false00008628612023FY0.0000100008628612023-01-012023-12-3000008628612023-07-01iso4217:USD00008628612024-04-01xbrli:shares00008628612023-12-3000008628612022-12-310000862861us-gaap:RelatedPartyMember2023-12-300000862861us-gaap:RelatedPartyMember2022-12-310000862861jan:SeriesSMember2022-12-31iso4217:USDxbrli:shares0000862861jan:SeriesSMember2023-12-300000862861jan:SeriesA1Member2023-12-300000862861jan:SeriesA1Member2022-12-3100008628612022-01-022022-12-310000862861us-gaap:PreferredStockMember2022-01-010000862861us-gaap:CommonStockMember2022-01-010000862861us-gaap:AdditionalPaidInCapitalMember2022-01-010000862861us-gaap:RetainedEarningsMember2022-01-010000862861us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-0100008628612022-01-010000862861us-gaap:RetainedEarningsMember2022-01-022022-12-310000862861us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-022022-12-310000862861us-gaap:AdditionalPaidInCapitalMember2022-01-022022-12-310000862861us-gaap:PreferredStockMember2022-01-022022-12-310000862861us-gaap:CommonStockMember2022-01-022022-12-310000862861us-gaap:PreferredStockMember2022-12-310000862861us-gaap:CommonStockMember2022-12-310000862861us-gaap:AdditionalPaidInCapitalMember2022-12-310000862861us-gaap:RetainedEarningsMember2022-12-310000862861us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000862861us-gaap:RetainedEarningsMember2023-01-012023-12-300000862861us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-300000862861us-gaap:CommonStockMember2023-01-012023-12-300000862861us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-300000862861us-gaap:PreferredStockMember2023-01-012023-12-300000862861us-gaap:PreferredStockMember2023-12-300000862861us-gaap:CommonStockMember2023-12-300000862861us-gaap:AdditionalPaidInCapitalMember2023-12-300000862861us-gaap:RetainedEarningsMember2023-12-300000862861us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-30jan:segment0000862861jan:SpyrTechnologiesIncMemberjan:GeoTraqIncMemberjan:AssetPurchaseAgreementMember2022-05-240000862861jan:SpyrTechnologiesIncMemberjan:GeoTraqIncMemberjan:AssetPurchaseAgreementMember2022-05-242022-05-24xbrli:pure0000862861us-gaap:SegmentContinuingOperationsMember2023-12-300000862861us-gaap:SegmentContinuingOperationsMember2022-12-310000862861jan:ContinuingOperationsAndDiscontinuedOperationsMember2023-12-300000862861jan:ContinuingOperationsAndDiscontinuedOperationsMember2022-12-310000862861jan:SoinIntangiblesMember2022-12-28jan:patent0000862861us-gaap:MarketingRelatedIntangibleAssetsMembersrt:MinimumMember2023-12-300000862861srt:MaximumMemberus-gaap:MarketingRelatedIntangibleAssetsMember2023-12-300000862861us-gaap:ComputerSoftwareIntangibleAssetMembersrt:MinimumMember2023-12-300000862861us-gaap:ComputerSoftwareIntangibleAssetMembersrt:MaximumMember2023-12-300000862861us-gaap:TechnologyBasedIntangibleAssetsMember2023-12-300000862861us-gaap:CustomerRelationshipsMembersrt:MinimumMember2023-12-300000862861us-gaap:CustomerRelationshipsMembersrt:MaximumMember2023-12-300000862861srt:MaximumMember2023-01-012023-12-300000862861jan:SeriesSConvertiblePreferredStockMemberjan:StiMergerSubIncMemberjan:SoinTherapeuticsLLCMember2022-12-280000862861jan:SeriesSConvertiblePreferredStockMemberjan:StiMergerSubIncMemberjan:SoinTherapeuticsLLCMember2022-12-282022-12-280000862861jan:StiMergerSubIncMemberjan:SoinTherapeuticsLLCMember2022-12-282022-12-280000862861jan:StockConversion1Memberjan:SeriesSConvertiblePreferredStockMemberjan:SoinTherapeuticsLLCMember2022-12-282022-12-280000862861us-gaap:RelatedPartyMemberjan:StockConversion1Memberjan:DrSoinMemberjan:SeriesSConvertiblePreferredStockMember2022-12-280000862861jan:SeriesSConvertiblePreferredStockMemberjan:SoinTherapeuticsLLCMemberjan:StockConversion2Member2022-12-282022-12-280000862861us-gaap:RelatedPartyMemberjan:StockConversion3Memberjan:DrSoinMemberjan:SeriesSConvertiblePreferredStockMember2022-12-280000862861jan:StockConversion3Memberjan:SeriesSConvertiblePreferredStockMemberjan:SoinTherapeuticsLLCMember2022-12-282022-12-280000862861jan:SoinTherapeuticsLLCMember2022-12-280000862861jan:SeriesSConvertiblePreferredStockMember2022-12-282022-12-280000862861jan:SeriesSConvertiblePreferredStockMember2022-12-280000862861jan:SeriesSConvertiblePreferredStockMember2022-02-280000862861jan:SeriesSConvertiblePreferredStockMember2023-12-300000862861jan:ARCAAndSubsidiariesMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-03-092023-03-090000862861jan:ARCAAndSubsidiariesMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembersrt:MinimumMember2023-03-092023-03-090000862861jan:ARCAAndSubsidiariesMemberjan:RelevantMonth1Memberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-03-092023-03-090000862861jan:ARCAAndSubsidiariesMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberjan:RelevantMonth2Member2023-03-092023-03-090000862861jan:ARCAAndSubsidiariesMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberjan:RelevantMonth2Membersrt:MinimumMember2023-03-092023-03-090000862861jan:ARCAAndSubsidiariesMembersrt:MaximumMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberjan:RelevantMonth2Member2023-03-092023-03-090000862861jan:ARCAAndSubsidiariesMemberjan:RelevantMonth3Memberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-03-092023-03-090000862861jan:ARCAAndSubsidiariesMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-03-090000862861jan:ARCAAndSubsidiariesMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-10-012023-12-300000862861jan:GulfCoastBankAndTrustCreditFacilityMemberus-gaap:FinancialGuaranteeMember2023-12-300000862861jan:GulfCoastBankAndTrustCreditFacilityMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberus-gaap:FinancialGuaranteeMember2023-12-300000862861jan:AssetPurchaseAgreementMemberjan:SpyrTechnologiesIncMember2022-05-240000862861jan:AssetPurchaseAgreementMemberjan:SpyrTechnologiesIncMember2022-05-242022-05-240000862861jan:AssetPurchaseAgreementMemberjan:SpyrTechnologiesIncMember2023-01-012023-12-300000862861jan:AssetPurchaseAgreementMember2022-05-240000862861jan:AssetPurchaseAgreementMembersrt:MaximumMember2022-05-240000862861jan:AssetPurchaseAgreementMembersrt:MinimumMember2022-05-240000862861jan:SpyrTechnologiesIncMember2022-05-240000862861jan:AssetPurchaseAgreementMemberjan:SpyrTechnologiesIncMember2022-05-242022-12-310000862861jan:SpyrTechnologiesIncMember2022-05-242022-12-310000862861jan:SpyrTechnologiesIncMember2023-01-012023-12-300000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:ARCAAndSubsidiariesMemberus-gaap:SegmentDiscontinuedOperationsMember2022-12-310000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:ARCAAndSubsidiariesMemberus-gaap:SegmentDiscontinuedOperationsMemberjan:BuildingsAndImprovementsMembersrt:MinimumMember2022-12-310000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:ARCAAndSubsidiariesMembersrt:MaximumMemberus-gaap:SegmentDiscontinuedOperationsMemberjan:BuildingsAndImprovementsMember2022-12-310000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:ARCAAndSubsidiariesMemberus-gaap:SegmentDiscontinuedOperationsMemberjan:BuildingsAndImprovementsMember2022-12-310000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:ARCAAndSubsidiariesMemberus-gaap:SegmentDiscontinuedOperationsMemberus-gaap:EquipmentMembersrt:MinimumMember2022-12-310000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:ARCAAndSubsidiariesMembersrt:MaximumMemberus-gaap:SegmentDiscontinuedOperationsMemberus-gaap:EquipmentMember2022-12-310000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:ARCAAndSubsidiariesMemberus-gaap:SegmentDiscontinuedOperationsMemberus-gaap:EquipmentMember2022-12-310000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:ARCAAndSubsidiariesMemberus-gaap:SegmentDiscontinuedOperationsMemberus-gaap:ConstructionMember2022-12-310000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:ARCAAndSubsidiariesMemberus-gaap:SegmentDiscontinuedOperationsMember2023-01-012023-12-300000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:ARCAAndSubsidiariesMemberus-gaap:SegmentDiscontinuedOperationsMember2022-01-022022-12-310000862861jan:RecyclingSegmentAndTechnologySegmentMemberus-gaap:PatentsMemberjan:ARCAAndSubsidiariesMemberus-gaap:SegmentDiscontinuedOperationsMember2022-12-310000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:ARCAAndSubsidiariesMemberus-gaap:ComputerSoftwareIntangibleAssetMemberus-gaap:SegmentDiscontinuedOperationsMember2022-12-310000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:ARCAAndSubsidiariesMemberus-gaap:SegmentDiscontinuedOperationsMember2023-12-30jan:state0000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:ARCAAndSubsidiariesMemberus-gaap:SegmentDiscontinuedOperationsMember2017-04-130000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:ARCAAndSubsidiariesMemberus-gaap:SegmentDiscontinuedOperationsMemberjan:GulfCoastBankAndTrustCompanyMember2022-12-310000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:ARCAAndSubsidiariesMemberjan:KlcFinancialMemberus-gaap:SegmentDiscontinuedOperationsMember2022-12-310000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:ARCAAndSubsidiariesMemberus-gaap:SegmentDiscontinuedOperationsMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:BeneficialOwnerMemberjan:IcgNoteMember2019-08-280000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:ARCAAndSubsidiariesMemberus-gaap:SegmentDiscontinuedOperationsMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:BeneficialOwnerMemberjan:IcgNoteMember2019-08-282019-08-280000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:ARCAAndSubsidiariesMemberus-gaap:SegmentDiscontinuedOperationsMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:BeneficialOwnerMemberjan:IcgNoteMember2022-01-010000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:ARCAAndSubsidiariesMemberus-gaap:SegmentDiscontinuedOperationsMemberus-gaap:BeneficialOwnerMemberjan:IcgNoteMemberus-gaap:NotesPayableOtherPayablesMember2022-04-300000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:ARCAAndSubsidiariesMemberus-gaap:SegmentDiscontinuedOperationsMemberus-gaap:BeneficialOwnerMemberjan:IcgNoteMemberus-gaap:NotesPayableOtherPayablesMember2023-05-242023-05-240000862861jan:RecyclingSegmentAndTechnologySegmentMemberus-gaap:RelatedPartyMemberjan:ARCAAndSubsidiariesMemberus-gaap:SegmentDiscontinuedOperationsMemberjan:IcgNoteMember2022-12-310000862861jan:RecyclingSegmentAndTechnologySegmentMemberus-gaap:SegmentDiscontinuedOperationsMemberjan:ArcaMember2023-01-012023-12-300000862861jan:RecyclingSegmentAndTechnologySegmentMemberus-gaap:SegmentDiscontinuedOperationsMemberjan:ArcaMember2022-01-022022-12-310000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:GeoTraqIncMemberus-gaap:SegmentDiscontinuedOperationsMember2023-01-012023-12-300000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:GeoTraqIncMemberus-gaap:SegmentDiscontinuedOperationsMember2022-01-022022-12-310000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:ARCAAndSubsidiariesMemberus-gaap:SegmentDiscontinuedOperationsMember2022-01-010000862861jan:SpyrTechnologiesIncMember2022-05-242022-05-240000862861jan:GeoTraqIncMember2022-05-240000862861jan:SpyrTechnologiesIncMember2023-01-012023-12-300000862861jan:SpyrTechnologiesIncMember2022-01-022022-12-310000862861jan:SpyrTechnologiesIncMember2023-12-300000862861jan:GeoTraqIncMember2023-01-012023-12-300000862861jan:GeoTraqIncMember2023-12-3000008628612022-01-022022-07-0200008628612022-04-032022-07-020000862861jan:GeoTraqIncMember2022-01-022022-12-310000862861jan:GeoTraqIncMember2022-12-310000862861jan:StockPurchaseAgreementMemberjan:VM7CorporationMember2023-03-092023-03-090000862861jan:StockPurchaseAgreementMemberjan:VM7CorporationMember2023-03-090000862861jan:StockPurchaseAgreementMemberjan:VM7CorporationMember2023-01-012023-12-3000008628612023-10-012023-12-300000862861us-gaap:SegmentContinuingOperationsMemberjan:SoinIntangiblesMember2023-12-300000862861us-gaap:SegmentContinuingOperationsMemberjan:SoinIntangiblesMember2022-12-310000862861us-gaap:SegmentContinuingOperationsMemberjan:PatentsAndDomainsMember2023-12-300000862861us-gaap:SegmentContinuingOperationsMemberjan:PatentsAndDomainsMember2022-12-310000862861us-gaap:ComputerSoftwareIntangibleAssetMemberus-gaap:SegmentContinuingOperationsMember2023-12-300000862861us-gaap:ComputerSoftwareIntangibleAssetMemberus-gaap:SegmentContinuingOperationsMember2022-12-310000862861jan:SeriesGConvertiblePreferredStockMember2022-01-010000862861jan:CommonShareEquivalentsMember2022-01-010000862861jan:SeriesGConvertiblePreferredStockMember2022-01-022022-12-310000862861jan:CommonShareEquivalentsMember2022-01-022022-12-310000862861jan:SeriesGConvertiblePreferredStockMember2022-12-310000862861jan:CommonShareEquivalentsMember2022-12-310000862861jan:SeriesGConvertiblePreferredStockMember2023-01-012023-12-300000862861jan:CommonShareEquivalentsMember2023-01-012023-12-300000862861jan:SeriesGConvertiblePreferredStockMember2023-12-300000862861jan:CommonShareEquivalentsMember2023-12-300000862861jan:AFCOCreditCorporationFinancingAgreementMemberjan:FinancingArrangementMember2023-12-300000862861jan:AFCOCreditCorporationFinancingAgreementMemberjan:FinancingArrangementMember2022-12-310000862861jan:AFCOCreditCorporationFinancingAgreementMemberjan:FinancingArrangementMemberjan:AFCOCreditCorpMember2022-07-310000862861jan:AFCOCreditCorporationFinancingAgreementMemberjan:FinancingArrangementMemberjan:AFCOCreditCorpMember2022-07-212022-07-210000862861jan:AFCOCreditCorporationFinancingAgreementMemberjan:FinancingArrangementMemberjan:AFCOCreditCorpMembersrt:MinimumMember2022-08-012023-04-010000862861jan:AFCOCreditCorporationFinancingAgreementMembersrt:MaximumMemberjan:FinancingArrangementMemberjan:AFCOCreditCorpMember2022-08-012023-04-010000862861jan:AFCOCreditCorporationFinancingAgreementMemberjan:FinancingArrangementMemberjan:AFCOCreditCorpMember2022-12-310000862861jan:AFCOCreditCorporationFinancingAgreementMemberjan:FinancingArrangementMemberjan:AFCOCreditCorpMember2023-12-300000862861jan:AFCOCreditCorporationFinancingAgreementMemberjan:FinancingArrangementMemberjan:AFCOCreditCorpMember2023-01-012023-12-300000862861jan:GeoTraqIncMember2017-08-182017-08-180000862861jan:SeriesAConvertiblePreferredStockMemberjan:GeoTraqIncMember2017-08-182017-08-180000862861jan:SeriesAConvertiblePreferredStockMemberjan:GeoTraqIncMember2017-08-180000862861jan:SeriesA1ConvertiblePreferredStockMember2023-12-300000862861jan:SeriesA1ConvertiblePreferredStockMember2022-12-310000862861jan:SeriesA1ConvertiblePreferredStockMember2023-01-012023-12-300000862861jan:SeriesA1ConvertiblePreferredStockMember2022-01-022022-12-310000862861jan:SeriesSConvertiblePreferredStockMemberjan:SoinTherapeuticsLLCMember2022-12-282022-12-280000862861us-gaap:RelatedPartyMemberjan:StockConversion1Memberjan:DrSoinMemberjan:SeriesSConvertiblePreferredStockMember2022-12-282022-12-280000862861us-gaap:RelatedPartyMemberjan:DrSoinMemberjan:SeriesSConvertiblePreferredStockMemberjan:StockConversion2Member2022-12-282022-12-280000862861us-gaap:RelatedPartyMemberjan:StockConversion3Memberjan:DrSoinMemberjan:SeriesSConvertiblePreferredStockMember2022-12-282022-12-280000862861us-gaap:RelatedPartyMemberjan:StockConversion3Memberjan:DrSoinMember2022-12-282022-12-280000862861us-gaap:RelatedPartyMemberjan:DrSoinMember2022-12-282022-12-280000862861jan:SeriesSConvertiblePreferredStockMember2022-12-310000862861jan:SeriesSConvertiblePreferredStockMember2022-01-010000862861jan:SeriesSConvertiblePreferredStockMember2022-01-022022-12-31jan:vote0000862861jan:ArticlesOfIncorporationMember2023-12-300000862861jan:ArticlesOfIncorporationMember2022-12-310000862861jan:SecuritiesPurchaseAgreementMember2023-03-222023-03-220000862861jan:SecuritiesPurchaseAgreementMember2023-03-220000862861us-gaap:PrivatePlacementMember2023-08-182023-08-180000862861us-gaap:PrivatePlacementMember2023-08-180000862861us-gaap:PrivatePlacementMemberjan:PreFundedWarrantsMemberMember2023-08-180000862861us-gaap:PrivatePlacementMemberjan:PreFundedWarrantsMemberMember2023-08-310000862861us-gaap:PrivatePlacementMember2023-12-300000862861jan:A2023PlanMember2023-12-300000862861jan:A2023PlanMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-300000862861jan:A2023PlanMember2023-01-012023-12-300000862861jan:A2023PlanMemberus-gaap:RestrictedStockUnitsRSUMember2023-12-300000862861jan:Plan2016Member2020-11-030000862861jan:Plan2016Member2020-11-040000862861jan:Plan2016Member2023-12-300000862861jan:Plan2016Member2022-12-310000862861jan:Plan2011Member2023-12-300000862861jan:Plan2011Member2022-12-310000862861jan:Plan2011Member2023-01-012023-12-3000008628612021-01-032022-01-010000862861jan:ExercisePriceRangeOneMember2023-12-300000862861jan:ExercisePriceRangeOneMember2023-01-012023-12-300000862861jan:ExercisePriceRangeTwoMember2023-12-300000862861jan:ExercisePriceRangeTwoMember2023-01-012023-12-300000862861jan:ExercisePriceRangeThreeMember2023-12-300000862861jan:ExercisePriceRangeThreeMember2023-01-012023-12-300000862861jan:ExercisePriceRangeFourMember2023-12-300000862861jan:ExercisePriceRangeFourMember2023-01-012023-12-300000862861us-gaap:EmployeeStockOptionMember2023-01-012023-12-300000862861us-gaap:EmployeeStockOptionMember2022-01-022022-12-310000862861us-gaap:EmployeeStockOptionMember2023-12-300000862861us-gaap:SegmentContinuingOperationsMember2023-01-012023-12-300000862861us-gaap:SegmentDiscontinuedOperationsMember2023-01-012023-12-300000862861us-gaap:SegmentDiscontinuedOperationsMember2022-01-022022-12-310000862861us-gaap:DomesticCountryMember2023-12-300000862861us-gaap:StateAndLocalJurisdictionMember2023-12-300000862861us-gaap:RelatedPartyMemberjan:LiveVenturesIncorporatedMember2023-01-012023-12-300000862861us-gaap:RelatedPartyMemberjan:LiveVenturesIncorporatedMember2022-01-022022-12-310000862861us-gaap:RelatedPartyMemberjan:LiveVenturesIncorporatedMember2023-12-30utr:sqft0000862861jan:RecyclingSegmentAndTechnologySegmentMemberjan:ARCAAndSubsidiariesMemberjan:JanOneMemberus-gaap:SegmentDiscontinuedOperationsMemberjan:IsaacCapitalGroupLLCICGMemberus-gaap:BeneficialOwnerMemberjan:IcgNoteMember2023-05-240000862861us-gaap:RelatedPartyMemberjan:IcgNoteMember2023-12-300000862861jan:ARCARecyclingPurchasingAgreementMember2022-04-050000862861jan:ARCARecyclingPurchasingAgreementMember2023-12-300000862861jan:ARCARecyclingPurchasingAgreementMemberus-gaap:RelatedPartyMemberjan:LiveVenturesIncorporatedMember2023-12-300000862861jan:ARCARecyclingPurchasingAgreementMemberus-gaap:RelatedPartyMemberjan:LiveVenturesIncorporatedMember2022-12-3100008628612021-08-02jan:officer0000862861jan:SkyBridgeAmericasMember2017-01-252017-01-250000862861jan:SkyBridgeAmericasMember2018-02-282018-02-280000862861jan:SkyBridgeAmericasMember2021-02-012021-02-010000862861jan:SkyBridgeAmericasMember2023-12-300000862861jan:AMTIMCapitalIncMember2022-02-012022-12-12jan:Quarterly0000862861jan:GeoTraqIncMember2021-06-012021-06-010000862861jan:GeoTraqIncMember2021-04-092021-04-090000862861jan:SeriesA1ConvertiblePreferredStockMember2023-03-172023-03-170000862861us-gaap:CommonStockMember2023-03-172023-03-170000862861jan:SeriesA1ConvertiblePreferredStockMember2023-06-012023-06-010000862861us-gaap:CommonStockMember2023-06-012023-06-010000862861jan:SeriesA1ConvertiblePreferredStockMember2023-09-012023-09-010000862861us-gaap:CommonStockMember2023-09-012023-09-010000862861jan:SeriesA1ConvertiblePreferredStockMember2023-09-302023-09-300000862861jan:GeoTraqIncMemberus-gaap:RelatedPartyMemberjan:Mr.SullivanMember2023-12-300000862861jan:GeoTraqIncMemberus-gaap:RelatedPartyMemberjan:Mr.SullivanMember2022-12-310000862861jan:AlixpartnersLlcMember2022-10-192022-10-190000862861jan:AlixpartnersLlcMember2023-01-012023-12-300000862861jan:AlixpartnersLlcMember2023-12-30jan:traches0000862861jan:TrusteesMain270LlcMember2023-01-012023-12-300000862861jan:TrusteesMain270LlcMemberjan:ApplianceSmartIncMember2023-01-012023-12-300000862861jan:WestervilleSquareMember2023-01-012023-12-300000862861jan:WestervilleSquareMember2023-06-042023-06-040000862861jan:ApplianceSmartIncMember2023-12-3000008628612017-12-30jan:landlord0000862861jan:BiotechnologyMember2023-01-012023-12-300000862861jan:BiotechnologyMember2022-01-022022-12-310000862861jan:ContinuingOperationsAndDiscontinuedOperationsMember2023-01-012023-12-300000862861jan:ContinuingOperationsAndDiscontinuedOperationsMember2022-01-022022-12-310000862861jan:BiotechnologyMember2023-12-300000862861jan:BiotechnologyMember2022-12-310000862861us-gaap:SegmentDiscontinuedOperationsMember2023-12-300000862861us-gaap:SegmentDiscontinuedOperationsMember2022-12-310000862861us-gaap:SubsequentEventMember2024-01-120000862861us-gaap:SubsequentEventMember2024-01-122024-03-050000862861us-gaap:SubsequentEventMember2024-01-122024-01-120000862861us-gaap:SubsequentEventMember2024-03-052024-03-050000862861us-gaap:SubsequentEventMemberjan:SeriesSConvertiblePreferredStockMemberjan:SoinTherapeuticsLLCMember2024-01-242024-01-240000862861us-gaap:SubsequentEventMemberjan:SoinTherapeuticsLLCMember2024-03-012024-03-310000862861srt:ScenarioForecastMemberjan:SoinTherapeuticsLLCMember2024-07-012024-07-010000862861srt:ScenarioForecastMemberjan:SoinTherapeuticsLLCMember2024-12-312024-12-310000862861us-gaap:RelatedPartyMemberus-gaap:SubsequentEventMemberjan:IcgNoteMember2024-02-070000862861us-gaap:RelatedPartyMemberus-gaap:SubsequentEventMemberus-gaap:EquityUnitPurchaseAgreementsMemberjan:IcgNoteMember2024-02-23jan:agreements0000862861us-gaap:RelatedPartyMemberus-gaap:SubsequentEventMemberus-gaap:EquityUnitPurchaseAgreementsMemberjan:IcgNoteMember2024-02-232024-02-230000862861us-gaap:RelatedPartyMemberus-gaap:SubsequentEventMemberjan:IcgNoteMember2024-02-230000862861jan:IsaacConsultingAgreementMemberus-gaap:RelatedPartyMemberus-gaap:SubsequentEventMemberjan:Mr.JonIsaacMember2024-03-042024-03-040000862861jan:IsaacConsultingAgreementMemberus-gaap:RelatedPartyMemberus-gaap:SubsequentEventMemberjan:Mr.JonIsaacMember2024-03-04jan:insurance_policy0000862861jan:IsaacConsultingAgreementMemberus-gaap:RelatedPartyMemberus-gaap:SubsequentEventMemberjan:UniversalLifeInsurancePolicyPolicyOneMemberjan:Mr.JonIsaacMember2024-03-040000862861jan:IsaacConsultingAgreementMemberus-gaap:RelatedPartyMemberus-gaap:SubsequentEventMemberjan:UniversalLifeInsurancePolicyPolicyTwoMemberjan:Mr.JonIsaacMember2024-03-04utr:D

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | | |

| x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 30, 2023

or

| | | | | |

| o | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File No. 000-19621

JANONE INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Nevada | | 41-1454591 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

325 E. Warm Springs Road, Las Vegas, Nevada | | 89119 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 702-997-5968

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Common Stock, $0.001 par value Title of each class | JAN Trading Symbol(s) | Nasdaq Capital Market Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | o | Accelerated filer | o | Non-accelerated filer | x |

| Smaller reporting company | x | Emerging growth company | o | | |

If any emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal controls over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. o

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). o Yes x No

The aggregate market value of the registrant’s common stock held by non-affiliates, based on the closing sales price of such stock on July 1, 2023 was $2,981,872.

The number of shares outstanding of the registrant’s common stock as of April 8, 2024 was 8,593,636.

TABLE OF CONTENTS

PART I

ITEM 1. BUSINESS

General

JanOne Inc. (formerly known as Appliance Recycling Centers of America, Inc.) and subsidiaries (collectively, “we,” the “Company,” or “JanOne”) is focused on being a clinical-stage pharmaceutical company committed to finding treatments for conditions that cause severe pain and bringing drugs to market with non-addictive pain-relieving properties.

One of the Company’s goals is to reduce the need for prescriptions for dangerous opioid drugs by treating underlying diseases that cause severe pain. The Company’s first drug candidate is a treatment for Peripheral Artery Disease (“PAD”), a condition that can cause severe pain and affects over 8.5 million people in the United States. The Company intends to champion new initiatives—digital technologies, educational advocacy, and revolutionary painkilling drugs that address what we believe is a multibillion dollar a year market—to help combat the opioid crisis, which claims tens of thousands of lives each year.

On December 28, 2022, we entered into a Purchase Agreement (the “Soin Purchase Agreement”) with Soin Therapeutics, LLC. Under the Soin Purchase Agreement, the Company acquired Soin Therapeutics and its LDN product, now known as JAN123. JAN123 is a novel formulation of 2.0 mg of LDN that results in a biphasic release of the product. The release properties of JAN123 provide for an immediate release of less than half the product with a slow, sustained release of the remaining product. Importantly, the rapid release of LDN has been reported to lead to vivid and lucid unpleasant dreams, which should be eliminated with the formulation of JAN123. Initially, a single tablet of JAN123 will be administered orally, once a day before sleep, with eventual titration up to two tablets (4 mg) before sleep.

The name of the Company, JanOne Inc., was strategically chosen to express the start of a new day in the fight against the opioid epidemic. January one is the first day of a New Year—universally considered as a day of optimism, resolution, and hope. JanOne stands by its strategic commitment to fresh thinking and innovative means to assist in ending the worst drug crisis in our nation’s history.

Through March 8, 2023, the Company operated its legacy businesses through its Recycling Subsidiaries, consisting of: (a) ARCA Recycling, Inc., a California corporation (“ARCA Recycling”), (b) ARCA Canada Inc., a corporation organized under the laws of Ontario, Canada (“ARCA Canada”), and (c) Customer Connexx, LLC, a Nevada limited liability company (“Connexx”). ARCA Recycling and ARCA Canada recycle major household appliances in North America by providing turnkey appliance recycling and replacement services for utilities and other sponsors of energy efficiency programs. Connexx is a company that provides call center services for recycling businesses. On March 9, 2023, we entered into a Stock Purchase Agreement (the “Recycling Purchase Agreement”) with VM7 Corporation, a Delaware corporation (“VM7”), under which it agreed to acquire all of the outstanding equity interests of the Recycling Subsidiaries. The principal of VM7 is Virland A. Johnson, our Chief Financial Officer.

The information contained in or accessible from our website is not incorporated into this Annual Report on Form 10-K (the “Form 10-K”), and it should not be considered part of this Form 10-K. We have included our website address in this Form 10-K solely as an inactive textual reference.

The Company was incorporated in Minnesota in 1983, although, through its predecessors, began operating its legacy recycling business in 1976. In 2018, the Company reincorporated in the State of Nevada. The Company’s principal office is located at 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119.

Biotechnology

Overview

We are a clinical-stage biopharmaceutical company focused on becoming the leader in identifying, acquiring, licensing, developing, partnering, and commercializing novel, non-opioid, and non-addictive therapies to address the large, unmet medical need for the treatment of pain and addiction. JAN101 (formerly known as TV1001SR) is a potential treatment for PAD, a vascular disease that affects more than 8.5 million people in the U.S. and more than 60 million people worldwide. We expect to commence Phase IIb/III clinical trials for the treatment of PAD in 2025.

JAN101

Generally

JAN101, formerly known as TV1001SR, is a patented oral, sustained-release pharmaceutical composition of sodium nitrite that targets poor blood flow to the extremities, such as those with vascular complications of diabetes or PAD and treats pain. A conclusion from a round of human studies found JAN101 prevents the prevalent reports of headaches by patients treated with an immediate release formulation of sodium nitrite. In a previous study of patients with PAD, a 40 mg BID treatment with immediate release sodium nitrite led to a statistically significant reduction in reported pain, while an 80 mg BID treatment had a more pronounced effect on bioactivity and Flow Mediated Dilation, a measure of vascular function. However, a number of subjects in both treatment groups reported headaches and dizziness following treatment. Although this did not result in subjects discontinuing treatment, JAN101 was developed to overcome this side effect. JAN101 was tested in a bridging study of diabetic neuropathy subjects and, during that bridging study, the subjects did not report headaches or dizziness. Subjects in this bridging study also reported less pain following treatment and improvements in bioactivity (quantitative sensory testing, a measure of nerve function) were similar to the PAD study, where the 80 mg dosing group had the greatest improvement in Flow Mediated Dilation. The ability to alleviate pain with BID treatment of JAN101 offers promise for a new non-addictive, non-sedating treatment of chronic pain.

Clinical Studies in Humans JAN101 Attributes

•Well-established safety profile

•Excellent bioavailability

•Lack of induced tolerance

•Non-narcotic

JAN101 does not mask pain, but instead treats the cause of pain by improving tissue and vascular function.

Benefits of Sodium Nitrite on Vascular Health

In initial research studies, sodium nitrite effectively restored ischemic tissue blood flow and was effective in a wide range of pathologies involving alterations of angiogenesis – development of new blood vessels – including diabetes, wound healing, and tissue necrosis. Beneficial effects include enhancing angiogenesis, endothelial cell proliferation, and arteriogenesis. There is also a strong association between reduced circulating nitrite levels and cardiovascular diseases in humans. We describe some of the associations and beneficial effects of sodium nitrite/nitrite below.

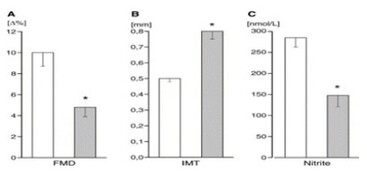

Plasma nitrite levels are negatively correlated to cardiovascular disease

Plasma nitrite levels were inversely related to number of cardiovascular risk factors a subject had and decreased plasma nitrite was associated with decreased flow mediated vasodilation (FMD) and increased intimal medial thickness (IMT) (both are indicators of vascular pathology). Kleinbongard, et al. (2006) Free Radic Biol and Medicine 40:295-302.

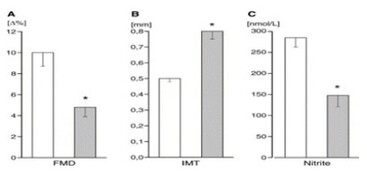

Plasma nitrite levels are reduced in diabetic and PAD patients

Exercise is a well-known stimulator of endothelial nitric oxide synthase activity, an enzyme that enhances nitric oxide (NO) production, which leads to increased plasma nitrite. In the study by Allen, et al., these authors revealed that baseline plasma levels of nitrite were less in patients with diabetes mellitus (DM) or DM + PAD. Importantly, increases in plasma nitrite levels were not observed in either DM, PAD, or DM + PAD patients after supervised exercise. These data reveal that

baseline nitrite availability is compromised in DM patients and that supervised exercise is unable to increase plasma nitrite levels but actually results in a decrease in nitrite, highlighting a physiological efficiency of this molecule. Allen, et al., Nitric Oxide 2009 20:231-2377.

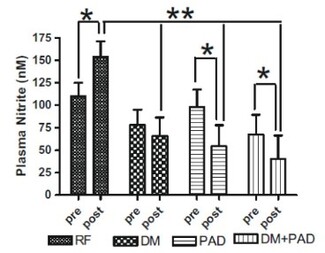

Skeletal Muscle Nitrite and Metabolite Levels are Reduced in Critical Limb Ischemia (CLI) Patients

Skeletal muscle nitrite, nitrosothiol (RSNO), nitric oxide-heme, and cGMP are all significantly reduced in CLI (the most severe form of PAD) patients. Diabetic patients with CLI show even further nitrite reductions.

In summary, nitrite levels in various cardiovascular and vascular diseases appear to be inversely related to the severity of the disease in humans:

•Lower nitrite levels are associated with higher level of heart failure;

•Lower nitrite levels are observed in diabetic patients with PAD and are not compensated by exercise; and

•Nitrite levels are lower in the muscles of patients with critical limb ischemia and are further reduced in diabetic subjects with critical limb ischemia.

Given the association between low levels of circulating nitrite and human diseases, supplementation with sodium nitrite has been studied preclinically in animals. Below are summaries of some of the more important findings:

•Promotes angiogenesis

•Stimulates wound healing

•Prevents tissue necrosis

From Arya, et al.

Nitrite Therapy Selectively Increases Ischemic Tissue Vascular Density in a NO-dependent Manner

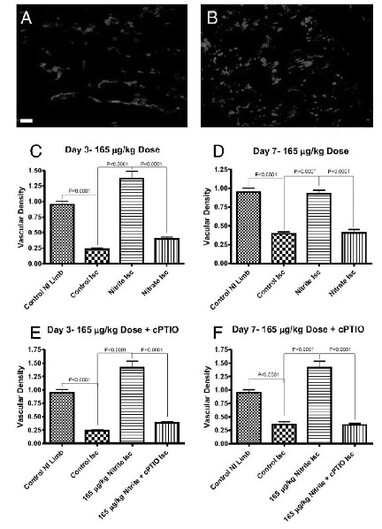

Chronic sodium nitrite therapy increases ischemic tissue vascular density in a NO-dependent manner. A and B show representative images of CD31 (red) and DAPI nuclear (blue) staining from sodium nitrite and sodium nitrate ischemic gastrocnemius muscle tissue at day 7. C and D report the vascular density of ischemic gastrocnemius muscle tissue at days 3 and 7 for 165 μg/kg sodium nitrite and nitrate treatments, respectively. E and F demonstrate the vascular density of ischemic gastrocnemius muscle tissue at days 3 and 7 from 165 μg/kg sodium nitrite plus carboxy PTIO. (Scale bar, 150 μm.) n = 10 mice per treatment group. Kumar D., et al., PNAS; 2008; 105:7540-7545.

Nitrite Therapy Augments Arterial Perfusion of Ischemic Tissue

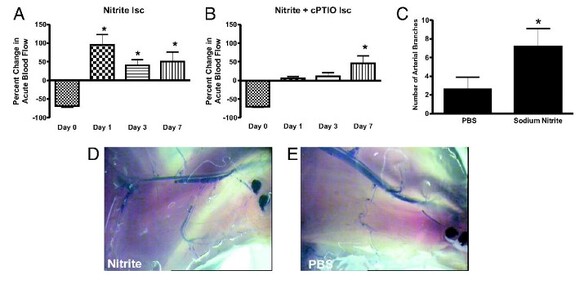

Chronic sodium nitrite therapy acutely increases ischemic tissue blood flow and stimulates arteriogenesis. A and B report 165 μg/kg sodium nitrite-induced acute changes in blood flow of chronically ischemic tissues at various time points with or without cPTIO, respectively. C reports the number of arterial branches between PBS and nitrite therapies. D and E illustrate vascular casting of the arterial vasculature in ischemic hind limbs of day 7 nitrite or PBS-treated mice, respectively. *, P < 0.01 vs. sodium nitrite. N = 10 mice per treatment group. Kumar D., et.al., PNAS;2008; 105:7540-7545.

Nitrite Therapy Restores Diabetic Ischemic Hind-Limb Blood Flow and Promotes Wound Heal

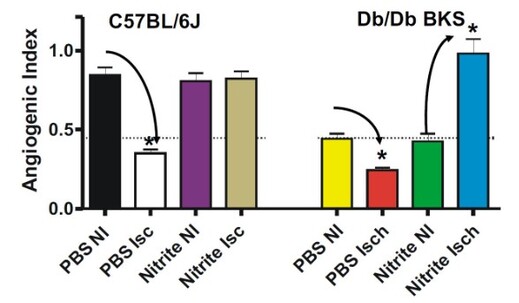

Unilateral femoral artery ligation was performed on 18-20 week old male Db/Db mice. Mice were randomized to PBS or sodium nitrite (165 μg/kg) therapy twice daily via I.P. injection. Laser doppler flowmetry was performed at the indicated time points. Increased wound dehiscence was noted in the PBS treated animals at day 7 but not in nitrite treated animals. (Bir, et al., Diabetes 2014, 63(1):270-81).

Nitrite Therapy Increases Diabetic Ischemia Induced Angiogenesis

Nitrite therapy prevented ischemia mediated endothelial cell density loss in normal C57BL/6J ischemic limbs. Nitrite therapy significantly restored endothelial cell density in ischemic limbs of diabetic mice to normal C57BL/6J levels compared to PBS therapy of non-ischemic and ischemic conditions. These data suggest that nitrite therapy may be useful in attenuating microvascular rarefaction due to loss of nitric oxide that is observed during metabolic dysfunction (Frisbee JC AJP Integr Comp Physiol 2005 289(2):R307-16; Stepp et al Microcirculation 2007 14(4-5): 311-6).

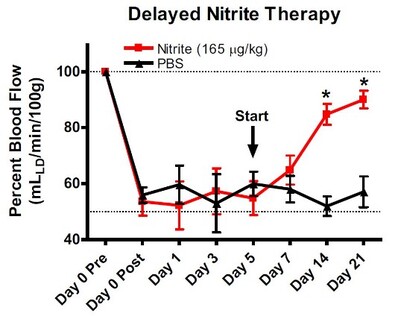

Delayed Nitrite Therapy Restores Ischemic Hind-Limb Blood Flow

Studies were performed to determine whether nitrite mediated therapy would be effective in tissue that had been left ischemic for 5 days after femoral artery ligation. Femoral artery ligation was performed in C57BL/6J mice and the animals

randomized to either PBS or sodium nitrite therapy 5 days after artery ligation. Treatments were given b.i.d. via I.P. injection. Ischemic limb blood flow was measured using laser doppler flowmetry. (Bir, et al., Diabetes 2014, 63(1):270-81).

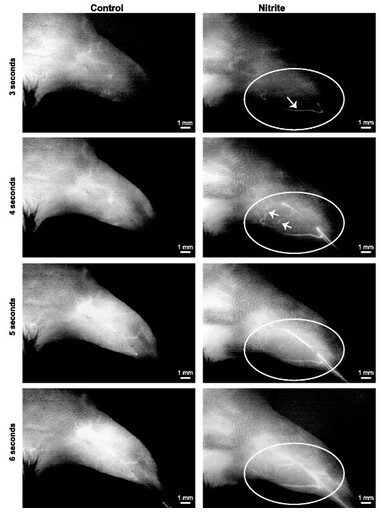

Delayed nitrite therapy increases SPY angiogram arteriogenesis

Delayed nitrite therapy increases SPY angiogram arteriogenesis. Representative temporal SPY angiogram image stills (3–6s) are shown at 11 days following ligation and 6 days after beginning therapy (either PBS or sodium nitrite). Left: PBS control angiogram. Right: sodium nitrite angiogram following injection of ICG. n = 5 animals per cohort. Circles identify limb anatomical regions of vascular blush, whereas arrows indicate perfused vessels that progressively occur over time.

Bir, et al., Am J Physiol Heart Circ Physiol 2012;303:H178-H188.

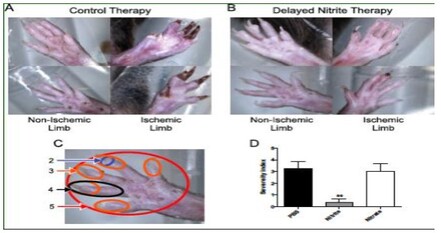

Nitrite Therapy Prevents Tissue Necrosis in Aged Db/Db Mice

Delayed sodium nitrite (165 ug/kg) or control PBS therapy was stated 5 days post-femoral artery ligation in nine-month old Db/Db mice. Nitrite therapy significantly prevented tissue necrosis (panel B) compared to control PBS therapy (panel A). Panel D reports tissue necrosis severity as a function of degree of limb and digit involvement. Nitrite therapy, but not PBS control or sodium nitrate, significantly prevented tissue necrosis. (Bir, et al., Diabetes 2014, 63(1):270-81).

Nitrite and Hind Limb Ischemia Summary

Sodium nitrite has long been known to be a potent vasodilator (transiently increasing blood vessel diameter) that can lead to a drop in blood pressure when given acutely. The above studies indicate that chronic administration at low doses promotes angiogenesis, unlike one-time nitrite therapy, which does not stimulate angiogenesis. In addition, these studies and a large number of other studies not reviewed above show:

•Nitrite therapy is very specific, acting only in damaged, ischemic tissue;

•Delayed nitrite therapy effectively restores ischemic tissue blood flow;

•Nitrite therapy is effective in a wide range of pathologies involving alterations of angiogenesis including critical limb ischemia, heart failure, and tissue necrosis;

•Nitrite supplementation has had positive effects in various diabetes models, including diabetic nephropathy and diabetic wound healing;

•Beneficial effects center on enhancing angiogenesis, endothelial cell proliferation, and arteriogenesis; and

•Sustained release nitrite therapy, unlike immediate release therapy, does not lead to vasodilation or a drop in blood pressure.

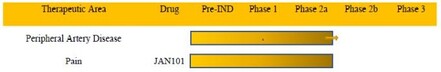

JAN101

JAN 101 is designed to treat diseases associated with poor vascular function. The following table summarizes our current product candidate:

Pain

Pain is a protective reaction that alerts the body to the presence of actual or potential tissue damage so that necessary corrective responses can be mounted. The National Institutes of Health (the “NIH”) defines chronic pain as pain that persists beyond the normal healing time of an injury or that persists longer than three months. It is estimated that chronic pain affects 100 million individuals in the United States and over 1.5 billion people worldwide; thus, more people suffer from chronic pain than diabetes, heart disease, and cancer combined (Cowen Therapeutic Categories Outlook, March 2019). Chronic pain exacts a tremendous cost in terms of direct treatment and rehabilitation expenditures, lost worker productivity, prevalent addiction to opioid-based drugs, and emotional and financial burden for patients and their families. According to an Institute of Medicine of the National Academies report, pain is a significant public health problem in the United States that costs society between $560 billion and $635 billion annually. Despite the magnitude of the pain problem, innovation in the development of therapeutic solutions has been largely absent. Since 2010, there have been 20 approvals by the FDA for the treatment of pain, of which 12 were opioid variants, one was an extended-release generic corticosteroid, five were variants of aspirin, and two were variants of other existing drugs. We are developing a novel product candidate designed to overcome the limitations of current treatment options for patients with PAD who suffer from chronic pain. According to a research study by Stanford University, more than 24% of patients with PAD are at risk of high opioid use. By treating pain at the source and presenting patients and physicians with better and safer treatment alternatives, we expect to minimize opioids at the prescription pad. Given the properties of JAN101, we have made the strategic decision to focus initially on pain associated with PAD by treating the underlying cause of PAD.

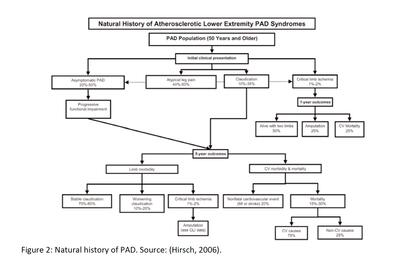

Peripheral artery disease

Peripheral artery disease (“PAD”) is a general term for conditions in which arterial blood flow to the limbs is partially blocked. When there is less blood present in the extremities relative to demand, muscle pain and fatigue result, especially in the calf, which is also known as “intermittent claudication.” In many patients, pain and fatigue are relieved through rest. Roughly half of patients with PAD are asymptomatic. The most common cause of PAD / intermittent claudication is atherosclerosis. Diabetes, chronic kidney disease, hypertension, and smoking are all risk factors that can increase the likelihood of PAD. In atherosclerosis, fat deposits (plaques) build up along arterial walls, resulting in a reduction in blood flow in the legs. This same process can cause strokes if the arteries leading up to the brain are affected.

Because of the high rate of asymptomatic patients, prevalence figures vary widely. Some estimate that up to 200 million people worldwide have PAD, ranging from asymptomatic disease to severe. Prevalence increases as a function of patient age, rising sharply after the age of 60. Thus, in countries with an aging population, it is expected that the prevalence of PAD will only increase. There is also a strong ethnic and racial component to PAD prevalence, which may be due to cultural differences in diet and exercise, along with genetic differences. Some suggest a prevalence of eight to 12 million in the United States alone, with roughly one-third experiencing pain when walking, which improves upon resting. The diagnosis of PAD usually begins with patient complaints of pain in the extremities. If the patient is already being treated or monitored for diabetes or other risk factors, then the physician will check for a weak or absent pulse in the extremity. Decreased blood pressure, poor wound healing, and whooshing sounds (via stethoscope) in the legs are also tell-tale signs

of PAD / intermittent claudication. Angiograms, electrocardiograms, and ultrasounds can also be used to image and confirm the diagnosis.

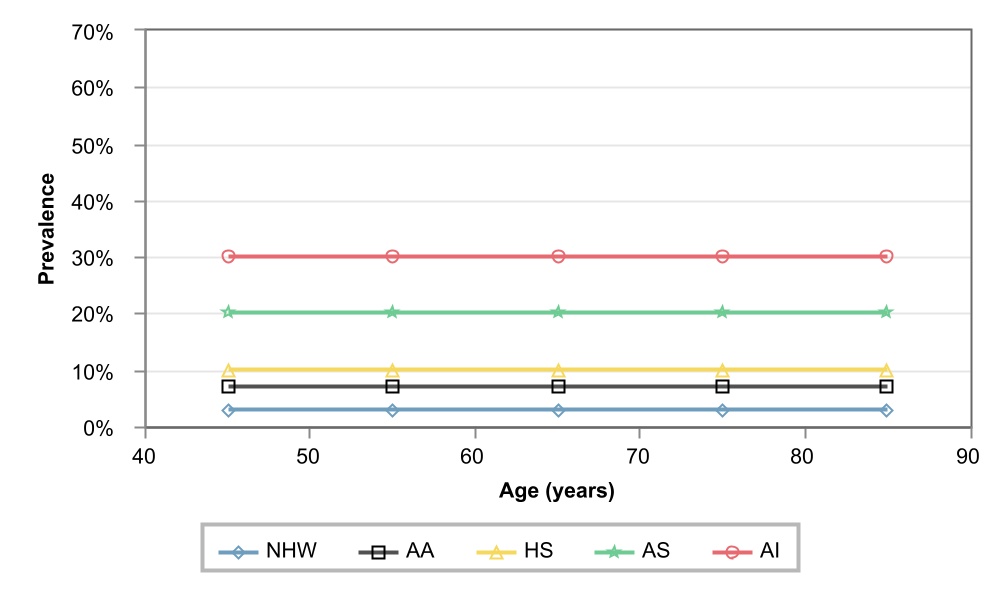

Figure 1: Ethnic-specific prevalence of PAD in men in the US, by age. NHW = Non-Hispanic Whites,

AA = African American, HS = Hispanics, AS = Asian Americans, AI = American Indians. Source: (Criqui, 2015)

The non-drug treatment of PAD / intermittent claudication may be divided into four general categories:

•Lifestyle – Primarily changes in diet and smoking cessation.

•Exercise – Patients who walk, cycle, stretch, or swim can experience marked improvement. Formal programs involving treadmills and track walking (usually three to five times per week) are frequently provided to patients. However, if the pain is triggered by exercise (claudication) and is significant, it can discourage the patient from exercise.

•Angioplasty – A procedure by which the affected artery is stretched with a balloon-like device. This procedure has limited effectiveness and is reserved for severely blocked arteries.

•Bypass Surgery – Arteries that are beyond angioplasty can be bypassed entirely. This procedure is typically reserved for cases where the blockage is considered very long (~10 centimeters) and nearly complete.

The underlying condition is not addressed by surgery. Surgical approaches will not, in the long run, improve exercise capacity and walking distance. Only exercise itself, coupled with lifestyle changes and drug approaches, has this benefit.

Prescription drugs for the treatment of the underlying PAD may be divided into multiple categories, depending on the underlying condition and severity:

•Cholesterol-Lowering Agents – Statins and bile acid sequestrants.

•Antiplatelet Medications – Aspirin and related drugs, such as clopidogrel. Cilostazol also has antiplatelet properties.

•Antihypertensives – Patients with underlying high blood pressure can and will receive any number of medications to reduce blood pressure, such as ACE inhibitors and diuretics.

•Diabetes Therapies – While a substantial portion of PAD patients may have pre-diabetes or fulminant diabetes, it is unknown if aggressive treatment of diabetes has a positive effect on PAD.

•Pain – To our knowledge, no drugs are specifically indicated for PAD-associated pain. Pentoxifylline, for example, is indicated “…for the treatment of patients with intermittent claudication on the basis of chronic occlusive arterial disease of the limbs.” (Sanofi-Aventis U.S. LLC, 2010). However, the evidence supporting the effectiveness of pentoxifylline is mixed. Short-term courses of NSAIDs, such

as ibuprofen, may be used, provided the patient is not on another anticoagulant, like aspirin. Non-drug pain relievers, such as TENS and massage therapy, may also be used in these patients. Opioids may also be used, which creates a risk for addiction and potential misuse at the medicine cabinet by family members.

The lack of any truly effective treatment of PAD, along with encouraging early trial results using JAN101 on both improving vascular function and reducing pain in PAD patients, has created an opportunity potentially to treat this large unmet medical need. By improving vascular function, JAN101 has the potential to reduce associated pain and improve PAD patients’ quality of life.

Our Strategy

Our focus is to develop and commercialize novel, non-opioid, and non-addictive therapies to address, safely and effectively, the significant unmet medical need of chronic pain or treat conditions that cause pain. The principal elements of our strategy to achieve this mission are the following:

•License, acquire, develop, and create novel, non-opioid and non-addictive therapies by leveraging our understanding of pain biology to address the large and growing problem of pain. While innovation in medical sciences has led to exciting new treatment options in many disease areas, pain has seen limited innovation in recent years. We have a deep understanding of the pathophysiology of pain and diseases that cause pain. We intend to leverage this understanding to bring innovation in the pain treatment paradigm through targeted acquisitions of companies or assets in development. Our advisors and doctors have years of collective experience in leadership positions at institutions and substantial scientific experience and understand the complexity of designing and executing clinical trials for and developing therapies.

•Advance the development of JAN101, designed for the treatment of patients with PAD and pain associated with the disease. There are limited therapeutic options available for patients with PAD and we believe that JAN101 has the potential to transform the standard of care to a twice-a-day pill to improve moderate-to-severe PAD substantially.

•Leverage clinical activity of JAN101 possibly to expand into new indications. The Company is in discussion with multiple researchers about expanding JAN101’s use into other indications. JanOne will provide the researchers previously manufactured clinical supplies of JAN101 for use in their clinical trials.

•Advance JAN101 through clinical development and pursue development of additional product candidates through acquisitions. Our objective is to build a well-balanced, multi-asset portfolio targeting the large population of patients with chronic and acute pain. To achieve this, in addition to

JAN101, we intend to pursue partnerships, licensing agreements, and potential acquisitions of other pharma companies. We continue our search for assets with indications where we believe they could have meaningful impact and address the large unmet medical need. In addition, we may choose to selectively in-license or acquire complementary product candidates by leveraging the insights, network, and experience of our team.

•Maximize the commercial potential of all our product candidates. We currently intend to retain all commercial rights to JAN101 in the United States and selectively partner outside of the United States. Because we believe that PAD is an attractive market for many major pharmaceutical companies, we may sub-license or partner certain indications if we believe it may enhance stockholder value. As we continue to build and develop our product portfolio, we may opportunistically pursue strategic partnerships that maximize the value of our pipeline while seeking to develop other indications.

•Leverage our management team background and expertise. We have assembled a team with extensive experience described above.

Chronic Pain

The NIH defines chronic pain as pain that persists either beyond the normal healing time of an injury or longer than three months. We believe that chronic pain represents a significant public health crisis. It is estimated that chronic pain affects 100 million individuals in the United States and over 1.5 billion people worldwide; thus, more people suffer from chronic pain than diabetes, heart disease, and cancer combined (Cowen Therapeutic Categories Outlook, March 2019). Chronic pain exacts a tremendous cost in terms of direct treatment and rehabilitation expenditures, lost worker productivity, prevalent addiction to opioid-based drugs, and emotional and financial burden for patients and their families. According to an Institute of Medicine of the National Academies report, pain is a significant public health problem in the United States that costs society between $560 billion and $635 billion annually. Chronic pain is the leading cause of long-term disability in the United States, and approximately 23 million adults in the United States experience severe pain over a three-month period. Globally, the prevalence of chronic pain is even larger, with over one billion people worldwide affected each year. Common types of chronic pain include those of neuropathic and inflammatory origin and may involve the skin, muscles, joints, bones, tendons, ligaments, and other soft tissues. Chronic pain is associated with a variety of clinical conditions including, but not limited to, arthritis, spinal conditions, cancer, fibromyalgia, diabetes, surgical recovery, visceral injury, and general trauma.

Pain is a necessary protective reaction that alerts the body to the presence of actual or potential tissue damage so that necessary corrective responses can be mounted. Pain is signaled by specialized cells in the peripheral nervous system called nociceptors, or pain-sensing fibers. These pain-sensing fibers normally transmit information about stimuli that approach or exceed harmful intensity from different locations in the body to the brain, which registers this information as a sensation of pain. In the case of tissue injury due to trauma or infection, pain accompanies the associated inflammation, persists for the duration of the inflammatory response, and aids healing by inhibiting use of the affected body part.

Pain also can modify the central nervous system, such that the brain becomes sensitized and registers more pain with less provocation. This is called central sensitization. When central sensitization occurs, the nervous system goes through a process called wind-up and gets regulated in a persistent state of high reactivity. This persistent, or up-regulated, state of reactivity lowers the threshold for what triggers the sensation of pain and can result in the sensation of pain even after the initial injury might have healed.

When there is dysfunction in pain signaling, injury to the nervous system, or an unhealed injury, pain becomes no longer just a symptom, but a disease in itself.

Current Therapeutic Approaches to Treating Chronic Pain and Their Limitations

NSAIDs

Some of the most widely used therapies to treat chronic inflammatory pain are non-steroidal anti-inflammatory drugs (“NSAIDs”). NSAIDs can have significant side effects that include gastrointestinal bleeding, gastritis, high blood pressure, fluid retention, kidney problems, heart problems, and rashes. On April 7, 2005, the FDA announced a decision to require boxed warnings of potential cardiovascular risk for all NSAIDs.

Corticosteroids

Corticosteroids, or steroids, also possess anti-inflammatory properties and are commonly used in the practice of pain management, either systemically or locally, depending on the condition. Steroids work by decreasing inflammation and reducing the activity of the immune system. While steroids are commonly used, they may have numerous and serious side effects. These side effects may include allergic or hypersensitivity reactions, increased risk for infection, adrenal insufficiency, diabetes or decreased glucose tolerance, hypertension, loss of bone density, and loss of joint cartilage volume. In addition, steroids should not be administered when there is an infection present because steroids can inhibit the body’s natural infection-fighting immune response. Also, if a joint is already damaged or is subject to chronic deterioration, intra-articular, or IA steroid injections are not likely to provide any long-term restorative benefit. For the above reasons, IA steroid injections are generally recommended to be administered no more often than every six weeks and not more than three to four times per year.

Opioids

Opioids are some of the most widely prescribed therapeutics for chronic and acute pain, and sales of these drugs have quadrupled between 1999 and 2010. According to a National Survey on Drug Use and Health report, in 2016 more than one-third of adult Americans were prescribed opioids and 230 million opioid prescriptions were written that year in the United States. Opioids act by binding to specific receptors located on neurons in both the central and peripheral nervous system throughout the body including in the brain, spinal cord, and other nervous tissue. Although they can be effective in providing pain relief, the increased medical use of opioids has been accompanied by an increase in the abuse and misuse of prescription opioids. In addition, for most patients, chronic opioid use is a poor option due to an intolerance to the many side effects, including nausea, vomiting, drowsiness, and constipation, and the propensity for opioids to become less effective with long-term use. According to the Centers for Disease Control and Prevention (the “CDC”), almost two million individuals abused or were dependent on prescription opioids in 2014. CDC figures show that the number of opioid-related overdose deaths has quadrupled between 1999 and 2010, and currently approximately 40% of opioid overdose deaths in the United States involve a prescription opioid. This increase in prescription opioid-related deaths in the United States prompted former President Trump to declare the opioid crisis a national Public Health Emergency in October 2017. Opioid abuse has become an epidemic in the United States, ranking as the nation’s second most prevalent illegal drug problem. These major issues create the need to find new approaches to treating chronic pain.

Our Approach to Treating PAD and Chronic Pain

The unmet medical need for treating PAD and chronic pain reflects the historic failure to develop novel classes of analgesics with comparable or greater efficacy, an acceptable level of adverse effects and a lower abuse liability than those currently available. Some of the reasons for this include the heterogeneity of chronic pain and its related conditions, and the complexity and diversity of the underlying pathophysiological mechanisms for pain. However, recent advances in the understanding of the neurobiology of pain are beginning to offer opportunities to identify new drug targets and develop new therapeutic strategies.

We have taken an innovative and targeted approach to identifying treatments for chronic pain that leverages our understanding of the pathophysiology of pain. Pain is variable. For example, it can be inflammatory or neuropathic in nature, and it may be localized to a specific area of the body or it may be generalized throughout. We believe that the most effective way to treat chronic pain is through therapies that specifically target the origin of the pain signal. We strive to maximize JAN 101’s potential based on its unique mechanism of action related to the origin of the pain signal.

A Randomized, Double-Blind Study of the Effects of a Sustained Release Formulation of Sodium Nitrite (SR-nitrite) on Patients with Diabetic Neuropathy

Background: Sodium nitrite has been reported to be effective in reducing chronic peripheral pain.

Objectives: To evaluate the safety and efficacy of 40 and 80 mg, BID, of an oral sustained-release formulation of sodium nitrite (SR-nitrite) in patients suffering from diabetic neuropathy, and to determine whether SR-nitrite would reduce the frequency of headaches reported previously by subjects receiving the same doses of an immediate release formulation. Study Design: Phase II, single-center, randomized, double-blind, placebo-controlled clinical trial. Setting: The Ohio Pain Clinic and Kettering Medical Center.

Methods: Twenty-four patients were randomized to 40 mg or 80 mg SR-nitrite or placebo twice daily for 12 weeks. The primary objective was to determine whether headaches would be reduced using SR-nitrite. The primary efficacy endpoint was the mean difference in the change of the Neuropathic Pain Symptom Inventory (NPSI) pain score from baseline to that

reported after 12 weeks of treatment. Secondary endpoints included changes from baseline for the Brief Pain Inventory (BPI) Scale, the RAND 36 questionnaire, Short-Form McGill Questionnaire, daily patient reported score for neuropathic pain, changes in HbA1c, PulseOx, and quantitative sensory testing.

Results: The number of subjects reporting adverse events and the number of adverse events did not change with dose. There were no reports of treatment-related headaches. Although no significant differences were identified in patient responses to the questionnaires, a trend was observed. In the NPSI assessment, patients in the 40 mg and 80 mg dosing groups reported a 12.7% and 22.0% reduction in pain, respectively, compared to an 8.4% reduction by patients in the placebo group. A trend was also observed with the BPI total severity score. However, the 40 mg dosing group reported the greatest reduction in pain using the McGill Pain index and via patient logs of daily pain scores, where the mean of pain scores reported by subjects in the 40 mg group dropped by day 41 and generally stayed lower than the mean of scores reported by subjects in either of the other two groups. Patients in the 80 mg SR-nitrite group had an improvement in both Nerve Sensory Conductance and Nerve Sensory Velocity. No changes were observed in HbA1c levels or PulseOx.

Limitations: Small sample size.

Conclusion: Sustained release sodium nitrite prevents the prevalent reports of headaches by patients treated with an immediate release formulation of sodium nitrite. In a previous study of patients with peripheral arterial disease (PAD), 40 mg BID treatment led to a statistically significant reduction in reported pain. Similar trends were observed at the end of the trial period for most of the pain questionnaires used in the study. The 80 mg BID treatment had the more pronounced effect on bioactivity (quantitative sensory testing), which was similar to the PAD study, where this dosing group had the greatest improvement in Flow Mediated Dilation . The ability to alleviate pain with BID treatment of SR-nitrite offers promise for a new non-addictive, non-sedating treatment of chronic pain and warrants further study.

Microcirculatory injury, which is common in diabetic patients, can lead to a number of problems. Prominent among these is diabetic peripheral neuropathy (DPN). About 10% of patients will have evidence of DPN at the time they are initially evaluated, and almost 50% of diabetic patients will ultimately develop DPN. Of diabetic patients with DPN, 40% to 50% suffer from chronic pain, as well as paresthesia, sensory loss, and weakness, and have at least an eight-fold increased risk of undergoing a distal lower extremity amputation compared to similar non-diabetics. Endothelial cells play an important part in the regulation of microcirculation, as they maintain vascular tone by secreting both vasodilators and vasoconstrictors. A central feature of diabetic microvascular disease (MVD) is endothelial dysfunction, which, in turn, plays an important role in the development and progression of DPN. The pathophysiological factors leading to endothelial dysfunction in diabetes include chronic hyperglycemia and protein glycosylation, insulin resistance, inflammation, and increased oxidative stress. Studies have now shown a close relationship between endothelial dysfunction and diminished nitric oxide (NO) bioavailability. Endogenously produced NO has a half-life measured in seconds, and is rapidly oxidized to nitrite (NO2–) and nitrate (NO3–) end-products, the latter of which is biologically inert. In the presence of microcirculatory ischemia and endothelial cell dysfunction, however, endogenous NO production by eNOS is much more limited. In such circumstances, circulating NO2 can be non-enzymatically reduced to increase NO availability. In addition to serving as a circulating NO reservoir, nitrite itself has also been shown to have direct and potent vasodilatory effects in vitro and in vivo. The findings that NO2– mediates vasodilatation, both directly and through NO generation, has led to growing interest in the potential effectiveness of nitrite as a therapeutic agent in conditions associated with DPN and endothelial dysfunction. Such conditions include diabetic microvascular disease, DPN, and retinopathy, in which low levels of NO and NO2–, as well as elevated levels of nitrate (NO3–), suggest that the complete oxidation of NO occurs during diabetes with insufficient NO2– reserves to restore NO bioavailability. Previous human studies with an oral formulation of NaNO2 have shown that administration twice daily improves vascular function. In the peripheral arterial disease study, subjects who received the lower dose of NaNO2 reported a significant reduction in pain. Although side effects were minimal, headaches and dizziness were reported by a large number of subjects, likely due to the rapid release of NaNO2 leading to vasodilation. An oral, sustained-release formulation of NaNO2 (SR-nitrite) was developed in an attempt to overcome these problems and was tested in a porcine model of metabolic syndrome with critical limb ischemia. SR-nitrite-treated animals showed increased myocardial NO bioavailability, diminished oxidative stress, and cytoprotection in ischemic tissue. Importantly, 24-hour telemetry recordings of blood pressure showed no evidence of vasodilation. In the above study, we hypothesized that the SR-nitrite would reduce or eliminate headaches reported in patients following administration of the immediate release formulation. Given the promising results on reducing pain in diabetic patients with PAD reported in the previous study, patients with diabetic neuropathy were utilized in this study to determine whether any trends in reducing pain could be observed. The study design was a randomized, placebo controlled, double-blind phase II study was carried out to investigate the safety and potential biological activity of multiple doses of an oral, sustained-release formulation of sodium nitrite (SR-nitrite; TheraVasc Inc., Cleveland, OH, USA), BID in doses of 40 mg and 80 mg over a 12-week treatment period, in human subjects with diabetes and neuropathic pain in the lower extremities and feet.

The trial was approved by the Copernicus Group Institutional Review Board and listed on ClinicalTrials.gov: www.clinicaltrials.gov/ct2/show/NCT02412852. The study was funded by TheraVasc Inc. (“TheraVasc”).

JAN101—Regulatory Strategy

Sodium nitrite has been previously approved as one of the active components of cyanide poisoning antidote. This means the approval path for JAN101 is through a 505(b)(2) (“NDA”), which we intend to pursue.

JAN101—Commercial Strategy

We currently intend to use third-party providers and manufacturers to support the commercialization JAN101, if we are successful in obtaining FDA approval. We believe that we can promote JAN101 to the patients suffering from PAD in a cost effective manner. We anticipate our commercial operation will include outside sales management, outside sales support, distribution support, and an internal marketing group. Additional requisite capabilities will include focused management of key accounts, such as managed-care organizations, group purchasing organizations, and government accounts. We intend selectively to partner with third parties with vast experience in the space, as we have been partnering for every aspect of development.

Competition

The biotechnology and pharmaceutical industries are characterized by extensive research and development efforts, rapidly advancing technologies, intense competition, and a strong emphasis on proprietary products. We are currently focused on the development and commercialization of our asset pipeline of novel, non-opioid, and non-addictive therapies for PAD. The number of patients suffering from chronic PAD is large and growing. While we believe that JAN 101 and our Chief Scientific Officer’s development experience and scientific knowledge provide us with competitive advantages, we face potential competition from many different sources, including pharmaceutical, biotechnology, and specialty pharmaceutical companies that market or develop therapeutics to treat chronic pain. Academic research institutions, governmental agencies, as well as public and private institutions are also potential sources of competitive products and technologies. Our competitors may have significantly greater financial resources, robust drug pipelines, established presence in the market, and expertise in research and development, manufacturing, pre-clinical and clinical testing, obtaining regulatory approvals and reimbursement, and marketing approved products than we do. These competitors also compete with us in recruiting and retaining qualified clinical, regulatory, scientific, sales, marketing, and management personnel, establishing clinical trial sites and patient registration for clinical trials, as well as in acquiring technologies complementary to, or necessary for, our programs. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. The key competitive factors affecting the success of JAN 101 (as well as other subsequent product candidates), if and when approved, is likely to be its efficacy, durability, safety, price, and the availability of reimbursement from government and other third-party payors.

Significant competition exists in the PAD pain field. Although we believe our approach to developing novel treatments for pain is unique from most other existing or investigational therapies, such as NSAIDs, corticosteroids, and opioids, we will need to compete with all currently available and future therapies within the indications where our development is focused. With respect to JAN101, the main classes of marketed products that are available for the treatment of PAD pain include NSAIDs and opioids. Furthermore, numerous monoclonal antibodies targeting nerve growth factor, or NGF inhibitors, are in clinical development, including two product candidates in Phase III.

There are a number of companies developing or marketing therapies for the treatment and management of pain that may compete with JAN 101, including many major pharmaceutical and biotechnology companies.

Intellectual Property

Our success depends in large part upon our ability to obtain and maintain proprietary protection for our products and technologies, and to operate without infringing or otherwise violating the proprietary rights of others. We endeavor to protect our products using a combination of intellectual property protections and available government regulatory and marketing exclusivities afforded to new medicines. For example, we endeavor to protect our products by, among other methods, filing United States and foreign patent applications related to our proprietary technology, inventions, and improvements that are important to the development and implementation of our business. We also use other forms of protection, such as confidential information, trade secrets, and know-how, and trademarks to protect our intellectual property, particularly where we do not believe patent protection is appropriate or obtainable.

The proprietary nature of, and protection for, JAN 101, processes, and know-how are important to our business. Our policy is to pursue, maintain, and defend intellectual property rights, and to protect the technology, inventions, and improvements that are commercially important to our business.

Trade Secrets and Other Proprietary Information

In addition to patents, we rely on trade secrets and know-how to develop and maintain our competitive position. For example, we have developed methods for more efficient manufacture of sustained released sodium nitrite tablets. We seek to protect our proprietary information, in part, by confidentiality agreements and invention assignment agreements with our employees, consultants, scientific advisors, contractors, and commercial partners.

License Agreement

On November 19, 2019, we entered into a Patent and Know How License Agreement (the “License Agreement”) with UAB Research Foundation (“UABRF”), TheraPAD, and the Board of Supervisors of Louisiana State University and Agricultural and Mechanical College, acting on behalf of LSU Health Shreveport, together with UABRF and TheraPAD collectively, the “Licensors”). Under the License Agreement, the Licensors have agreed to grant to JanOne an exclusive, worldwide license, including the right to sublicense, to the Licensors’ patent rights and know-how related to the Licensors’ sustained release formulation of sodium nitrite. Under the License Agreement, we have agreed to pay a non-refundable upfront license fee and certain milestone payments upon the achievement of certain milestones of up to approximately $6.5 million and certain royalty payments and annual license maintenance fees. The License Agreement requires us to use commercially reasonable efforts to develop and commercialize JAN101.

Soin Therapeutics

JanOne acquired Soin Therapeutics, a company focused on the development of a novel formulation of low-dose naltrexone (“LDN”) for the treatment of chronic regional pain syndrome (“CRPS”) in 2022. CRPS is a rare pain disorder, characterized by a complex set of symptoms, affecting approximately 200,000 patients annually in the US. There are currently no approved treatments for patients with CRPS. Prior to the acquisition, Soin Therapeutics received Orphan Drug Designation for the product, which provides a variety of incentives for developing the product in this indication.

JAN123

Generally

JAN123 is a novel formulation of 2.0 mg of LDN that results in a biphasic release of the product. The release properties of JAN123 provide for an immediate release of less than half the product with a slow, sustained release of the remaining product. Importantly, the rapid release of LDN has been reported to lead to vivid and lucid unpleasant dreams, which should be eliminated with the formulation of JAN123. Initially, a single tablet of JAN123 will be administered orally, once a day before sleep, with eventual titration up to two tablets (4 mg) before sleep.

Naltrexone

Naltrexone was first synthesized in 1965 and approved by the FDA for the oral treatment of opioid dependence in 1984, with the brand name Trexan. Later it was approved for the oral treatment of alcohol dependence in 1995, when the brand name was changed by DuPont to ReVia. A depot formulation for intramuscular injection was approved by the FDA under the brand name Vivitrol for alcohol dependence in 2006 and opioid dependence in 2010. Typical oral doses are 50 to 100 mg daily, with a once-monthly intramuscular formulation also available. At these doses, Naltrexone has been shown to function as a nonselective opioid antagonist with a high affinity for µ opioid receptors, which decreases addiction cravings (Schumacher, Basbaum et al. 2017, Opioid Agonists & Antagonists. Basic & Clinical Pharmacology, 14e. B. G. Katzung. New York, NY, McGraw-Hill Education). However, there is a risk that patients who are non-compliant with oral naltrexone may experience opioid intoxication simply by skipping doses of naltrexone. Oral bioavailability is also variable from patient to patient, largely due to first-pass metabolism. Thus, naltrexone is pharmacologically effective, but may be ineffective in a real world setting without counseling and strong patient support (Minozzi, 2011, Oral naltrexone maintenance treatment for opioid dependence. Chchrane Database Syst Rev(4), CD001333). There are also multiple generic Naltrexone tablets available on the market for oral administration.

Low-Dose Naltrexone (LDN)

Compared to the standard dose, LDN is defined as a daily dose of Naltrexone of 1 to 5 mg, which is 10- to 100-fold lower than the dose used to manage substance use disorders (LDN Research Trust, Toljan and Vrooman 2018, Low-Dose

Naltrexone (LDN)-Review of Therapeutic Utilization. Med Sci (Basel) 6(4)). Off-label uses of Naltrexone at lower doses have been explored based on a different mechanism of action for the treatment of inflammatory, rheumatologic, and neurologic conditions. These include multiple sclerosis, fibromyalgia, Crohn disease, chronic fatigue syndrome (CFS), and, more recently, CRPS. At the low doses used for these conditions, Naltrexone is thought to act as an immune modulator. Some speculate that this effect is related to reduced neuroinflammation in the case of disorders like CFS (Cant, Dalgleish et al. 2017, Naltrexone Inhibits IL-6 and TNFalpha Production in Human Immune Cell Subsets following Stimulation with Ligands for Intracellular Toll-Like Receptors. Front Immunol 8: 809).

Evidence suggests that, at low doses, Naltrexone antagonizes TLR4 on activated glial cells without the previously mentioned function as a mu-opioid receptor antagonist (Chopra and Cooper 2013, Treatment of Complex Regional Pain Syndrome (CRPS) using low-dose naltrexone LDN). J Neuroimmune Pharmacol 8(3): 470-476.). TLR4 has been shown to be a key mediator of microglial activation, which has been identified as a causal mechanism of neuropathic pain in CRPS. Microglial activation is associated with the release of pro-inflammatory cytokines, reactive oxygen species, and prostaglandins, which amplify the inflammatory response (Carniglia, Ramírez et al. 2017, Neuropeptides and Microglial Activation in Inflammation, Pain, and Neurodegenerative Diseases. Mediators of Inflammation 2017: 5048616). Thus, LDN presents a promising therapeutic avenue for the treatment of CRPS, a condition in which TLR4 upregulation is a primary pathway, through attenuation of glial activation and direct targeting of TLR4 activity (Del Valle, Schwartzman et al. 2009, Spinal cord histopathological alterations in a patient with longstanding complex regional pain syndrome. Brain Behav Immun 23(1): 85-91. By downregulating the inflammatory cytokine release, LDN should be beneficial for CRPS patients.