UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the Appropriate Box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to § 240.14a-12 |

JanOne Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

(5) |

Total fee paid: |

|

☐ |

Fee paid previously with preliminary materials: |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

Amount Previously Paid: |

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

(3) |

Filing Party: |

|

|

(4) |

Date Filed: |

JanOne Inc.

325 E. Warm Springs Road, Suite 102

Las Vegas, Nevada 89119

OF STOCKHOLDERS

Las Vegas, Nevada

October 5, 2021

Dear Stockholder:

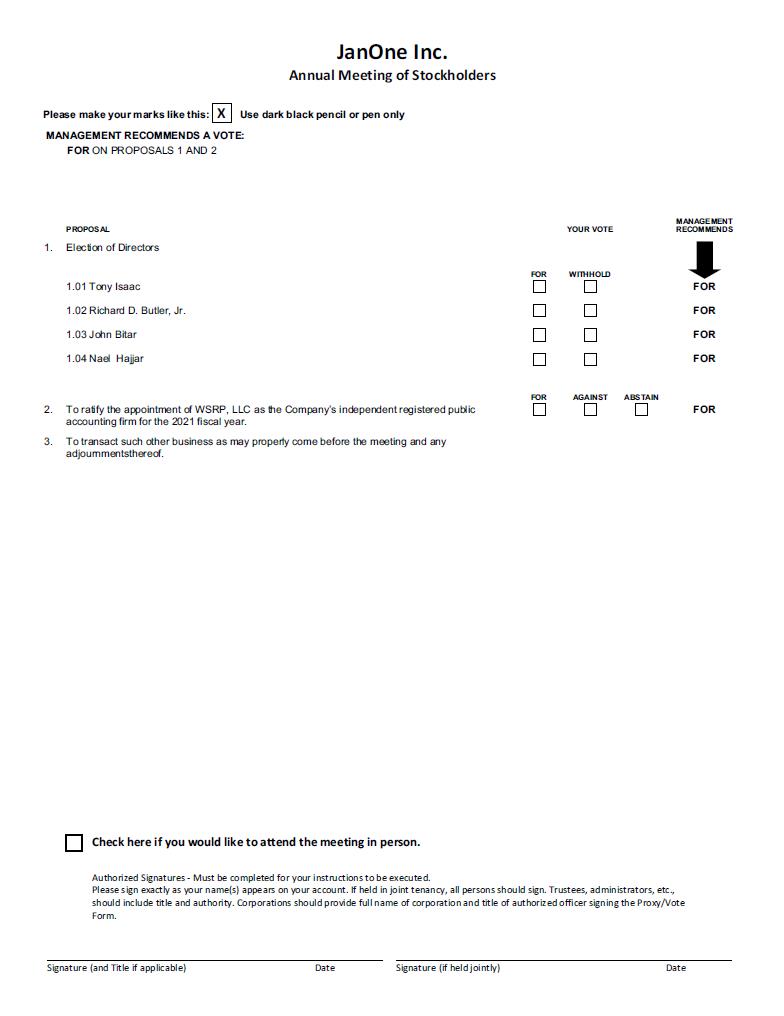

The 2021 Annual Meeting of Stockholders of JanOne Inc., a Nevada corporation, will be held on Tuesday, November 2, 2021, at 10:00 a.m., Pacific Time, at our principal executive offices located at 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119 for the following purposes:

|

|

1. |

To elect four directors to the Company’s Board of Directors. |

|

|

2. |

To ratify the appointment of WSRP, LLC as the Company’s independent registered public accounting firm for fiscal year 2021. |

|

|

3. |

To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement of the meeting. |

The Board of Directors has fixed the close of business on September 20, 2021 as the record date for the 2021 Annual Meeting. Only the holders of record of our common stock or Series A-1 Convertible Preferred Stock as of the close of business on the record date are entitled to receive notice of, and to vote at, the 2021 Annual Meeting and any adjournment thereof. We have also enclosed with this notice (i) our Annual Report on Form 10-K for the fiscal year ended January 2, 2021, and (ii) a Proxy Statement.

Your vote is extremely important regardless of the number of shares you own.

Whether you own a few shares or many, and whether or not you plan to attend the Annual Meeting in person, it is important that your shares be represented and voted at the meeting. You may vote your shares on the Internet, by telephone, or by completing, signing, and promptly returning a proxy card or you may vote in person at the Annual Meeting. Voting online, by telephone, or by returning your proxy card does not deprive you of your right to attend the Annual Meeting.

|

|

|

By Order of the Board of Directors, |

|

|

|

|

|

|

|

/s/ Tony Isaac |

|

|

|

Tony Isaac, Corporate Secretary |

The proxy statement is dated October 5, 2021, and is first being made available to stockholders on or about October 5, 2021.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on November 2, 2021: The Proxy Statement and Annual Report are available at www.proxypush.com/JAN.

|

|

Page No. |

|

1 |

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

4 |

|

7 |

|

|

PROPOSAL 2 – RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

12 |

|

14 |

|

|

16 |

|

|

17 |

|

|

18 |

|

|

18 |

i

JanOne Inc.

325 E. Warm Springs Road, Suite 102

Las Vegas, Nevada 89119

(800) 977-6038

PROXY STATEMENT FOR

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON NOVEMBER 2, 2021

This Proxy Statement relates to the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of JanOne Inc. (“JanOne” or the “Company”). The Annual Meeting will be held on Tuesday, November 2, 2021, at 10:00 a.m. Pacific Time, at our corporate offices located at 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119, or at such other time and place to which the Annual Meeting may be adjourned or postponed. The enclosed proxy is solicited by the Company’s Board of Directors (the “Board”). The proxy materials relating to the Annual Meeting are first being mailed to stockholders entitled to vote at the Annual Meeting on or about September 29, 2021. References in this Proxy Statement to “2020” or “fiscal 2020” refer to the Company’s fiscal year ended January 2, 2021.

QUESTIONS AND ANSWERS About the ANNUAL Meeting

|

Q: |

What is the purpose of the Annual Meeting? |

|

A: |

At the Annual Meeting, holders of our common stock and Series A-1 Convertible Preferred Stock (the “Series A-1 Preferred Stock”) will act upon the matters outlined in the accompanying Notice of Annual Meeting and this Proxy Statement, including the (i) election of four directors to the Board and (ii) ratification of the appointment of WSRP, LLC as the Company’s independent registered public accounting firm for fiscal 2021. |

|

Q: |

What are the Board’s recommendations? |

|

A: |

The Board recommends a vote: |

|

|

• |

FOR election of the nominated slate of directors; and |

|

|

• |

FOR the ratification of the Audit Committee’s appointment of WSRP, LLC as the Company’s independent registered public accounting firm for fiscal 2021. |

With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is given, in their own discretion.

|

Q: |

Who is entitled to attend the Annual Meeting? |

|

A: |

All holders of common stock and/or Series A-1 Preferred Stock as of the record date, September 20, 2021, or their duly appointed proxies, may attend the Annual Meeting. |

|

Q: |

Who is entitled to vote at the Annual Meeting? |

|

A: |

Only stockholders of record of outstanding shares of common stock and/or Series A-1 Preferred Stock of the Company at the close of business on the record date are entitled to receive notice of and to vote at the Annual Meeting, or any postponement or adjournment of the Annual Meeting. Each outstanding share of common stock entitles its holder to cast one vote on each matter to be voted upon. Each outstanding share of Series A-1 Preferred Stock entitles its holder to cast 17 votes per share on each matter to be voted upon, pursuant to the formula described in the Second Amended and Restated Certificate of Designation of the Preferences, Rights, and Limitations of the Series A-1 Convertible Preferred Stock of JanOne (in its former name of Appliance Recycling Centers of America, Inc.) filed by the Company with the Nevada Secretary of State on April 13, 2021. The shares of common stock and Series A-1 Preferred Stock will vote together as a single class for all proposals at the Annual Meeting. The holders of outstanding common stock are entitled to a total of 2,827,410 votes. The holders of Series A-1 Preferred Stock are entitled to a total of 4,058,393 votes. |

1

|

Q: |

What constitutes a quorum? |

|

A: |

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the voting power of the common stock and Series A-1 Preferred Stock outstanding on the record date will constitute a quorum. A quorum is required for business to be conducted at the Annual Meeting. You will be considered part of the quorum if you submit a properly executed proxy card, vote your proxy by using the internet voting service, or vote your proxy by using the toll-free telephone number listed on the proxy card, even if you abstain from voting. Shares held in “street name” by brokers that are voted on at least one proposal to come before the Annual Meeting will be counted as present in determining whether there is a quorum. |

|

Q: |

How do I vote my shares if they are registered directly in my name? |

|

A: |

We offer four methods for you to vote your shares at the Annual Meeting. While we offer four methods, we encourage you to vote through the Internet or by telephone, as they are the most cost-effective methods for the Company. We also recommend that you vote as soon as possible, even if you are planning to attend the Annual Meeting, so that the vote count will not be delayed. Both the Internet and the telephone provide convenient, cost-effective alternatives to returning your proxy card by mail. There is no charge to vote your shares via the Internet, though you may incur costs associated with electronic access, such as usage charges from Internet access providers. If you choose to vote your shares through the Internet or by telephone, there is no need for you to mail your proxy card. |

You may (i) vote in person at the Annual Meeting or (ii) authorize the persons named as proxies on the enclosed proxy card, Tony Isaac and Virland A. Johnson, to vote your shares by voting through the Internet or by telephone or by returning the enclosed proxy card by mail.

|

|

• |

By Internet: Go to www.proxypush.com/JAN. Have your proxy card available when you access the web site. You will need the control number from your proxy card to vote. |

|

|

• |

By telephone: Call (866) 436-6852 toll-free (in the United States, U.S. territories and Canada) on a touch-tone telephone. Have your proxy card available when you call. You will need the control number from your proxy card to vote. |

|

|

• |

By mail: Complete, sign and date the proxy card, and return it in the postage paid envelope provided with the proxy material. |

|

Q: |

How do I vote my shares of common stock if they are held in the name of my broker (street name)? |

|

A: |

If your shares of common stock are held by your broker, bank or other nominee, or its agent (“Broker”) in “street name,” you will receive a voting instruction form from your Broker asking you how your shares should be voted. You should contact your Broker with questions about how to provide or revoke your instructions. Holders of shares of Series A-1 Preferred Stock will receive the Proxy Materials directly from the Company. |

If you hold your shares in “street name” and do not provide specific voting instructions to your Broker, a “broker non-vote” will result with respect to Proposals 1, 2, and 3. Therefore, it is very important to respond to your Broker’s request for voting instructions on a timely basis if you want your shares held in “street name” to be represented and voted at the Annual Meeting. Please see below for additional information if you hold your shares in “street name” and desire to attend the Annual Meeting and vote your shares in person.

|

Q: |

What if I vote and change my mind? |

|

A: |

If you are a stockholder and do not hold your shares in “street name,” you may change your vote or revoke your proxy at any time before the proxy is exercised at the Annual Meeting. You may change or revoke it by: |

|

|

• |

Returning a later-dated signed proxy card or re-accessing the Internet voting site or telephone voting number listed on the proxy card; |

|

|

• |

Delivering a written notice of revocation to the Company’s Secretary at the Company’s principal executive office at 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119; or |

2

|

|

• |

Attending the meeting and voting in person at the meeting (although attendance at the meeting without voting at the meeting will not, in and of itself, constitute a revocation of your proxy). |

If you hold your shares in “street name,” refer to the voting instructing form provided by your Broker for more information about what to do if you submit voting instructions and then change your mind in advance of the Annual Meeting.

|

Q: |

How can I get more information about attending the Annual Meeting and voting in person? |

|

A: |

The Annual Meeting will be held on Tuesday, November 2, 2021, at 10:00 a.m., Pacific Time, at our principal executive offices located at 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119, or such other time and place to which the Annual Meeting may be adjourned or postponed. For additional details about the Annual Meeting, including directions to the Annual Meeting and information about how you may vote in person if you so desire, please contact the Company’s Secretary at (952) 930-9000. |

|

Q: |

What vote is required to approve each item? |

|

A: |

Election of Directors. Election of a director requires the affirmative vote of the holders of a plurality of the shares for which votes are cast at a meeting at which a quorum is present. The four persons receiving the greatest number of votes will be elected as directors. Stockholders may not cumulate votes in the election of directors. |

Ratification of Auditors. With respect to ratification of the appointment of our independent registered public accounting firm, the proposal will be approved if the proposal receives the affirmative vote of the majority of the number of shares entitled to vote and represented at the Annual Meeting, present in person, or by proxy, in favor of the proposal.

|

Q: |

Are abstentions and broker non-votes counted in the vote totals? |

|

A: |

A broker non-vote occurs when shares held by a Broker are not voted with respect to a particular proposal because the Broker does not have discretionary authority to vote on the matter and has not received voting instructions from its clients. If your Broker holds your shares in its name and you do not instruct your Broker how to vote, your Broker will only have discretion to vote your shares on “routine” matters. Where a proposal is not “routine,” a Broker who has received no instructions from its clients does not have discretion to vote its clients’ uninstructed shares on that proposal. At the Annual Meeting, only Proposal 2 (ratifying the appointment of our independent registered public accounting firm) is considered a routine matter. Your Broker will therefore not have discretion to vote on the election of directors as this is a “non-routine” matter. |

Broker non-votes and abstentions by stockholders from voting (including Brokers holding their clients’ shares of record, who cause abstentions to be recorded) will be counted towards determining whether or not a quorum is present. However, as the four nominees receiving the highest number of affirmative votes will be elected, abstentions and broker non-votes will not affect the outcome of the election of directors. With regard to the affirmative vote of the shares present at the meeting required for Proposal 2, it is a routine matter so there will be no broker non-votes, but abstentions will have the effect of a vote against Proposal 2.

|

Q: |

Who will count the vote? |

|

A: |

An Inspector of Elections will be appointed for the Annual Meeting to count the votes. |

|

Q: |

Can I dissent or exercise rights of appraisal? |

|

A: |

Under Nevada law, neither holders of our common stock nor holders of our Series A-1 Preferred Stock are entitled to dissenters’ rights in connection with any of the proposals to be presented at the Annual Meeting or to demand appraisal of their shares as a result of the approval of any of the proposals. |

3

|

Q: |

How will voting on any other business be conducted? |

|

A: |

Although we do not know of any business to be considered at the Annual Meeting other than the proposals described in this proxy statement, if any other business is presented at the Annual Meeting, your proxy gives authority to Tony Isaac, President and Chief Executive Officer, and Virland A. Johnson, Chief Financial Officer, to vote on such matters at their discretion. |

|

A: |

To be considered for inclusion in the Company’s proxy statement for the Company’s Annual Meeting to be held in 2022, stockholder proposals must be received at the Company’s office no later than June 4, 2022, or, in the event the Company changes the date of its Annual Meeting to be held in 2022 by more than 30 days from the date of this year’s meeting, a reasonable time before the Company begins to print and send its proxy materials. Proposals must be in compliance with Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and must be submitted in writing and delivered or mailed to the Company’s Secretary, at JanOne Inc., 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119. |

|

Q: |

Who pays for this proxy solicitation? |

|

A: |

The Company will bear the entire cost of this proxy solicitation, including the preparation, assembly, printing, and mailing of this Proxy Statement, the proxy card, and any additional solicitation materials furnished to the stockholders. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries, and custodians holding shares in their names that are beneficially owned by others so that they may forward the solicitation material to such beneficial owners. |

|

Q: |

Where can I access this Proxy Statement and the related materials online? |

|

A: |

The Proxy Statement and our Annual Report to Stockholders are available at http://www.proxypush.com/JAN. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of shares of our common stock and Series A-1 Preferred Stock as of September 20, 2021, for:

|

|

• |

each of our named executive officers; |

|

|

• |

each of our current directors; |

|

|

• |

all of our current executive officers and directors as a group; and |

|

|

• |

each person known to us to be the beneficial owner of more than 5% of either our common stock or Series A-1 Preferred Stock. |

All share information in the table (including footnotes) below reflects one-for-five (1:5) reverse stock split effectuated on April 19, 2019.

The business address of each beneficial owner listed in the table unless otherwise noted is c/o JanOne Inc., 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119.

4

We deem shares of our common stock and Series A-1 Preferred Stock that may be acquired by an individual or group within 60 days of September 20,2021 pursuant to the exercise of options or warrants or conversion of convertible securities to be outstanding for the purpose of computing the percentage ownership of such individual or group, but these shares are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person or group shown in the table. Percentage of ownership is based on 2,827,410 shares of common stock and 238,729 shares of Series A-1 Preferred Stock (which are the voting equivalent of 4,058,393 shares of common stock) outstanding on September 20, 2021. The information as to beneficial ownership was either (i) furnished to us by or on behalf of the persons named or (ii) determined based on a review of the beneficial owners’ Schedules 13D/G and Section 16 filings with respect to our common stock and Series A-1 Preferred Stock.

|

Name of Beneficial Owner |

|

Position with Company |

|

Number of Shares Beneficially owned (1) |

|

|

Percentage of Outstanding Common (2) |

|

||

|

Named Executive Officers and Directors: |

|

|

|

|

|

|

|

|

|

|

|

Tony Isaac (3) |

|

Director, President and Chief Executive Officer |

|

|

94,000 |

|

|

|

3.3 |

% |

|

Virland A. Johnson |

|

Chief Financial Officer |

|

|

— |

|

|

* |

|

|

|

Richard D. Butler (3) |

|

Director |

|

|

18,000 |

|

|

* |

|

|

|

John Bitar |

|

Director |

|

|

2,000 |

|

|

* |

|

|

|

Nael Hajjar |

|

Director |

|

|

— |

|

|

* |

|

|

|

All directors and executive officers as a group (6 persons) |

|

|

|

|

114,000 |

|

|

|

4.0 |

% |

|

Other 5% stockholders: |

|

|

|

|

|

|

|

|

|

|

|

Isaac Capital Group, LLC (4) |

|

|

|

|

392,941 |

|

|

|

13.9 |

% |

|

Altium Capital Management (5) |

|

|

|

|

190,476 |

|

|

|

6.7 |

% |

|

Ionic Ventures, LLC (6) |

|

|

|

|

190,476 |

|

|

|

6.7 |

% |

* Indicates ownership of less than 1% of the outstanding shares

|

(1) |

Unless otherwise noted, each person or group identified possesses sole voting and investment power with respect to such shares. |

|

(2) |

Applicable percentage of ownership is based on 2,827,410 shares of common stock outstanding as of September 20, 2021 plus, for each stockholder, all shares that such stockholder could acquire within 60 days upon the exercise of existing stock options and warrants or conversion of existing convertible securities. |

|

(3) |

Includes shares that could be purchased within 60 days upon the exercise of existing stock options or warrants, as follows: Mr. Isaac, 2,000 shares and Mr. Butler, 4,000 shares. |

|

(4) |

According to a Schedule 13G filed with the SEC on April 30, 2019, Isaac Capital Group, LLC (“Isaac Capital”) beneficially owned 392,941 shares of common stock. Isaac Capital has sole dispositive power as to all 392,941 shares and sole voting power as to 350,519 shares. The address for Isaac Capital is 3525 Del Mar Heights Road, Suite 765, San Diego, California 92130. |

|

(5) |

According to a Schedule 13G filed February 8, 2021, Altium Growth Fund, LP (the “Fund”), Altium Capital Management, LP, and Altium Growth GP, LLC (collectively “Altium”), has shared voting power and dispositive power with respect to 190,476 shares of common stock. According to this Schedule 13G, the Fund is the record and direct beneficial owner of the securities covered by this statement. Altium Capital Management, LP is the investment adviser of, and may be deemed to beneficially own securities, owned by, the Fund. Altium Growth GP, LLC is the general partner of, and may be deemed to beneficially own securities owned by, the Fund. The Schedule 13G lists Altium’s principal place of business as 152 West 57 Street, FL 20, New York, NY 10019. |

|

(6) |

According to a Schedule 13G filed February 1, 2021, Ionic Ventures LLC (“Ionic Ventures”) beneficially owned 190,476 shares of common stock. Ionic Ventures is controlled by Brendan O’Neil and Keith Coulston and has a principal address of 3053 Fillmore St., Suite 256 San Francisco, CA 94123. |

5

Beneficial Ownership of Series A-1 Preferred Stock

|

Name of Beneficial Owner |

|

Number of Shares Beneficially owned (1) |

|

|

Percentage of Outstanding Series A Preferred (2) |

|

||

|

Isaac Capital Group, LLC (3) |

|

|

6,141 |

|

|

|

2.6 |

% |

|

Gregg Sullivan (4) |

|

|

28,859 |

|

|

|

12.1 |

% |

|

Juan Yunis (5) |

|

|

203,729 |

|

|

|

85.3 |

% |

|

(1) |

Unless otherwise noted, each person or group identified possesses sole voting and investment power with respect to such shares. |

|

(2) |

Applicable percentage of ownership is based on 238,729 shares of Series A-1 Preferred Stock outstanding as of September 20, 2021. As of the date of this Proxy Statement, no holder of Series A-1 Preferred Stock has converted his or its shares of Series A-1 Preferred Stock into shares of the Company’s common stock. |

|

(3) |

The address for Isaac Capital is 3525 Del Mar Heights Road, Suite 765, San Diego, California 92130. On April 15, 2021, Isaac Capital converted 8,000 shares of Series A-1 Preferred stock. |

|

(4) |

The last known address for Mr. Sullivan is 4565 Dean Martin Drive, #106, Las Vegas, Nevada 89103. On January 16, 2019, GeoTraq terminated the employment of Mr. Sullivan pursuant to the terms of the employment agreement dated August 18, 2017 (the “Sullivan Employment Agreement”) between GeoTraq and Mr. Sullivan. Under the terms of the Sullivan Employment Agreement, 28,859 of the shares of the Company’s Series A Preferred Stock owned by Mr. Sullivan immediately prior to the termination are deemed to have been returned to the Company’s treasury for cancellation effective as of January 16, 2019, without the requirement that either Mr. Sullivan or the Company take any further action. An equivalent number of shares of Series A Preferred Stock were exchanged by the Company for such shares of Series A-1 Preferred Stock on June 19, 2019, in conjunction with an exchange by the Company for each holder of shares of Series A Preferred Stock as of such date. On or about April 9, 2021, GeoTraq, Gregg Sullivan, Tony Isaac, and the Company, among others, resolved all of their claims that related to, among other items, our acquisition of GeoTraq in August 2017, all post-acquisition activities, and Mr. Sullivan’s post-acquisition employment relationship with GeoTraq (all of such claims, the “GeoTraq Matters”). The resolution was effectuated through the parties’ execution and delivery of a Settlement Agreement and Mutual Agreement of Claims (the “GeoTraq Settlement Agreement”). Pursuant to this agreement, so long as the Company is in compliance with the stipulated consideration payment terms, Mr. Sullivan’s Series A-1 Preferred Stock is locked up and may not be converted into shares of the Company’s common stock. Upon fulfilment of the payment of consideration by the Company to Mr. Sullivan, as defined in the agreement, Mr. Sullivan’s Series A Preferred Stock is to be surrendered to the Company. |

|

(5) |

According to a Schedule 13D filed with the SEC on April 12, 2019, Juan Yunis beneficially owned 216,729 shares of Series A-1 Preferred Stock at that time. On April 15, 2021, Mr. Yunis converted 13,000 shares of Series A-1 Preferred stock. Mr. Yunis has sole dispositive and voting power as to all 203,729 shares of Series A-1 Preferred Stock. The address for Mr. Yunis is Carrera 44B # 96 - 67 Torre 1 Apto 1103, Barranquilla, Atlantico, 08002, Colombia. |

6

(proposal No. 1)

General

The property, affairs, and business of the Company are managed under the direction of the Board. A board of four directors is to be elected at the Annual Meeting. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the Board’s four nominees. The term of office for each person elected as a director will continue until the next annual meeting of stockholders and until a successor has been elected and qualified, or until such director is removed or resigns.

All of the nominees named below are presently directors of the Company and have served continuously since the year indicated. All nominees have indicated a willingness to serve if elected. The Company knows of no arrangements or understandings between a nominee and any other person pursuant to which the nominee has been selected as a director.

All shares represented by proxies that have been properly executed and returned or properly voted will be voted for the election of all of the nominees named below, unless other instructions are indicated thereon. In the event any one or more of such nominees should for any reason not be able to serve as a director, the proxies will be voted for such other person or persons as may be designated by the Board.

The Board recommends voting “FOR” the election of each of the Director nominees as directors, each of whom shall hold office for a term of one year, expiring at the Annual Meeting in 2022, and until his successor is elected and qualified, or until his earlier death, resignation, or removal.

Nominees for Election to the Board

The names of the nominees are set forth in the table below. Following the table is certain information for at least the last five years regarding each nominee.

|

Name |

|

Position with Company |

|

Director Since |

|

Age as of September 20, 2021 |

|

|

|

Tony Isaac |

|

Director, President and Chief Executive Officer |

|

2015 |

|

|

67 |

|

|

Richard D. Butler |

|

Director |

|

2015 |

|

|

73 |

|

|

Nael Hajjar |

|

Director |

|

2018 |

|

|

37 |

|

|

John Bitar |

|

Director |

|

2020 |

|

|

47 |

|

Tony Isaac has been a director of the Company since May 2015 and Chief Executive Officer of the Company since May 2016. He served as Interim Chief Executive Officer of the Company from February 2016 until May 2016. Mr. Isaac has served as Financial Planning and Strategist/Economist of Live Ventures Incorporated (“Live Ventures”) (Nasdaq: LIVE), a holding company for diversified businesses, since July 2012. He is the Chairman and Co-Founder of Isaac Organization, a privately held investment company. Mr. Isaac has invested in various companies, both private and public from 1980 to present. Mr. Isaac’s specialty is negotiation and problem-solving of complex real estate and business transactions. Mr. Isaac has served as a director of Live Ventures since December 2011. Mr. Isaac graduated from Ottawa University in 1981, where he majored in Commerce and Business Administration and Economics. We believe that Mr. Isaac has significant investment and financial expertise and public board experience that he brings to the Board.

Richard D. Butler, Jr. has been a director of the Company since May 2015. Mr. Butler is the owner of an advisory firm that provides real estate, corporate, and financial advisory services since 1999, and is the co-Founder, Managing Director, and, since 2005, a major stockholder of Ref-Razzer Company, a whistle manufacturing and vending company. Prior to this, Mr. Butler was the Co-Founder and Executive Vice President of Aspen Healthcare, Inc. from 1996 to 1999. From 1993 to 1996, Mr. Butler was a Managing Director at Landmark Financial and from 1989 to 1993 he was a Partner at Cal Ventures Real Estate Investment Group. Prior to this, Mr. Butler has also served as the President and Chief Executive Officer of Mt. Whitney Savings Bank, Chief Executive Officer of First Federal Mortgage Bank, Chief Executive Officer of Trafalgar

7

Mortgage, and Executive Officer and Member of the President’s Advisory Committee at State Savings & Loan Association (peak assets $14 billion) and American Savings & Loan Association (NYSE: FCA; peak assets $34 billion). Mr. Butler has served on the board of directors of Live Ventures (Nasdaq: LIVE) since August 2006. Mr. Butler attended Bowling Green University in Ohio, San Joaquin Delta College in California, and Southern Oregon State College. We believe that Mr. Butler brings to the Board extensive experience in financial management and executive roles, which enable him to provide important expertise in financial, operating and strategic matters that impact our Company.

John Bitar has been a director of the Company since January 2020. Since 2012, Mr. Bitar has been providing consulting services to companies and clients on business and legal strategies, management, operations, and cost controls. From 2007 to 2012, Mr. Bitar co-founded and was Managing Partner of a worker’s compensation law firm. Mr. Bitar has been an attorney admitted to the California State Bar since 1999. Mr. Bitar graduated from the University of Southern California in 1996 and earned his Juris Doctorate Degree in 1999 from University of the Pacific, McGeorge School of Law. We believe that Mr. Bitar has significant business experience and brings operational expertise to the Board.

Nael Hajjar has been a director of the Company since August 2018. Mr. Hajjar is currently the Unit Head for the Annual Wholesale Trade Survey in Statistics Canada’s Manufacturing and Wholesale Trade Division. From March 2011 through May 2016, Mr. Hajjar was a Senior Analyst – Economist of Statistics Canada’s Producer Prices Division where he developed Canada’s first ever Investment Banking Services Price Index while leading the development of a variety of Financial Services Price Index development projects. We believe that Mr. Hajjar brings to the Board extensive experience in research and analysis of financial statistics, economics, and business practices in a variety of industries including manufacturing, logging, Wholesale Trade, and financial services. We believe that Mr. Hajjar also has extensive experience in project management, and he holds a Bachelor of Social Science, Honors in Economics (which he earned in 2006), and Bachelor of Commerce, Option in Finance (which he earned in 2008), both from the University of Ottawa.

Director Independence

There are no family relationships among any of the directors or executive officers of the Company. Of the current directors, each of Messrs. Butler, Bitar, and Hajjar is an “independent” director, as defined under the rules of The Nasdaq Stock Market (“Nasdaq”) and each has been an independent director since each joined the Board.

Board Leadership Structure and Role in Risk Oversight

Tony Isaac, our President and Chief Executive Officer, also serves as Chairman of the Board. Currently, the Board does not have a Lead Independent Director. Although the Board reserves the right to make changes in the future, it believes that the current structure, as described in this Proxy Statement, is appropriate at this time given the size and experience of the Board, as well as the background and experience of management.

It is management’s responsibility to manage risk and bring to the attention of the Board of Directors the most material risks affecting the Company. The Board of Directors, including through committees of the Board comprised solely of independent directors, regularly reviews various areas of significant risk to the Company, and advises and directs management on the scope and implementation of policies, strategic initiatives, and other actions designed to mitigate various types of risks. Specific examples of risks primarily overseen by the full Board of Directors include competition risks, industry risks, economic risks, liquidity risks, and business operations risks. The Audit Committee reviews with management and the independent auditors significant financial risk exposures and the processes management has implemented to monitor, control, and report such exposures. The Audit Committee also reviews and approves transactions with related persons. The Compensation Committee (the “Compensation Committee”) reviews and evaluates potential risks related to the attraction and retention of talent, and risks related to the design of compensation programs established by the Compensation Committee for the Company’s executive officers.

8

Actions and Committees of the Board of Directors

In fiscal 2020, the Board of Directors met four times and took action by unanimous written consent eight times. In fiscal 2020, the Board of Directors had three standing committees: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. The Audit Committee met six times during fiscal 2020. The Compensation Committee did not hold a formal meeting during fiscal 2020 and took action by unanimous written consent three times. The Nominating and Corporate Governance Committee did not hold a formal meeting during fiscal 2020 but did take one action by unanimous written consent. The Board currently has no other standing committees and has no current plans to establish additional committees. Each person who served as a director during fiscal 2020 attended at least 75% of the meetings of the Board of Directors and of the committees on which the director served. It is the Company’s policy that all directors should attend the Annual Meeting of stockholders. Three out of five members of the Board of Directors who were in place at the time of last year’s annual meeting attended last year’s annual meeting of stockholders.

Audit Committee

The Audit Committee of the Board of Directors is comprised entirely of non-employee directors. In fiscal 2020, the members of the Audit Committee were Mr. Gao, Mr. Butler (Chair), and Mr. Hajjar. Each of Messrs. Gao, Butler, and Hajjar was an “independent” director as defined under Nasdaq rules. The Audit Committee is responsible for selecting and approving the Company’s independent auditors, for relations with the independent auditors, for review of internal auditing functions (whether formal or informal) and internal controls, and for review of financial reporting policies to assure full disclosure of financial condition. The Audit Committee operates under a written charter adopted by the Board of Directors, which is posted on the Company’s website at www.janone.com under the caption “Investor Relations - Governance.” The Board has determined that Mr. Butler is an “audit committee financial expert” as defined in SEC rules. Mr. Gao resigned from the Board of Directors effective January 6, 2020 and was replaced by John Bitar as disclosed in the Company’s Current Report on Form 8-K filed with the SEC on January 10, 2020. Mr. Bitar replaced Mr. Gao on the Audit Committee. The Audit Committee operates under a written charter adopted by the Board of Directors, which is posted on the Company’s website at www.janone.com under the caption “Investor Relations – Governance.”

Compensation Committee

The Compensation Committee of the Board of Directors is comprised entirely of non-employee directors. In fiscal 2019, the members of the Compensation Committee were Mr. Gao and Mr. Butler (Chair), each of whom was also an “independent” director as defined under Nasdaq rules. The Compensation Committee is responsible for review and approval of officer salaries and other compensation and benefits programs and determination of officer bonuses. Annual compensation for the Company’s executive officers, other than the CEO, is recommended by the CEO and approved by the Compensation Committee. The annual compensation for the CEO is recommended by the Compensation Committee and formally approved by the full Board of Directors. The Compensation Committee may approve grants of equity awards under the Company’s stock compensation plans. Mr. Gao resigned from the Board of Directors effective January 6, 2020 and was replaced by Mr. Bitar as disclosed in the Company’s Current Report on Form 8-K filed with the SEC on January 10, 2020. Following Mr. Gao’s resignation, Messrs. Butler (Chair) and Hajjar serve as the members of the Compensation Committee. The Compensation Committee operates under a written charter adopted by the Board of Directors, which is posted on the Company’s website at www.janone.com under the caption “Investor Relations – Governance.”

In the performance of its duties, the Compensation Committee may select independent compensation consultants to advise the committee when appropriate. No compensation consultant played a role in the executive officer and director compensation for fiscal 2019. In addition, the Compensation Committee may delegate authority to subcommittees where appropriate. The Compensation Committee may separately meet with management if deemed necessary and appropriate. The Compensation Committee operates under a written charter adopted by the Board of Directors in March 2011, which is posted on the Company’s website at www.janone.com under the caption “Investors – Corporate Governance.”

Governance Committee

The Nominating and Corporate Governance Committee (the “Governance Committee”) is comprised entirely of non-employee directors. In fiscal 2019, the members of the Governance Committee were Mr. Gao

9

(Chairman) and Mr. Butler, each of whom was also an “independent” director as defined under Nasdaq rules. The primary purpose of the Governance Committee is to ensure an appropriate and effective role for the Board of Directors in the governance of the Company. The principal recurring duties and responsibilities of the Governance Committee include (i) making recommendations to the Board regarding the size and composition of the Board, (ii) identifying and recommending to the Board of Directors candidates for election as directors, (iii) reviewing the Board’s committee structure, composition and membership and recommending to the Board candidates for appointment as members of the Board’s standing committees, (iv) reviewing and recommending to the Board corporate governance policies and procedures, (v) reviewing the Company’s Code of Business Ethics and Conduct and compliance therewith, and (vi) ensuring that emergency succession planning occurs for the positions of Chief Executive Officer, other key management positions, the Board chairperson and Board members. Mr. Gao resigned from the Board of Directors effective January 6, 2020 and was replaced by John Bitar as disclosed in the Company’s Current Report on Form 8-K filed with the SEC on January 10, 2020. Following Mr. Gao’s resignation, Messrs. Butler (Chair) and Bitar serve as the members of the Governance Committee. The Governance Committee operates under a written charter adopted by the Board of Directors, which is posted on the Company’s website at www.janone.com under the caption “Investor Relations - Governance.”

The Governance Committee will consider director candidates recommended by stockholders. The criteria applied by the Governance Committee in the selection of director candidates is the same whether the candidate was recommended by a Board member, an executive officer, a stockholders or a third party, and accordingly, the Governance Committee has not deemed it necessary to adopt a formal policy regarding consideration of candidates recommended by stockholders. Stockholders wishing to recommend candidates for Board membership should submit the recommendations in writing to the Secretary of the Company.

The Governance Committee identifies director candidates primarily by considering recommendations made by directors, management, and stockholders. The Governance Committee also has the authority to retain third parties to identify and evaluate director candidates and to approve any associated fees or expenses. Board candidates are evaluated on the basis of a number of factors, including the candidate’s background, skills, judgment, diversity, experience with companies of comparable complexity and size, the interplay of the candidate’s experience with the experience of other Board members, the candidate’s independence or lack of independence, and the candidate’s qualifications for committee membership. The Governance Committee does not assign any particular weighting or priority to any of these factors and considers each director candidate in the context of the current needs of the Board as a whole. Director candidates recommended by stockholders are evaluated in the same manner as candidates recommended by other persons.

Review, Approval or Ratification of Transactions with Related Persons

The Audit Committee is responsible for the review and approval of all transactions in which the Company was or is to be a participant and in which any executive officer, director, or director nominee of the Company, or any immediate family member of any such person (“related persons”) has or will have a material interest. In addition, all, if any, transactions with related persons that come within the disclosures required by Item 404 of the SEC’s Regulation S-K must also be approved by the Audit Committee. The policies and procedures regarding the approval of all such transactions with related persons have been approved at a meeting of the Audit Committee and are evidenced in the corporate records of the Company. Each member of the Audit Committee is an “independent” director as defined under Nasdaq rules.

Code of Ethics

Our Audit Committee has adopted a code of ethics applicable to our directors and officers (including our Chief Executive Officer, President, and Chief Financial Officer) and other of our senior executives and employees in accordance with applicable rules and regulations of the SEC and Nasdaq. A copy of the code of ethics may be obtained upon request, without charge, by addressing a request to Corporate Secretary, JanOne Inc., 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119. The code of ethics is also posted on our website at www.janone.com under “Investors – Corporate Governance.”

We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding the amendment to, or waiver from, a provision of the code of ethics by posting such information on our website at the address and location specified above and, to the extent required by the listing standards of the Nasdaq Capital Market, by filing a Current Report on Form 8-K with the SEC disclosing such information.

10

Board Contact Information

If you would like to contact the Board or any committee of the Board, you can send an email to board@janone.com, or write to JanOne Inc., c/o Corporate Secretary, 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119. All communications will be compiled by the Secretary of the Company and submitted to the Board or the applicable committee or director on a periodic basis.

EXECUTIVE OFFICERS

Set forth below is certain information regarding each of our current executive officers as of September 20, 2021, other than Tony Isaac, whose biographical information is presented under “Nominees for Election to the Board of Directors.”

|

Virland A. Johnson, 61 |

Mr. Johnson was appointed Chief Financial Officer of the Company on August 21, 2017. Mr. Johnson had previously served the Company as a consultant beginning in February 2017. Mr. Johnson served as Chief Financial Officer for Live Ventures from January 2017 until September of 2021. Prior to joining Live Ventures, Mr. Johnson was Sr. Director of Revenue for JDA Software from February 2010 to April 2016, where he was responsible for revenue recognition determination, sales and contract support while acting as a subject matter expert. Prior to joining JDA, Mr. Johnson provided leadership and strategic direction while serving in C-Level executive roles in public and privately held companies such as Cultural Experiences Abroad, Inc., Fender Musical Instruments Corp., Triumph Group, Inc., Unitech Industries, Inc. and Younger Brothers Group, Inc. Mr. Johnson’s more than 30 years of experience is primarily in the areas of process improvement, complex debt financings, SEC and financial reporting, turn-arounds, corporate restructuring, global finance, merger and acquisitions and returning companies to profitability and enhancing stockholder value. Mr. Johnson holds a Bachelor’s degree in Accountancy from Arizona State University which he earned in 1982. Mr. Johnson is a Certified Public Accountant licensed in the State of Arizona. |

11

Ratification of Appointment of Independent Registered Public Accounting Firm

(Proposal No. 2)

The Audit Committee has selected WSRP, LLC (“WSRP”) as the Company’s independent registered public accounting firm for fiscal year 2021. The Company is submitting its selection of WSRP for ratification by the stockholders at the Annual Meeting. A representative of WSRP is expected to be present at the Annual Meeting via teleconference and will be available to respond to appropriate questions.

The Company’s Bylaws do not require that stockholders ratify the selection of the Company’s independent registered public accounting firm. However, the Company is submitting the selection of WSRP to stockholders for ratification as a matter of good corporate practice. If stockholders do not ratify the selection, the Audit Committee will reconsider whether to retain WSRP. Even if the selection is ratified, the Audit Committee at its discretion may change the appointment at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

On March 23, 2018, the Audit Committee approved the appointment of SingerLewak LLP (“SingerLewak”) as the Company’s independent registered public accounting firm, effective upon the execution of an engagement letter between the Company and SingerLewak. During the Company’s fiscal years ended December 30, 2017 and December 31, 2016 and for the subsequent interim period through March 28, 2018, neither the Company, nor anyone on behalf of the Company consulted with SingerLewak regarding either: (i) the application of accounting principles to a specified transaction, either completed or proposed; or the type of audit opinion that might be rendered on the Company’s financial statements, or (ii) any matter that was either the subject of a disagreement as described in Item 304(a)(1)(iv) of Regulation S-K or a reportable event within the meaning of Item 304(a)(1)(v) of Regulation S-K.

On October 14, 2019, SingerLewak informed the Company that it resigned as the Company’s independent registered public accounting firm. The audit report of SingerLewak on the Company’s financial statements for the fiscal years ended December 29, 2018 and December 30, 2017 contained no adverse opinion or disclaimer of opinion and was not qualified or modified as to uncertainty, audit scope, or accounting principles. During the Company’s fiscal years ended December 29, 2018 and December 30, 2017, and for the subsequent interim period through the date of the Company’s Current Report on Form 8-K (the “Form 8-K”), the Company had no “disagreements” (as described in Item 304 (a)(1)(iv) of Regulation S-K) with SingerLewak on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of SingerLewak, would have caused it to make reference in connection with its opinion to the subject matter of the disagreements. During the Company’s fiscal years ended December 29, 2018 and December 30, 2017, and for the subsequent interim period through the date of such Form 8-K, there was no “reportable event” within the meaning of Item 304(a)(1)(v) of Regulation S-K other than the following material weaknesses (A) reported in the Company’s Annual Report on Form 10-K for the fiscal year ended December 29, 2018: (i) insufficient information technology general controls (“ITGCs”) and segregation of duties. Several employees of the Company have been provided access to Company systems when their duties do not appear to require access, or which results in a lack of segregation of duties. No authorization or lack of sufficient approval was noted on some journal entry transactions; and (ii) inadequate control design or lack of sufficient controls over significant accounting processes. Inventory and purchase controls are not sufficient. The financial close process needs additional formal procedures and closing checklists and reconciliations. Revenue recognition controls regarding transactions with sales tax elements need additional process checks and controls, and (B) reported in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended June 29, 2019: (1) insufficient ITGC and segregation of duties. It was noted that people who were negotiating a contract, were also involved in approving invoices without proper oversight. Additional controls and procedures are necessary and are being implemented to have check and balance on significant transactions and governance with those charged with governance authority; (2) inadequate control design or lack of sufficient controls over significant accounting processes. The cutoff and reconciliation procedures were not effective with certain accrued and deferred expenses; (3) insufficient assessment of the impact of potentially significant transactions; and (4) insufficient processes and procedures related to proper recordkeeping of agreements and contracts. In addition, contract to invoice reconciliation was not effective with a certain transportation service provider.

12

On October 15, 2019, the Audit Committee of the Board of Directors of the Company approved the engagement of, and the Company engaged, WSRP as the Company’s new independent registered public accounting firm, effective immediately. During the Company’s fiscal years ended December 29, 2018 and December 30, 2017 and for the subsequent interim period through the date of filing the Company’s Current Report on Form 8-K, neither the Company, nor anyone on behalf of the Company consulted with WSRP regarding either: (i) the application of accounting principles to a specified transaction, either completed or proposed; or the type of audit opinion that might be rendered on the Company’s financial statements, or (ii) any matter that was either the subject of a disagreement as described in Item 304(a)(1)(iv) of Regulation S-K or a reportable event within the meaning of Item 304(a)(1)(v) of Regulation S-K.

Fees Paid to Auditors by the Company During Most Recent Fiscal Years

The following fees were billed to us by our independent registered public accounting firm, WSRP and SingerLewak for 2019. SingerLewak served as the Company’s auditor from fiscal 2017 and reviewed the Company’s quarterly financial statements for each of the first two fiscal quarters during fiscal 2019. WSRP was appointed the Company’s auditor during October 2019.

|

Description |

|

January 2, 2021 |

|

|

December 28, 2019 |

|

||

|

Audit fees |

|

$ |

212,725 |

|

|

$ |

219,549 |

|

|

Audit-related fees |

|

|

11,466 |

|

|

|

— |

|

|

Tax fees |

|

|

48,459 |

|

|

|

79,201 |

|

|

All other fees |

|

|

— |

|

|

|

— |

|

|

Total |

|

$ |

272,650 |

|

|

$ |

298,750 |

|

Audit fees consist of fees for professional services rendered in connection with the audit of the Company’s year-end financial statements, quarterly reviews of financial statements included in the Company’s quarterly reports, services rendered relative to regulatory filings, and attendance at Audit Committee meetings.

The Audit Committee of the Board of Directors has considered whether the provision of the services described above was and is compatible with maintaining the independence of WSRP.

The Audit Committee pre-approves all audit and permissible non-audit services provided by the independent auditors. All the fees and services for fiscal 2020 and fiscal 2019 were approved by the Audit Committee.

The Board recommends a vote FOR ratification of the Audit Committee’s appointment of WSRP as our independent registered public accounting firm for fiscal 2021.

13

The following table sets forth the cash and non-cash compensation for fiscal years ended January 2, 2021 and December 28, 2019, earned by each person who served as Chief Executive Officer during fiscal 2019, and our other two most highly compensated executive officers who held office as of December 28, 2019 (“named executive officers”):

Summary Compensation Table for Fiscal Year Ended January 2, 2021

|

Name and Principal Position (1) |

|

Year |

|

Salary ($) |

|

|

Bonus ($) |

|

|

Stock Award ($) |

|

|

Option Awards ($) |

|

|

All Other Compensation ($) |

|

|

Total ($) |

|

||||||

|

Tony Isaac |

|

2020 |

|

|

534,471 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

534,471 |

|

|

Chief Executive Officer |

|

2019 |

|

|

571,427 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

571,427 |

|

|

Eric Bolling |

|

2020 |

|

|

301,442 |

|

|

|

— |

|

|

|

54,203 |

|

|

|

— |

|

|

|

— |

|

|

|

355,645 |

|

|

President (2) |

|

2019 |

|

|

148,077 |

|

|

|

— |

|

|

|

500,000 |

|

|

|

— |

|

|

|

— |

|

|

|

648,077 |

|

|

Virland A. Johnson |

|

2020 |

|

|

121,731 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

121,731 |

|

|

Chief Financial Officer |

|

2019 |

|

|

125,274 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

125,274 |

|

|

(1) |

The Company only had two executive officers for the fiscal year ended January 2, 2021. |

|

(2) |

On August 9, 2020, we entered into a first amendment to amendment and restated employment agreement (the “Employment Agreement Amendment”) with Eric Bolling. Under the terms of the Employment Agreement Amendment, in exchange for the Company issuing Mr. Bolling 40,000 shares of fully vested, restricted common stock of the Company (the “August 2020 Shares”), Mr. Bolling (i) agreed to continue to provide the services described in his employment agreement, (ii) resigned his position as President of the Company and Chairman of the Board of Directors (the “Board”), provided that Mr. Bolling will continue as a member of the Board and further agreed that it is in the Company’s sole discretion whether Mr. Bolling continues as a member of the Board following the Company’s 2020 Annual Meeting of Stockholders; (iii) agreed to forego his base salary on a going forward basis and further agreed that he is not entitled to any base salary or any further remuneration or compensation from the Company whatsoever (other than the August 2020 Shares) after August 1, 2020, and (iv) forfeited the other 70,607 shares of the Company’s common stock that was owed to him under the terms of the employment agreement prior to the execution and delivery of the Employment Agreement Amendment. This amount reflects the fair value of a stock grant awarded to Mr. Bolling, as discussed. |

Outstanding Equity Awards at January 2, 2021

The following table provides a summary of equity awards outstanding for our Named Executive Officers at January 2, 2021:

|

Name |

|

Number of Securities Underlying Unexercised Options (in shares) Exercisable |

|

|

Number of Securities Underlying Unexercised Options (in shares) Unexercisable |

|

|

Option Exercise Price ($) |

|

|

Option Expiration Date |

|||

|

Tony Isaac |

|

|

2,000 |

|

|

|

— |

|

|

|

9.90 |

|

|

05/18/2025 |

|

Eric Bolling (1) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

Virland A. Johnson |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

(1) |

During August 2020, Mr. Bolling resigned his position as President of the Company and Chairman of the Board. |

The Company uses stock options to attract and retain executives, directors, consultants and key employees. Stock options are currently outstanding under three stock option plans. The Company’s 2016 Equity Incentive Plan (the “2016 Plan”) was adopted by the Board of Directors in October 2016 and approved by the shareholders at the 2016 annual meeting of shareholders. Under the 2016 Plan, the Company has reserved an

14

aggregate of 400,000 shares of its common stock for option grants. On November 4, 2020, at the Annual Meeting, the Company’s stockholders approved an amendment (the “Plan Amendment”) to the 2016 Plan to increase the total number of shares of the Company’s common stock reserved for issuance under the 2016 Plan to from 400,000 shares to 800,000 shares. The Company’s 2011 Stock Compensation Plan (the “2011 Plan”) was adopted by the Board of Directors in March 2011 and approved by the shareholders at the 2011 annual meeting of shareholders. The 2011 Plan expired on December 29, 2016, but options granted under the 2011 Plan before it expired will continue to be exercisable in accordance with their terms. As of January 2, 2021, options to purchase an aggregate of 113,900 shares were outstanding, including options for 78,000 shares under the 2016 Plan and options for 35,900 shares under the 2011 Plan. The Plans are administered by the Compensation Committee or the full Board of Directors acting as the Committee.

The Plan permits the grant of the following types of awards, in the amounts and upon the terms determined by the Administrator:

|

|

• |

Options. Options may either be incentive stock options (“ISOs”) which are specifically designated as such for purposes of compliance with Section 422 of the Internal Revenue Code or non-qualified stock options (“NSOs”). Options shall vest as determined by the Administrator, subject to certain statutory limitations regarding the maximum term of ISOs and the maximum value of ISOs that may vest in one year. The exercise price of each share subject to an ISO will be equal to or greater than the fair market value of a share on the date of the grant of the ISO, except in the case of an ISO grant to a stockholder who owns more than 10% of the Company’s outstanding shares, in which case the exercise price will be equal to or greater than 110% of the fair market value of a share on the grant date. The exercise price of each share subject to an NSO shall be determined by the Board at the time of grant but will be equal to or greater than the fair market value of a share on the date of grant. Recipients of options have no rights as a stockholder with respect to any shares covered by the award until the award is exercised and a stock certificate or book entry evidencing such shares is issued or made, respectively. |

|

|

• |

Restricted Stock Awards. Restricted stock awards consist of shares granted to a participant that are subject to one or more risks of forfeiture. Restricted stock awards may be subject to risk of forfeiture based on the passage of time or the satisfaction of other criteria, such as continued employment or Company performance. Recipients of restricted stock awards are entitled to vote and receive dividends attributable to the shares underlying the award beginning on the grant date. |

|

|

• |

Restricted Stock Units. Restricted stock units consist of a right to receive shares (or cash, in the Administrator’s discretion) on one or more vesting dates in the future. The vesting dates may be based on the passage of time or the satisfaction of other criteria, such as continued employment or Company performance. Recipients of restricted stock units have no rights as a stockholder with respect to any shares covered by the award until the date a stock certificate or book entry evidencing such shares is issued or made, respectively. |

Compensation of Non-Employee Directors

The Company uses a combination of cash and share-based incentive compensation to attract and retain qualified candidates to serve on the Board of Directors. In setting director compensation, the Company considers the significant amount of time that directors expend fulfilling their duties to the Company as well as the skill level required by the Company of members of the Board.

Non-employee directors of the Company receive an annual fee of $24,000 for their service as directors. The Chairman of the Audit Committee receives an additional annual fee of $6,000. All of the Company’s directors are reimbursed for reasonable travel expenses incurred in attending meetings.

The table below presents cash and non-cash compensation paid to non-employee directors during the 2020 fiscal year.

Non-Management Director Compensation for Fiscal Year Ended January 2, 2021

|

Name (1) |

|

Fees Earned or Paid in Cash ($) |

|

|

Option Awards ($) |

|

|

All Other Compensation ($) |

|

|

Total ($) |

|

||||

|

John Bitar |

|

|

17,758 |

|

|

|

— |

|

|

|

— |

|

|

|

17,758 |

|

|

Richard D. Butler, Jr. (2) |

|

|

30,000 |

|

|

|

— |

|

|

|

— |

|

|

|

30,000 |

|

|

Nael Hajjar |

|

|

14,400 |

|

|

|

— |

|

|

|

— |

|

|

|

14,400 |

|

15

|

|

(1) |

The Chairman of the Audit Committee received an additional annual fee of $6,000 and each other member of the Audit Committee received an additional annual fee of $6,000. All of the Company’s directors were reimbursed for reasonable travel expenses incurred in attending meetings. |

|

|

(2) |

Mr. Gao resigned from the Board of Directors effective January 6, 2020 and was replaced by John Bitar as disclosed in the Company’s Current Report on Form 8-K filed with the SEC on January 10, 2020. |

Policy Prohibiting Hedging

We consider it improper and inappropriate for our directors, officers, and other employees to engage in any transactions that hedge or offset, or are designed to hedge or offset, any decrease in the value of our securities. As such, our no hedging policy prohibits all employees, including directors and executive officers, from engaging in any speculative or hedging transactions or any other transactions that are designed to offset any decrease in the value of our securities.

Transactions with related persons

Shared Services

Tony Isaac, the Company’s Chief Executive Officer, is the father of Jon Isaac, President and Chief Executive Officer of Live Ventures and managing member of ICG, a greater than 5% stockholder of the Company. Tony Isaac, Chief Executive Officer, Virland Johnson, Chief Financial Officer, Richard Butler, Board of Directors member, and Dennis Gao, Board of Directors member of the Company, are Board of Directors member, Chief Financial Officer, Board of Directors member, and Board of Directors members, respectively, of Live Ventures. The Company also shares certain executive, accounting, and legal services with Live Ventures. The total services shared were approximately $243,000 and $193,000 for fiscal years ending January 2, 2021 and December 28, 2019, respectively. Customer Connexx rents approximately 9,900 square feet of office space from Live Ventures at its Las Vegas, NV office. The total rent and common area expense were approximately $196,000 and $177,000 for fiscal years ending January 2, 2021 and December 28, 2019, respectively

ApplianceSmart Note (000’s omitted)

On December 30, 2017, Purchaser entered into the Agreement and purchased from the Company all of the Stock of ApplianceSmart in exchange for the Purchase Price. Effective April 1, 2018, the Purchaser issued the ApplianceSmart Note with a three-year term in the original principal amount of $3,919 for the balance of the purchase price. ApplianceSmart is guaranteeing the repayment of the ApplianceSmart Note.

On December 30, 2017, Purchaser entered into the Agreement with the Company and ApplianceSmart. Pursuant to the Agreement, the Purchaser purchased from the Company all of the Stock of ApplianceSmart in exchange for the Purchase Price. Effective April 1, 2018, the Purchaser issued the ApplianceSmart Note with a three-year term in the original principal amount of $3,919 for the balance of the purchase price. ApplianceSmart is guaranteeing the repayment of the ApplianceSmart Note.

On December 26, 2018, the ApplianceSmart Note was amended and restated to grant the Company a security interest in the assets of the Purchaser, ApplianceSmart, and ApplianceSmart Contracting Inc. in exchange for modifying the repayment terms to provide for the payment in full of all accrued interest and principal on April 1, 2021, the maturity date of the ApplianceSmart Note.

On March 15, 2019, the Company entered into subordination agreements with third parties pursuant to which it agreed to subordinate the payment of indebtedness under the ApplianceSmart Note and the Company’s security interest in the assets of ApplianceSmart and other related parties in exchange for up to $1,200 payable within 15 days of the agreement. ApplianceSmart can re-borrow up to the principal amount of the Note, $3,919.

On December 9, 2019, ApplianceSmart filed a voluntary petition (the “Chapter 11 Case”) in the United States Bankruptcy Court for the Southern District of New York (the “Bankruptcy Court”) seeking relief under Chapter 11 of Title 11 of the United States Code (the “Bankruptcy Code”). ApplianceSmart is seeking to confirm a plan of reorganization under which it would pay the Company $25 in full satisfaction of the

16

Company’s claim on the guaranty. The Company would release its junior security interest in ApplianceSmart’s assets. Based on its evaluation of the alternative possible remedies and its reasonable business judgment, the Company is willing to accept this proposal if the plan is confirmed by the Bankruptcy Court.

Related Party ICG Note

On August 28, 2019, ARCA Recycling entered into and delivered to ICG a secured revolving line of credit promissory note, whereby ICG agreed to provide the ARCA Recycling with a $2.5 million revolving credit facility (the “ICG Note”). The ICG Note originally matured on August 28, 2020. On August 25, 2020, the ICG Note was amended to extend the maturity date to December 31, 2020. On March 30, 2021, ARCA Recycling entered into a Second Amendment and Waiver (the “Second Amendment”) to the ICG Note to further extend the maturity date to August 18, 2021 and waive certain defaults under the ICG Note. On August 12, 2021, ARCA Recycling entered into a Third Amendment and Waiver (the “Third Amendment”) to the ICG Note to further extend the maturity date to February 28, 2022. See Note 15 for a complete discussion. The ICG Note bears interest at 8.75% per annum and provides for the payment of interest, monthly in arrears. ARCA Recycling will pay a loan fee of 2.0% on each borrowing made under the ICG Note. In connection with entering into the ICG Note, the Borrower also entered into a security agreement in favor of the Lender, pursuant to which ARCA Recycling granted a security interest in all of its assets to the Lender. The obligations of ARCA Recycling under the ICG Note are guaranteed by the Company. The foregoing transaction did not include the issuance of any shares of the Company’s common stock, warrants, or other derivative securities. ICG is a record and beneficial owner of approximately 16% of the outstanding common stock of the Company. Jon Isaac is the manager and sole member of ICG, and the son of Tony Isaac, the Chief Executive Officer of JanOne and ARCA Recycling.

The Audit Committee operates pursuant to a charter which is reviewed annually by the Audit Committee. Additionally, a brief description of the primary responsibilities of the Audit Committee is included in this Proxy Statement under the discussion of “The Board of Directors and Certain Governance Matters — Committee Membership — Audit Committee.” Under the Audit Committee charter, management is responsible for the preparation, presentation and integrity of the Company’s financial statements, the application of accounting and financial reporting principles and our internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent registered public accounting firm is responsible for auditing our financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States of America.

In the performance of its oversight function, the Audit Committee reviewed and discussed the audited financial statements and internal control over financial reporting of the Company with management and with the independent registered public accounting firm. The Audit Committee also discussed with the independent registered public accounting firm the matters required to be discussed by Public Company Accounting Oversight Board Auditing Standard No. 1301 “Communications with Audit Committee.” In addition, the Audit Committee received the written disclosures and the letters from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence and discussed with the independent registered public accounting firm their independence.

Based upon the review and discussions described in the preceding paragraph, the Audit Committee recommended to the Board that the audited financial statements of the Company be included in its Annual Report on Form 10-K for the fiscal year ended January 2, 2021, filed with the SEC.

|

October 5, 2021 |

|

The Audit Committee |

|

|

|

|

|

|

|

Richard D. Butler, Jr. (Chair) |

|

|

|

John Bitar |

|

|

|

Nael Hajjar |

17

At the date of this proxy statement the Company’s management knows of no other matters which may come before the Annual Meeting. However, if any other matters properly come before the meeting, it is the intention of the persons named in the accompanying proxy form to vote such proxies received by the Company in accordance with their judgment on such matters.

A copy of our Annual Report on Form 10-K for the fiscal year ended January 2, 2021 has been mailed to you with this Proxy Statement. Except as provided above, the Annual Report is not to be considered a part of these proxy soliciting materials or subject to Regulations 14A or 14C or to the liabilities of Section 18 of the Exchange Act. The information contained in the “Audit Committee Report” shall not be deemed “filed” with the SEC or subject to Regulations 14A or 14C or to the liabilities of Section 18 of the Exchange Act. We will provide upon written request, without charge to each stockholder of record as of the record date, a copy of our Annual Report on Form 10-K for the fiscal year ended January 2, 2021 as filed with the SEC. Any exhibits listed in the Form 10-K also will be furnished upon request at the actual expense incurred by us in furnishing such exhibits. Any such requests should be directed to our Corporate Secretary at our principal executive offices at 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119.

STOCKHOLDERS ARE URGED TO VOTE BY INTERNET OR TELEPHONE OR IMMEDIATELY MARK, DATE, SIGN AND RETURN THE ENCLOSED PROXY VIA FACSIMILE TO THE ATTENTION OF CORPORATE SECRETARY, JANONE INC., AT (952) 930-9000 OR IN THE ENCLOSED POSTAGE-PAID ENVELOPE. YOUR VOTE IS IMPORTANT.

|

By Order of the Board of Directors |

|

|

|

/s/ Tony Isaac |

|

|

|

Tony Isaac, Secretary |

October 5, 2021

18