Alloc IN

Logistics

|

|

0

|

|

0

|

|

0

|

|

0

|

|

0

|

|

12,474

|

|

13,871

|

|

11,874

|

|

15,490

|

|

13,011

|

|

13,239

|

|

0

|

|

79,959

|

|

|

Alloc OUT

Logistics

|

|

0

|

|

0

|

|

0

|

|

0

|

|

0

|

|

(12,474

|

)

|

(13,871

|

)

|

(11,874

|

)

|

(15,490

|

)

|

(13,011

|

)

|

(13,239

|

)

|

0

|

|

(79,959

|

)

|

|

TOTAL CORP

G&A

EXPENS

|

|

$

|

326,900

|

|

$

|

343,019

|

|

$

|

488,462

|

|

$

|

340,633

|

|

$

|

365,552

|

|

$

|

480,592

|

|

$

|

402,861

|

|

$

|

413,353

|

|

$

|

543,463

|

|

$

|

398,575

|

|

$

|

534,373

|

|

$

|

0

|

|

$

|

4,637,783

|

|

|

Model 4%

|

|

6.0

|

%

|

5.6

|

%

|

5.9

|

%

|

5.3

|

%

|

5.5

|

%

|

5.1

|

%

|

5.1

|

%

|

4.7

|

%

|

5.1

|

%

|

4.0

|

%

|

5.0

|

%

|

0.0

|

%

|

5.1

|

%

|

|

OPERATING

INCOME

|

|

$

|

(159,517

|

)

|

$

|

(149,391

|

)

|

$

|

133,588

|

|

$

|

321,549

|

|

$

|

282,801

|

|

$

|

601,557

|

|

$

|

366,377

|

|

$

|

629,726

|

|

$

|

837,480

|

|

$

|

641,862

|

|

$

|

781,965

|

|

$

|

0

|

|

$

|

4,288,007

|

|

|

Model 7%

|

|

-2.9

|

%

|

-2.4

|

%

|

1.6

|

%

|

5.0

|

%

|

4.2

|

%

|

6.4

|

%

|

4.7

|

%

|

7.1

|

%

|

7.9

|

%

|

6.4

|

%

|

7.3

|

%

|

0.0

|

%

|

4.7

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Income

(Expenses)

|

|

(8,364

|

)

|

44

|

|

10,006

|

|

(17,510

|

)

|

8,258

|

|

(36,799

|

)

|

(3,120

|

)

|

(5,361

|

)

|

20,419

|

|

(876

|

)

|

(3,581

|

)

|

0

|

|

(36,884

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Income

|

|

0

|

|

0

|

|

0

|

|

0

|

|

0

|

|

0

|

|

0

|

|

16,606

|

|

1,383

|

|

0

|

|

1,715

|

|

0

|

|

19,704

|

|

|

Interest Expense

|

|

(103,282

|

)

|

(96,438

|

)

|

(98,491

|

)

|

(98,101

|

)

|

(110,496

|

)

|

(115,103

|

)

|

(128,406

|

)

|

(136,061

|

)

|

(129,781

|

)

|

(151,585

|

)

|

(154,069

|

)

|

0

|

|

(1,321,813

|

)

|

|

Model 1%

|

|

-1.9

|

%

|

-1.6

|

%

|

-1.2

|

%

|

-1.5

|

%

|

-1.7

|

%

|

-1.2

|

%

|

-1.6

|

%

|

-1.5

|

%

|

-1.2

|

%

|

-1.5

|

%

|

-1.4

|

%

|

00

|

%

|

-1.5

|

%

|

|

INC BEFORE

MGMT FEE, IN

|

|

$

|

(271,163

|

)

|

$

|

(245,785

|

)

|

$

|

45,103

|

|

$

|

205,938

|

|

$

|

180,563

|

|

$

|

449,655

|

|

$

|

234,851

|

|

$

|

504,910

|

|

$

|

729,501

|

|

$

|

489,401

|

|

$

|

626,030

|

|

$

|

0

|

|

$

|

2,949,014

|

|

|

INC BEFORE

INCOME TAX

|

|

$

|

(271,163

|

)

|

$

|

(245,785

|

)

|

$

|

45,103

|

|

$

|

205,938

|

|

$

|

180,563

|

|

$

|

449,655

|

|

$

|

234,851

|

|

$

|

504,910

|

|

$

|

729,501

|

|

$

|

489,401

|

|

$

|

626,030

|

|

$

|

0

|

|

$

|

2,949,014

|

|

|

Model 6%

|

|

-5.0

|

%

|

-4.0

|

%

|

0.5

|

%

|

3.2

|

%

|

2.7

|

%

|

4.8

|

%

|

3.0

|

%

|

5.7

|

%

|

6.8

|

%

|

4.9

|

%

|

5.9

|

%

|

0.0

|

%

|

3.3

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for

(Benefit

of) lnco

|

|

0

|

|

0

|

|

0

|

|

0

|

|

0

|

|

0

|

|

0

|

|

873

|

|

64,719

|

|

0

|

|

0

|

|

0

|

|

65,592

|

|

|

Model 2.4%

|

|

0.0

|

%

|

0.0

|

%

|

0.0

|

%

|

0.0

|

%

|

0.0

|

%

|

0.0

|

%

|

0.0

|

%

|

0.0

|

%

|

0.6

|

%

|

0.0

|

%

|

0.0

|

%

|

0.0

|

%

|

0.1

|

%

|

|

NET INCOME

|

|

$

|

(271,163

|

)

|

$

|

(245,785

|

)

|

$

|

45,103

|

|

$

|

205,938

|

|

$

|

180,563

|

|

$

|

449,655

|

|

$

|

234,851

|

|

$

|

504,037

|

|

$

|

664,782

|

|

$

|

489,401

|

|

$

|

626,030

|

|

$

|

0

|

|

$

|

2,883,422

|

|

|

Model 3.6%

|

|

-5.0

|

%

|

-4.0

|

%

|

0.5

|

%

|

3.2

|

%

|

2.7

|

%

|

4.8

|

%

|

3.0

|

%

|

5.7

|

%

|

6.2

|

%

|

4.9

|

%

|

5.9

|

%

|

0.0

|

%

|

3.2

|

%

|

|

Computer check

net

profit

|

|

(271,162

|

)

|

(245,783

|

)

|

45,104

|

|

205,944

|

|

180,565

|

|

449,654

|

|

234,853

|

|

504,036

|

|

664,782

|

|

489,402

|

|

626,030

|

|

0

|

|

2,883,425

|

|

2

Appliance Recycling

Centers of America, Inc.

Consolidated Balance

Sheet

For the Eleven Months

Ending November 24, 2007

|

|

|

November

|

|

2007

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

Cash in Bank

|

|

$

|

860,686.23

|

|

$

|

1,421,790.62

|

|

|

Accounts

Receivable

|

|

816,044.25

|

|

11,065,509.48

|

|

|

Accounts

Receivable - Intercompany

|

|

0.00

|

|

0.00

|

|

|

Inventories

|

|

127,927.29

|

|

12,466,207.34

|

|

|

Prepaid Assets

|

|

(275,621.33

|

)

|

1,535,257.56

|

|

|

|

|

|

|

|

|

|

Total Current

Assets

|

|

1,529,036.44

|

|

26,488,765.00

|

|

|

|

|

|

|

|

|

|

PROPERTY AND

EQUIPMENT

|

|

|

|

|

|

|

Land

|

|

0.00

|

|

2,050,264.50

|

|

|

Building &

Improvements

|

|

114,011.25

|

|

4,939,932.26

|

|

|

Equipment

|

|

50,023.02

|

|

7,696,994.40

|

|

|

|

|

|

|

|

|

|

Total

|

|

164,034.27

|

|

14,687,191.16

|

|

|

Accumulated

Depreciation

|

|

(77,426.51

|

)

|

(8,303,005.37

|

)

|

|

|

|

|

|

|

|

|

Net

Property & Equipment

|

|

86,607.76

|

|

6,384,185.79

|

|

|

|

|

|

|

|

|

|

Long Term

Prepaids, net

|

|

3,957.60

|

|

456,907.18

|

|

|

Goodwill, net

|

|

0.00

|

|

99,547.49

|

|

|

Investment in

Subsidiary

|

|

0.00

|

|

600.00

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

1,619,601.80

|

|

33,430,005.46

|

|

|

|

|

|

|

|

|

|

LIABILITIES &

SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

Current

Liabilities

|

|

|

|

|

|

|

Line of Credit

|

|

$

|

422,366.64

|

|

$

|

13,260,015.60

|

|

|

Current

Maturities of Long Term Debt

|

|

0.00

|

|

364,237.28

|

|

|

Accounts Payable

Trade

|

|

(87,025.44

|

)

|

3,089,232.19

|

|

|

Accounts Payable

- Intercompany

|

|

0.00

|

|

(447.70

|

)

|

|